Key Decisions on IOTA's Path Forward

TL;DR:

IOTA is undergoing a major upgrade with Stardust, aiming to enhance its tokenomics and capabilities. After the launch of IOTA 2.0, we will introduce programmable smart contracts on Layer 1. The Assembly project and token will be discontinued in favor of IOTA Chains, a generalized smart contract framework. A new Ecosystem Fund will be created to decentralize governance and support ecosystem growth. A temporary token inflation over four years will support this fund. We also discuss token distribution changes and governance.

Over the past decade, the crypto market has evolved from what was initially a small community of idealists and dreamers experimenting with novel concepts on Bitcointalk Forum, into a global industry with billions in yearly investments and tens of thousands of people working full-time to progress the adoption of distributed ledgers and cryptocurrencies.

When IOTA was started in 2015, the team and our community were driven by a vision to create a better, sustainable, and more equitable future for everyone. Our primary goal was to create an impact in the real world, showcasing the potential of IOTA across all industries together with large enterprise companies and governments. Guided by a scientific approach, we introduced the first DAG-based DLT architecture, and over the years have developed it further into a reliable, global network infrastructure.

With our forthcoming IOTA 2.0 protocol upgrade, we will take the next big step to introduce a unique and highly competitive protocol architecture that is fully permissionless, leaderless, and decentralized. This has the potential to position IOTA as one of the leading technologies for traditional industries and for new Web3 ecosystems to build, grow, and scale on IOTA.

To make this future a reality, we feel that now the time has come to make bold decisions, double down on IOTA, and maximize the utility and economic activity of the $IOTA token. To do so we had to make some key decisions.

The four key decisions we want to share today are:

- We will focus on maximizing the utility, scalability, and economic activity of the IOTA network and the $IOTA token, with Shimmer positioned as a complementary staging network to validate and expedite the technical roadmap of IOTA.

