stake.link is the first delegated liquid staking protocol for the Chainlink ecosystem. It offers significant benefits compared to staking alone, and allows the ability for its users to participate in governance, initiate a “set it and forget” process for staking LINK, and the option to boost their rewards. At its core, it also gives users the ability to leverage the weight, experience, and trust from over 15 of the top Chainlink node operators, getting the ability to receive staking rewards in a way that would be impossible to accomplish as a sole staker.

Started in 2022, stake.link provides third-party delegated staking with DeFi interoperability which is represented by the liquid staking receipt token stLINK. This gives users a proportionate share of the earned rewards while supporting the Chainlink ecosystem as a whole. With Chainlink allowing 20 million LINK tokens to be available to the Chainlink staking pool in Q4 2023, there are many people who want to get in on the action. The Community Pool has a cap and has created difficulties for those attempting to stake their LINK. stake.link has recently launched a number of improvements based on community governance and best practices, helping to solve the challenge of staking LINK into the Community Pool without spending long stretches of time watching the network and waiting for capacity to become available.

In this guide we will discuss the foundation of stake.link, how it works, and simplify the many different moving parts in order to take full advantage of the many features.

LINK Staking

The core of stake.link is LINK staking, although what makes the protocol much more valuable are the tools it gives to users that accomplish two things: boosting rewards/yield, and making LINK staking much easier

To begin on stake.link, you will need to go to app.stake.link and connect your Web3 wallet. On the main site there are three different options for staking:

- LINK Pool

- SDL Pool

- ixETH Index Pool

To contribute to the LINK Pool, you will select how much you wish to deposit and then stake it. When there is capacity in the Community Pool, you will receive stLINK liquid tokens in return which represent the position you’ve staked. With the stLINK token you can take advantage of various DeFi activities such as yield farming, borrowing/lending, and more. During this time the staked tokens will still earn a share of the node operator fees (as mentioned above, stake.link represents the 15 top operators in the whole of Chainlink). If you wish to withdraw the original LINK tokens, along with the yields earned, you must burn the corresponding stLINK.

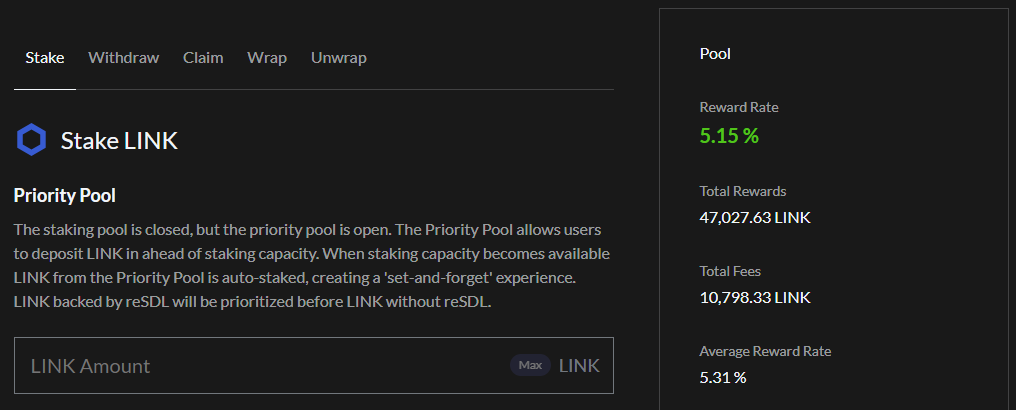

This is very straightforward, but is complicated somewhat because of Chainlink’s Community Pool at full capacity. A sole staker would have to watch for untold amounts of time, waiting for LINK to free up so they can stake. Because of its high demand, this could easily be a full time job. Thankfully, stake.link users can avoid this by staking LINK into the Priority Pool.

Priority Pool

The Priority Pool is a way to automate LINK staking into the Community Pool. The team has referred to the pool as a “layover, pending takeoff” for the LINK tokens ready to be sent into the Community Pool. This is an excellent solution as it automates LINK staking for the depositors, allowing them to stake whenever and when there is room available, their LINK will enter the Community Pool and start earning rewards, and the user will receive their stLINK tokens. While this does allow users to “set-and-forget”, there is the question of priority. The stake.link protocol had originally been set up in a FIFO (first-in-first-out) manner, but based on community feedback has introduced a new system that encourages long term locked assets and as a result, more strength and stability for the platform. This process is described below as we introduce the SDL and reSDL.

SDL Token and Pool

SDL is the native token of the stake.link platform, and is used for governance. Under the prior system, staking the SDL would result in a receipt token called stSDL (in the same manner as the LINK staked produces a stLINK token). With the recent upgrades, stake.link is converting the stSDL to a transferable NFT format, which is called a “Reward Escrow SDL,” or a reSDL. This is beneficial because it allows the NFT (and the underlying assets it represents) to be easily traded.

The reSDL also plays an important role in the Priority Pool. Think of it as a form of a Disneyland FastPass, essentially paying for the privilege to get to the front of the line. Users holding reSDL will be first in line for the next moment LINK capacity opens in the Community Pool. For example, let’s say that three users have each deposited 5 LINK into the Priority Pool. The first two users each have 5 reSDL, and the third user does not have any. If 12 LINK spots were to open in the Community Pool, the first two users would get their 5 LINK tokens staked, and the third user would get only 2 LINK tokens staked. This creates a very high incentive for users to earn reSDL, otherwise they might be waiting a long time in the Priority Pool. The good news is, unlike a FastPass, users don’t have to buy the reSDL tokens. Instead, users simply need to stake and/or lock their SDL tokens in order to earn reSDL. From a high level, this mechanism creates a positive feedback loop: Users want to stake LINK, so they lock/stake their SDL tokens and earn reSDL. They get to stake the LINK (and earn stLINK), they earn protocol rewards, and the protocol is strengthened by more and more locked/staked SDL.

The SDLPool is where users can stake (and lock) their SDL tokens. There are two ways to earn the reSDL. Simply staking SDL will earn an NFT that represents the amount of reSDL rewarded, which is at a 1:1 ratio to the amount of SDL staked. However, there is a tool called the LinearBoostController (see their Docs for full details) that provides an additional boost when a user both stakes and locks their SDL. Longer locking durations increase the boost even further, incentivizing with maximum reSDL when a user stakes their SDL and locks it for long periods of time. There is no limit to the reSDLs (or the number of NFTs that represent them) that can be earned.

Of course, the SDL is also used as the governance token, which allows you to have an important voice in the future of the platform. Given the significant improvements already made due to community feedback, stake.link’s governance seems to be very active and beneficial.

Other Features

In addition to its core features, stake.link is continuously working on expanding its offerings.

ixETH Index Pool

stake.link has developed the Ethereum Liquid Staking Index token (ixETH), which is a blended rebasing token that is able to track the returns from top ETH liquid stakers.

SergAI, AI-Powered Chatbot

SergAI is an AI-powered chatbot as part of the latest round of platform upgrades. Once released the chatbot will be able to expertly answer many questions surrounding not just stake.link, but Chainlink as well. It will be able to provide key value information (yield rates, thresholds, etc.), and can help to explain more complex topics such as the Priority Pool, reSDL allocation, and more.

Final Thoughts

stake.link is a protocol with a single mission: to generate high yields through LINK staking. However, the complex system of incentives, tokens/NFTs, and pools help to create a positive reinforcement loop where everyone is motivated to act in a way that benefits the stake.link platform, the users themselves, and the larger Chainlink ecosystem. By understanding the moving parts, you should now be able to take full advantage of the rewards, boosts, priority staking, and governance opportunities. Good luck!