A new one has been added to the depeg (stablecoin losing its peg to $1) events, which have been increasing in number recently in the cryptocurrency world.

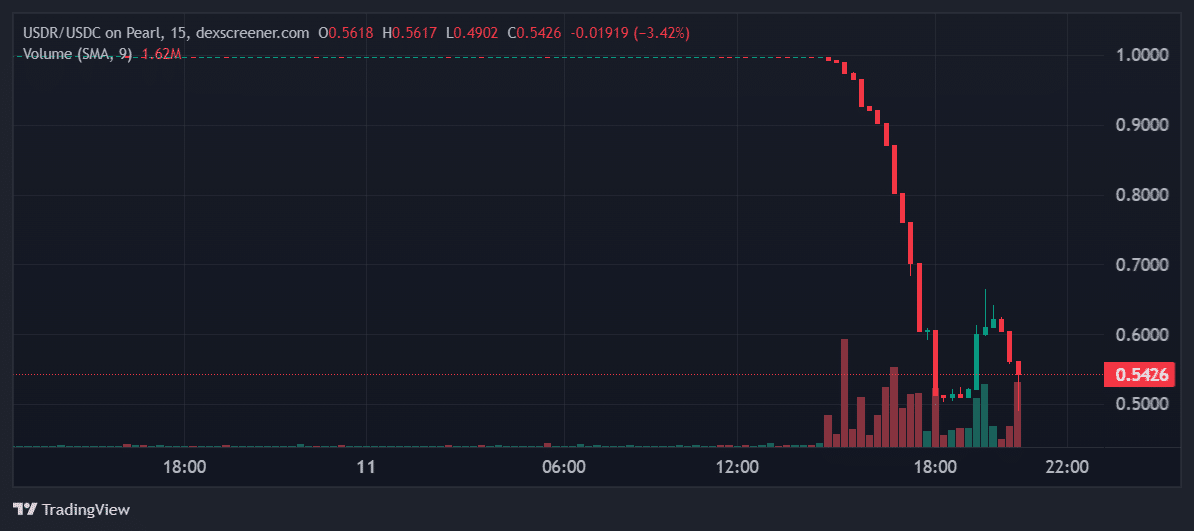

Polygon-based stablecoin Real USD (USDR), backed by illiquid real estate assets, has lost its peg and fallen below $1, trading at $0.54 at the time of writing.

The USDR losing its peg means it is no longer in a one-to-one relationship with the US dollar. The coin was backed by another devalued token, another gutted token, and a treasury backed by a small insurance fund.

After the Treasury exhausted its holdings of DAI tokens in order to maintain the peg to $1, USDR fell to approximately $0.51. The remaining funds of the treasury consist of an insurance fund of $ 6.2 million. However, with a circulation of 45 million USDR coins, $45 million in total value would be required to maintain the peg to $1.

The treasury also relied on support from the native Tangible token (TNGBL), but this token has fallen to $3.82, a 45% decline in the last 24 hours. According to on-chain data published by Tangible DAO, the entity behind USDR, the treasury currently holds zero DAI.

*This is not investment advice.