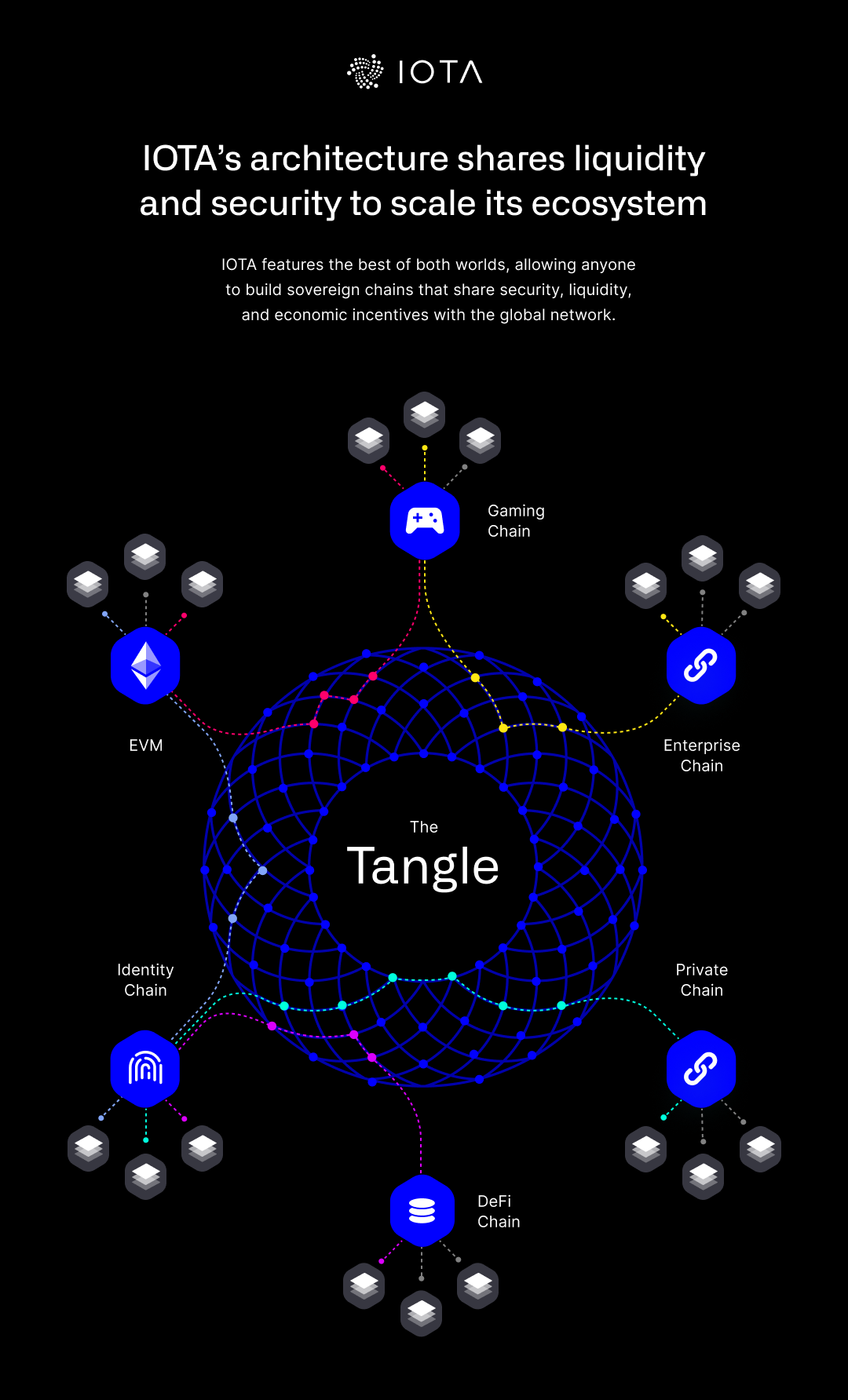

- After the launch of IOTA 2.0, we will introduce programmability on the IOTA Layer 1 (L1) by integrating general-purpose smart contracts. This will help to maximize the utility of the $IOTA token by increasing the demand for Mana and it will align L2 networks with the IOTA L1 through shared security.

- We will not further develop and release the Assembly project and the Assembly token. Instead, we will focus our efforts on IOTA Chains, our generalized smart contract framework for anchoring Layer 2 (L2) blockchains on IOTA, and developing L1 smart contracts. IOTA holders that staked for Assembly tokens will get an IOTA token airdrop.

- We will introduce a new Ecosystem Fund that will help further decentralize the governance of IOTA and support ecosystem growth. Several community governance vehicles, committees, and entities will be set up to empower the community to help manage the ecosystem fund. This Ecosystem Fund will be funded through a temporary token inflation that will last for four years, increasing the total supply to 4.6 billion IOTA tokens.

Future-proofing IOTA

IOTA 2.0 will be a consensus and settlement layer capable of securing and tokenizing assets, to enable seamless and frictionless transfers and to connect and create new digital ecosystems for Web3, enterprises, and governments. Our leaderless consensus is one of the best alternatives to the existing validator/miner-based networks by maximizing decentralization and permissionless participation for everyone.

Our generalized smart contract framework (IOTA Smart Contract Chains) will allow anyone to deploy and anchor WASM or EVM-based L2 networks into the IOTA L1. The upcoming launch of the ShimmerEVM on the Shimmer network – the staging network of IOTA – will mark the launch of the first smart contract chain in the IOTA ecosystem. We will continue investing in IOTA Chains to increase customizability, decentralization, tooling, features, interoperability, and broader support with existing solutions. This includes supporting zkRollups and other zk-based technologies in the future.

Just some examples of L2 networks that are currently being developed within our ecosystem are:

- ShimmerEVM, the first EVM-compatible smart contract chain to launch on Shimmer. This will be the basis for an entire DeFi ecosystem to be created.

- GovChains, which we have developed through EBSI (European Blockchain Services Infrastructure), are an example of government-operated L2 networks to be built on IOTA to enable new digital services for governments and citizens (e.g. digital identities, digital product passports, registries, etc.)

- TLIP is a network for trade and logistics, currently already running in a large-scale pilot in Kenya and being expanded across Africa and other countries.

- Demia is an L2 network for tracking, securing, and making decisions based on verifiable climate data.

These L2 networks will finally introduce programmability and dApps to the IOTA ecosystem. However, unless they are unified and share security with the L1, they will inevitably take activity and liquidity away from it, thereby decreasing its security and growth.

To further expand the possibilities of IOTA and enable shared security and liquidity, we will introduce programmability through general-purpose smart contracts on the IOTA L1.

The full picture:

- With IOTA 2.0, we will have a highly competitive consensus and settlement protocol to establish IOTA’s unique ledger architecture as a foundational trust layer;

- With IOTA Chains, we have a framework for building and launching general-purpose and application-specific L2 smart contract networks on IOTA, including EVM and WASM-based networks;

- With the introduction of L1 programmability, we will have a framework to open up the IOTA base layer to new possibilities for builders to create applications and utility on a single, highly scalable, and composable network and to secure and connect L2 networks built on IOTA.

Smart contracts on IOTA L1

Through a multi-year development effort, L1 smart contracts on IOTA will be introduced through a general-purpose VM (Virtual Machine). This solution will run on the unique DAG of IOTA 2.0 without limiting the overall scalability and throughput of the network.

