Cardano (ADA) witnessed a change in the Total Value Locked (TVL) in the DeFi ecosystem. The TVL experienced an increase of nearly 10% and surpassed $160 million. Cardano’s growth in DeFi contributed to a positive impact on protocols and tokens by increasing liquidity.

Current Status of Cardano

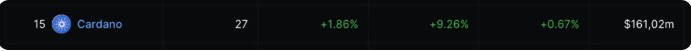

According to the latest data from DefiLlama on October 6, there was a 9.26% increase in the weekly TVL of the Cardano network. The total locked value reached $161 million. Analyzing the metrics, this indicates a 1.86% increase in the past 24 hours and a 0.67% increase on a monthly basis.

With these increases, it seems that Cardano is further solidifying its position in the growing DeFi ecosystem. Interestingly, the $161 million TVL value corresponds to 1.75% of ADA’s market capitalization of $9.17 billion at the time of writing.

Cardano and DeFi Protocols

It is important to note that the total value locked on a chain is measured by the total token amount generated through transactions in all DeFi protocols on the blockchain. This metric takes into account activities such as staking, liquidity providers, lending, borrowing, and similar applications.

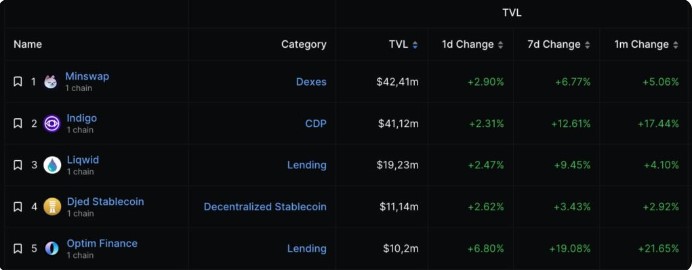

The first protocol to be examined is the decentralized exchange Minswap (MIN), which holds the top position with a TVL value of $42.41 million. Additionally, Indigo (INDY) can take this place from Minswap at any moment, possibly due to INDY’s recent increase in value. Liqwid Finance (LQ) with a similar function to AAVE and Djed Stablecoin have TVL values of $19.23 million and $11.14 million, respectively.

Finally, Optim Finance, another significant lending protocol, has risen to a prominent position among other Cardano protocols. With a daily increase of 6.80%, 19.08% in the past seven days, and 21.65% in a month, it has become a favorite among investors. All these increases can have long-lasting positive effects on the Cardano price.