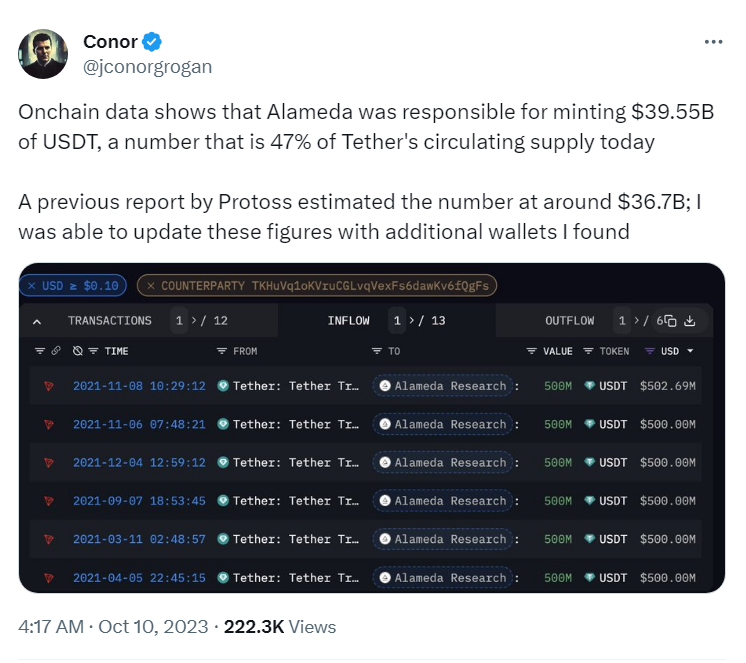

According to Onchain data, Coinbase product director Conor Grogan recently shared on Twitter that Alameda Research, based on their analysis of on-chain data, has been responsible for the creation of a significant amount of USDT. Specifically, they have minted a staggering 39.55 billion USDT, which currently represents around 47% of the total circulating supply of Tether. This information is further supported by data provided by SBF, which suggests that the number of USDT minted by Alameda Research surpasses the value of their Assets Under Management (AUM) at its peak.

It is worth noting that one of the factors contributing to this phenomenon is the off-chain destruction process implemented by Tether. Rather than using a traditional deposit address, Tether directly sends the redeemed funds to their treasury department. Considering that all USDT redemptions from FTX can be attributed to Alameda Research, it can be estimated that they have redeemed an impressive $3.9 billion worth of USDT. This redemption activity took place over a period of just two days and coincided with the Luna implosion in May.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.