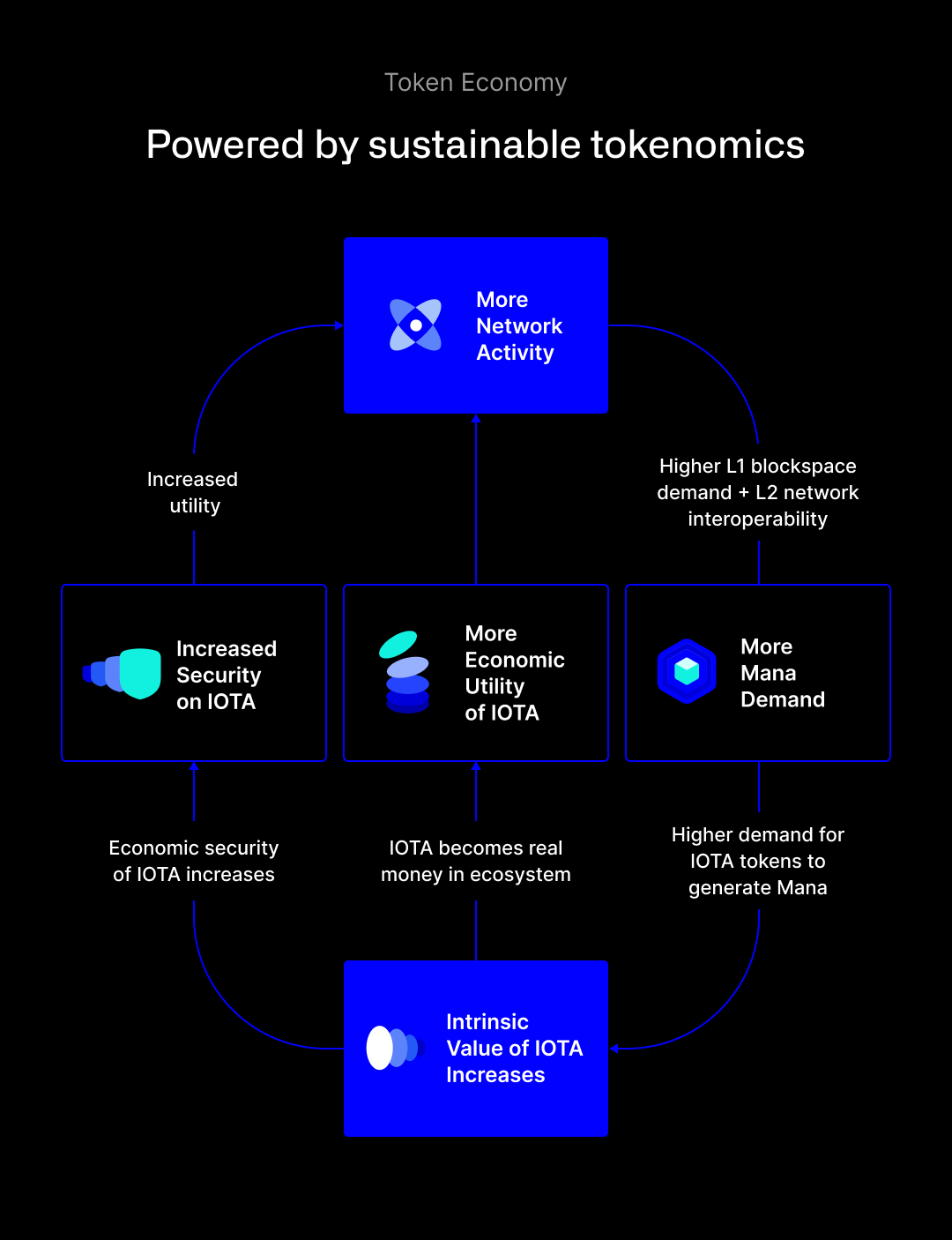

Applications built on IOTA through L1 smart contracts will generate significantly more demand for Mana, which in turn will increase the demand for $IOTA tokens. This self-sustaining economic system is key to increasing the security of the IOTA network and in turn, generating more demand for applications and L2 networks to build on IOTA.

