- 1 Polkadot crypto has declined by 9.48% in the last one month.

- 2 The $DOT coin was launched in 2020.

The Polkadot coin is a digital currency that enables different blockchains to communicate and cooperate with each other. The $DOT coin is the main currency of the Polkadot network. It is a project created by the Web3 Foundation to support the development of decentralized web applications.

The $DOT crypto has seen an increase of 3.58% in its market value in the last 24 hours, reaching $5.21 Billion. However, the trading volume has dropped by 2.50%. The current ratio of volume to market cap of the coin is 1.97%. The coin has a circulating supply of 1.26 Billion $DOT and no fixed limit on its total supply.

The trading volume of the $DOT coin in the derivatives market has fallen by 0.53% in the last 24 hours and experienced a decrease of 1.51% in the open interest of the crypto. It shows that the traders are losing interest in the crypto. The ratio of long to short positions of the coin is 0.9944. It has experienced a short liquidation of $27.38K in the last 24 hours.

$DOT Price Technical Analysis

a by writer11_gsm on TradingView.com

The Polkadot price has been dropping from the higher levels, creating a series of lower lows and lower highs. It resulted in a descending triangle pattern. The market has also broken down below the same pattern, which signals more downward pressure for the crypto in the future.

The Polkadot crypto price is falling due to more sellers in the market, which shows a price decline. The market is also following a death cross of the 50-day and the 200-day EMAs. It shows the price is weak and in a downward trend.

The RSI of the crypto is very bearish as it has not reached the overbought level of 70 for a long time. This crypto asset has been staying below the 50-level which, shows the price is in a downtrend.

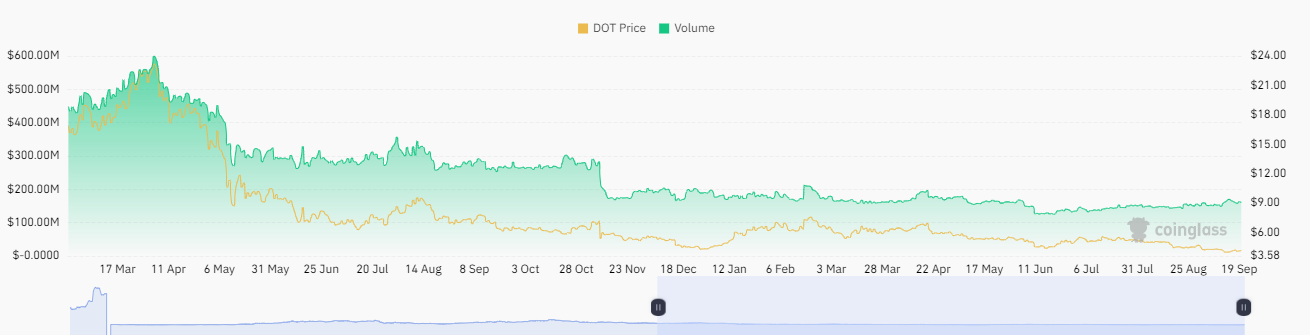

Polkadot Volume Analysis

The crypto volume has not changed much or increased and the current volumes are low which shows that the traders are not interested in $DOT crypto.

Conclusion

The $DOT crypto has fallen below the descending triangle pattern with a rise in volume. It has been dropping from higher levels, forming lower lows following a death cross EMA band and a negative RSI. It shows the dominance of sellers and negative sentiment in crypto.

Therefore, the crypto price may keep falling unless the market reverses its trend and breaks above the previous swing high. Breaking this level will lead to a bullish change of character in the market.

Technical Levels

- Support levels: $2.00 and $4.00

- Resistance levels: $5.60 and $7.20

Disclaimer

The views and opinions stated by the author or any other person named in this article, are for informational purposes only and do not constitute financial, investment, or other advice. Investing in or trading crypto or stocks comes with a risk of financial loss.

thecoinrepublic.com

thecoinrepublic.com