Lido Finance has recently announced the termination of all operations on Solana after a community vote in Lido’s autonomous organization. The initial proposal to shut down on Solana was initially presented in early September this year following the identification of unsustainable financials as well as the lower percentage of fees generated on the Solana blockchain. Voting on the matter started by the end of September and was concluded just earlier this month. As per the recent update, the community has given a green signal regarding the departure from Solana, and the process will begin shortly.

Following now, Lido would not accept any staking requests and the offboarding of the voluntary node operator would begin from next month. Users are also required to unstake on Solana’s front-end by February next year. If the specified date is passed, all unstaking processes will be carried out via the use of CLI. The earlier proposal discusses clawing almost $20,000 a month from Lido DAO for the support of technical maintenance efforts associated with shutting down operations on Solana over the course of five months.

Lido and Solana Part Ways

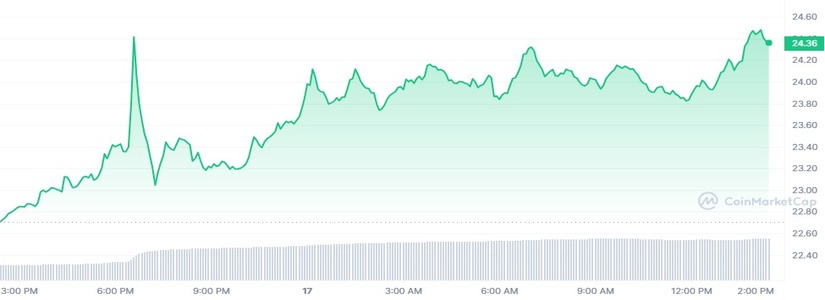

Despite the departure from the Solana blockchain, the platform’s native token, SOL, continues to fare reasonably well. At the time of writing, SOL has surged by a respectable 7.18% in the previous 24 hours. The surge has catapulted the trading price of the token up to almost $24.36 and the market cap currently stands at the $10.14 billion mark.

Lido’s P2P team has continuously worked on the Solana project since its acquisition in March 2022 from Chorus One. Since the takeover, the team has invested a sum of almost $700,000 into Lido on Solana. However, the profit turned out to be a mere $220,000 resulting in a loss of almost $484,000.

The platform continued to explain that the decision was a difficult one but had to be made to ensure the success of the broader Lido ecosystem. Despite the ongoing sunsetting process, it was clarified that staked Solana token holders would continue to receive network rewards. The platform’s staking services are now only supported on Ethereum and Polygon where $14 billion and $80 million are staked.

crypto-economy.com

crypto-economy.com