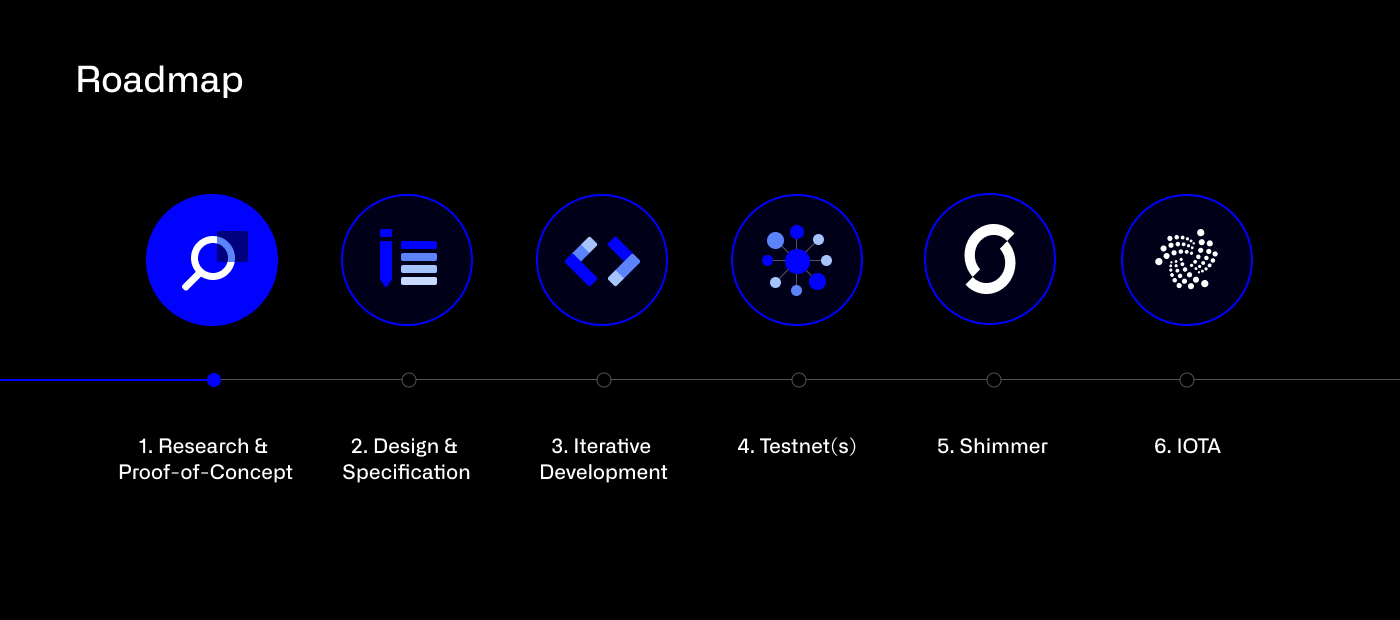

More progress updates and details on the solution will be shared in the coming months. The work on the solution has already started some months ago, with a new team focused on L1 smart contracts. The development of L1 smart contracts is a multi-year effort and we only intend to launch a public testnet of this sometime after the launch of IOTA 2.0.

$IOTA Tokenomics: One token to create a thriving ecosystem

With IOTA 2.0 and the introduction of Mana, the tokenomics of IOTA will receive a major overhaul. The upcoming demand for blockspace through L1 smart contracts, asset tokenization, and IOTA Chains anchoring activity will create more demand for IOTA tokens, thereby underpinning them with intrinsic value and utility. An increase in the value of the IOTA token also directly increases the security of the entire network, which in turn creates more demand for blockspace.

Demand for blockspace is the main driver for the value appreciation of IOTA. The more demand we have for blockspace, the more demand there is for Mana and thus, the IOTA token. With the introduction of L1 smart contracts, we expect to see the demand for Mana increase significantly. This will be a virtuous cycle where more adoption will lead to more demand for IOTA tokens to be staked to secure the network and to gain access to the network. Together with our ecosystem, we want to focus on maximizing the utility and economic activity of the IOTA L1 and the $IOTA token.

A deeper dive into the Tokenomics of IOTA 2.0 and the involvement of Mana will be published in the forthcoming IOTA Tokenomics Whitepaper.

We will not release Assembly and the Assembly token in favor of IOTA

We had initially intended to introduce Assembly because, at the time of the announcement, we did not have a feasible solution to establish programmability through general-purpose smart contracts directly on the IOTA L1. UTXO-based smart contracts were a very limited concept, not capable of delivering the kind of flexibility we envisioned. Over the past year, the DLT space, as well as our research teams, have made great progress in that direction. We have shown that we can indeed achieve programmability by directly embedding smart contracts on our L1 ledger without limiting the overall network’s performance.

This development, in combination with the advancement of zkRollups (which inherit the security of the L1 through cryptographic proofs, thus they no longer require complex mechanisms to guarantee economic security through a native token), proved to us that Assembly’s envisioned technical architecture, while technically feasible, would introduce too much of a delay on our technical roadmap and it would introduce a solution that we deem inferior to our new approach with L1 smart contracts.

With the planned introduction of smart contracts on L1 and the further development of the IOTA Chains framework for AppChains and zkRollups, the role of Assembly within the IOTA ecosystem would be obsolete. While we could continue to invest resources into it, launching a technologically inferior solution and yet another token would further fragment the ecosystem.

Instead of creating further complexity in our protocol, creating a potentially competing solution that takes away value from IOTA and the $IOTA token and diluting our focus, we have made the decision to officially stop Assembly and the Assembly token before its launch.

The ideas, concepts, and the intended value creation of Assembly will instead flow into IOTA. Instead of having competing tokens across the layers, we will embed the $IOTA token within all core functions of our network. The combination of a highly scalable, decentralized, and secure settlement layer with IOTA 2.0, the IOTA Chains framework for AppChains and zkRollups on L2, and the introduction of smart contracts on L1 will position IOTA as one of the leading Web3 ecosystems.

While this was a difficult decision to make, we are confident that this is the best path forward for IOTA and the future we want to create. IOTA stakers that have received Assembly tokens will be eligible for an IOTA token airdrop. Further details are provided below.

Ecosystem Fund to support IOTA’s growth and adoption

Since the start of IOTA in 2015, we have always done things differently than others. We did not raise a large funding round with our initial token sale (only $500k was raised), 100% of the token supply was issued to the community and we did not reserve any tokens for the founders, team, or the foundation. All development was funded by donations from the community.

As the industry evolved over the years and new token projects started to progressively reserve more of their issued token supplies to spend on marketing activities and adoption, it became increasingly more difficult for IOTA to compete with our limited ability to invest in the ecosystem’s growth and adoption.

The upcoming release of IOTA 2.0 and the launch of smart contracts on IOTA will mark a turning point. Together with our ecosystem we can finally take matters into our own hands and forge our own success. However, technology alone will not help IOTA succeed. Only by combining technology with the ability to invest in growth and adoption will we be able to position IOTA as a leading ecosystem again. Instead of battling for survival, we need to battle for adoption.

Before the launch of IOTA 2.0, we now have an opportunity to change IOTA’s tokenomics from 2015 by making an adjustment to the token distribution for the first and final time. Through a temporary token inflation that will last four years, we are introducing a new dedicated Ecosystem Fund to support the growth and further development of IOTA and realize its vision of the future.

IOTA token distribution with Stardust fork

The new IOTA ecosystem fund will be funded through the vested release of new IOTA tokens created as part of the upcoming IOTA Stardust hard fork (more details below). Following the hard fork, there will be a temporary bi-weekly token release that will last for four years, after which the total supply has been reached. This token release over four years will equate to an average temporary 12% inflation per year. After these four years, the circulating token supply of IOTA will be equal to its new fixed total supply of 4,600,000,000 IOTA. (Note that we are using a new IOTA token denomination: for more details, see the end of this article).

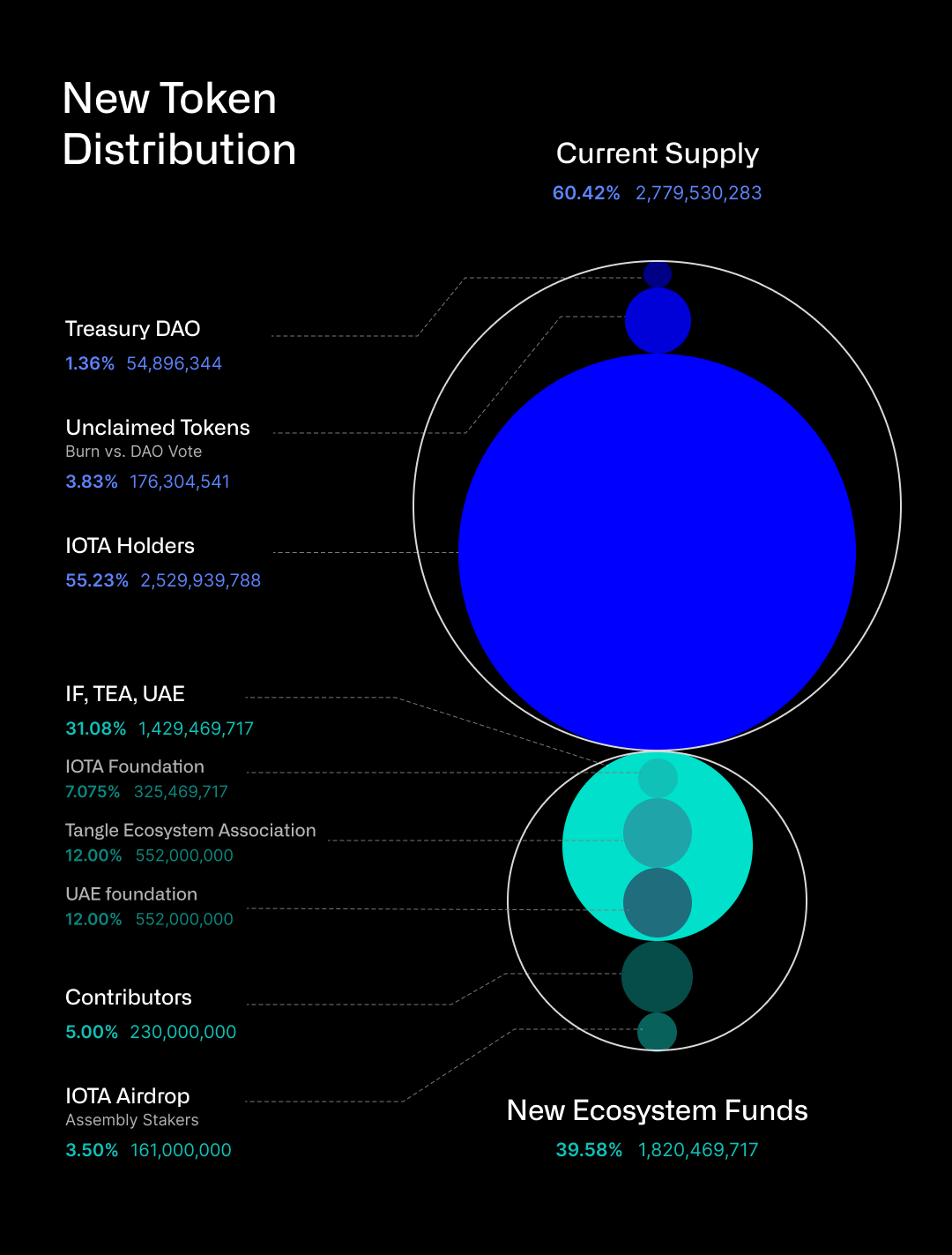

With the new token distribution, existing holders will retain more than 60% of the total supply, while the new IOTA ecosystem funds, contributors, and the IOTA token airdrop to those who staked for Assembly will together be less than 40%.

The following visuals break down the token distribution and release schedule, with the entities that will receive IOTA tokens through this release schedule:

- IOTA Holders: Existing IOTA holders own a total of 2,529,939,788 IOTA tokens.

- Unclaimed Tokens: The 176,304,541 unclaimed IOTA tokens from the Chrysalis network upgrade will be removed from the circulating supply and only released once valid claims are processed. After the end of the two-year claim period, the community can decide whether these tokens should be burned to reduce the total token supply or assigned to the IOTA Treasury DAO. More information is below.

- Treasury DAO: The Treasury DAO will receive 54,896,344 IOTA tokens, as was officially decided in a governance vote in 2022. As part of the unclaimed tokens of the previous migration period, a final valid manual claim of 7,664,631 will be processed.

- Ecosystem Fund: In total, the ecosystem fund will equal 1,820,469,717 IOTA tokens, which will be gradually released over four years. This ecosystem fund will be used for R&D (IOTA Foundation) and for Ecosystem Funding (TEA and IOTA DLT Foundation), as well as contributors and an IOTA airdrop.

- Tangle Ecosystem Association (based in Zug, Switzerland): Responsible for ecosystem funding and support, with a key focus on Europe and the US. TEA receives 12% of the total supply, or 552,000,000 IOTA tokens. 10% of those tokens will initially be unlocked, with the remainder unlocked through bi-weekly releases over four years.

- IOTA Foundation (based in Berlin, Germany):The main entity responsible for the R&D and government affairs work of IOTA. Receives 7.075% of all tokens, or 325,469,717 IOTA Tokens. An initial unlock of 10% of the locked IOTA tokens, with the remainder unlocked through bi-weekly releases over four years

- IOTA DLT Foundation (based in Abu Dhabi, UAE): Responsible for ecosystem funding and support, with a key focus on the MENA, Africa, and Asia regions. Receives 12% of the total supply, or 552,000,000 IOTA tokens. An initial unlock of 10% of those tokens with the remainder unlocked through bi-weekly releases over four years.

- Contributors: Contributors are key partners and dedicated members who are helping IOTA and the ecosystem. They will receive a total of 5% of the total supply, or 230,000,000 IOTA tokens. An initial unlock of 10% of IOTA tokens, with the rest vesting over 24 months.

- IOTA Airdrop: Airdrop for IOTA stakers that staked for Assembly tokens. A total of 3.5% of all tokens, or 161,000,000 IOTA Tokens, are distributed to IOTA stakers. An initial unlock of 10% of the IOTA Tokens, with the remainder unlocked through bi-weekly releases over 24 months. This airdrop will be directly visible within the wallet of each eligible user.

With the removal of the unclaimed tokens from the circulating supply, at the time of the network upgrade, the circulating supply of IOTA will be 2,785,272,714 IOTA tokens which is slightly more than today’s token supply of 2,779,530,283 MIOTA. Over four years, through a release of tokens every two weeks, the circulating supply will gradually increase. After four years, the total supply of 4,600,000,000 has been reached. It is important to mention that the community can vote in the future to further reduce the total circulating supply by burning the unclaimed tokens (more information below).

Governance of the ecosystem funds

In our efforts to further decentralize the ecosystem, two new entities have been established to further streamline and accelerate the growth and support of IOTA and its ecosystem. Separately to the IOTA Foundation, which is primarily focused on the R&D and regulatory affairs efforts, the Tangle Ecosystem Association based in Zug, Switzerland, and the IOTA DLT Foundation based out of Abu Dhabi, UAE, have been set up to support the IOTA ecosystem.

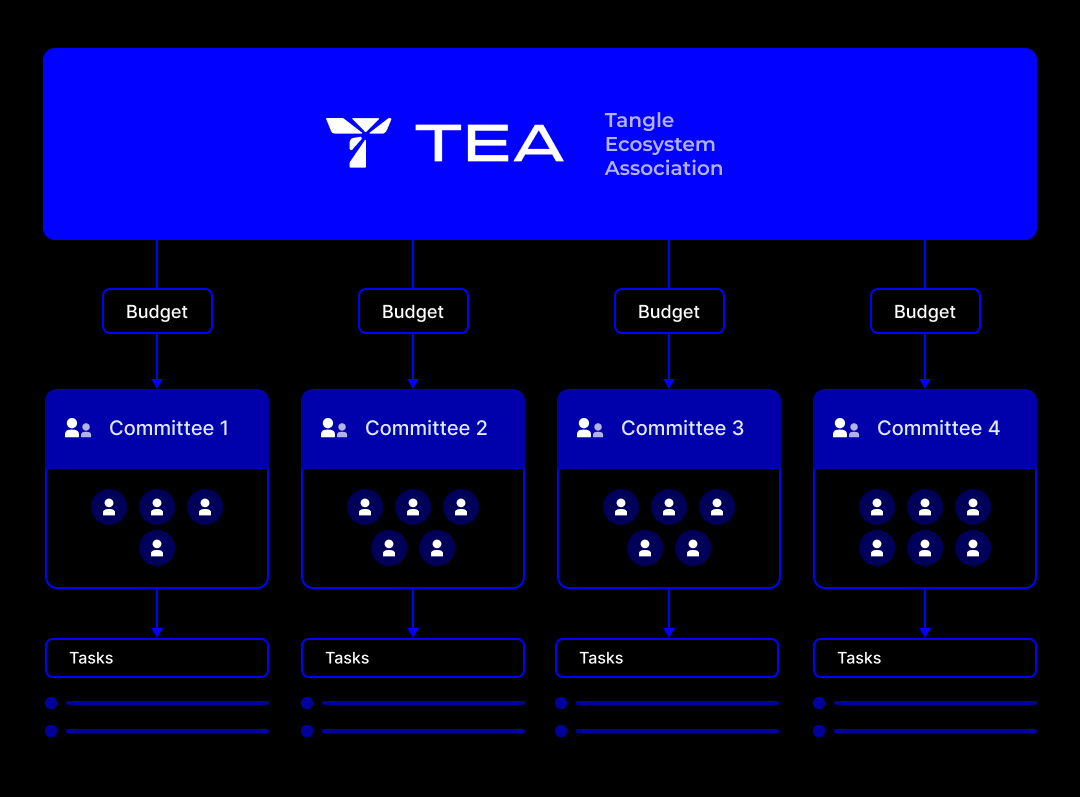

Under the legal umbrella of the Tangle Ecosystem Association and the IOTA DLT Foundation, our community will be empowered to initiate, set up, and run purpose-bound committees that will work collaboratively to improve IOTA and the overall ecosystem. These committees will be able to receive and steward budgets from the newly created ecosystem fund in a transparent manner.

The purpose of these committees, as indicated by their charter, is to support the growth of IOTA and its ecosystem by responsibly managing the new ecosystem token treasury. The governance structure for the Tangle Ecosystem Association and IOTA DLT Foundation have been uniquely designed to empower the IOTA community with special privileges. These privileges are:

- Governance over token treasury: Through a formal governance process, the IOTA community can propose and vote to establish special committees that will manage part of the token treasury for specific purposes (e.g. establish IOTA gaming ecosystem, IOTA marketing initiatives, Asia adoption, etc.).

- Oversight and transparency: The community will have oversight over how budgets of token-voted committees are allocated. Updates on the overall spending of the ecosystem funds will be shared every quarter, with a detailed yearly transparency report published at the end of the year.

Through a formal governance process, the community can establish specific committees. Community members will be voted into these committees through a token voting process, and the committees will be hosted under the legal umbrella of the entities. These committees are then directly responsible for allocating a predefined budget and can do so with autonomy.

The tasks of these committees can cover a wide range of important ecosystem responsibilities such as community building, marketing initiatives, public goods funding, pushing adoption in certain markets and industries, infrastructure integrations, organizing hackathons and events, and many others. The community will be empowered to propose these committees for specific tasks and nominate the members for these committees. If such proposals find enough support in the community and align with general guidelines and principles, the proposed committee will be established and will receive a budget from the newly created Ecosystem Fund.

We believe that this is an important step to further decentralize IOTA and to ensure its growth. We look forward to working together with our community to realize the vision of IOTA and allocate the new Ecosystem Fund in the best interest of IOTA.

After the Stardust upgrade, we will invite our community and ecosystem partners to work with us on a detailed process that defines the scope and governance of these committees and the respective allocated assets from the ecosystem fund for this endeavor. Exact details will then be discussed and voted on by the community

IOTA Community Treasury DAO

Once smart contracts are deployed on the IOTA mainnet, we will finally be able to officially establish the IOTA Community Treasury DAO. This DAO will receive 54,896,344 million IOTA tokens, as decided by a community-wide governance vote in 2022. The IOTA Community Treasury funds will be fully available after the IOTA smart contract chain has launched and the necessary governance smart contracts for this DAO have been deployed.

We recommend that the Tangle Treasury (recently established under the legal entity Tangle DAO LLC incorporated in the Marshall Islands) should receive a first budget from the IOTA Community Tokens to begin the operation of an IOTA Community Grant program along with its already successfully running Shimmer Grant Program. This initial budget allocation will make it possible for the IOTA Community Grant program to immediately become operational and start supporting the ecosystem.

After the IOTA Stardust upgrade, a governance vote amongst IOTA token holders will be held to officially enable the IOTA Community Grant Program under the Tangle DAO LLC. The IOTA Community Governance group has already created a governance proposal to facilitate these implementations.

IOTA token airdrop

Part of the total supply of the Assembly token had been distributed to IOTA stakers. To date, this amounts to 12,380,515,719.163956 ASMB tokens or around 12% of the total Assembly supply.

Because the development of the Assembly network has been stopped, stakers will not receive Assembly tokens. IOTA holders who have staked for Assembly tokens will be eligible for an airdrop of IOTA tokens. Following the IOTA Stardust network fork, roughly 161,000,000 IOTA, or 3.5% of the total supply, will be airdropped to IOTA stakers.

Any staker can look up the amount of IOTA tokens that will be airdropped to them by searching for their addresses in the token distribution for IOTA Stardust.

A new version of Firefly that displays the amount of IOTA tokens that will be airdropped to any staker will be released after the IOTA ledger has been upgraded to the IOTA Stardust protocol version. Likewise, the IOTA explorer will display future token unlocks for all addresses.

Apart from an immediate unlock of 10% of the allocated tokens per address, airdrops of IOTA tokens will be happening pro rata, over 24 months through bi-weekly automated unlocks.

Unclaimed tokens

After the IOTA network’s upgrade to the Chrysalis protocol version in February 2021, users were required to migrate their tokens to a new EdDSA-based ledger layout. From this migration period, 176,304,674 tokens still have not been migrated by their owners. The current ability to auto-migrate tokens from the pre-Chrysalis IOTA network via the Firefly wallet will end with the IOTA Stardust upgrade. Once IOTA smart contracts are available on the IOTA network, this feature will be restored and migrations can be processed automatically again.

The Coordinator for the current IOTA legacy mainnet will be deactivated synchronously with the upgrade of the IOTA network from Chrysalis to Stardust. We thank the engaged group of community members who have still been operating nodes in the legacy network since the Chrysalis upgrade in 2021 for their service to the community.

Until the new migration solution of the Stardust ledger is implemented, there will be a period in which no further claims can be processed. Therefore, we recommend that anyone who has been waiting for the migration of their tokens from the legacy network to migrate their tokens now to the Chrysalis network with the Firefly wallet’s automated migration functionality before this feature is temporarily deactivated with the Stardust protocol upgrade.

Once the smart contracts-based migration solution is established, the network will continue to service migrations for another two years before the ability to migrate tokens from the legacy network will end. After that time, the community will vote on whether any unclaimed tokens should be burned (thereby reducing the total token supply) or whether they should be contributed to the Community Treasury DAO.

Next Step: IOTA fork with Stardust upgrade

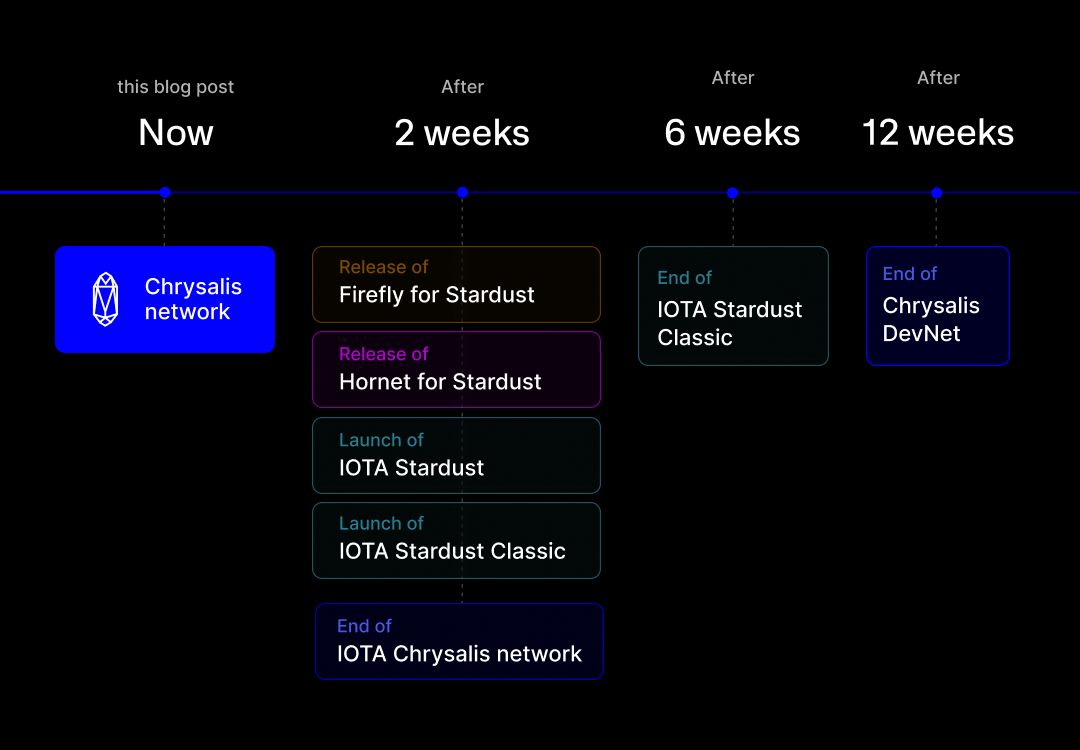

On September 29th, 2022 the Native Tokenization Framework (referred to internally as “Stardust”) was released on Shimmer. Since then, it has been battle-tested for release on the IOTA network. Two weeks from today, IOTA will be upgraded to the Stardust protocol.

With the Stardust upgrade, IOTA will receive exciting new features that will greatly increase its utility, including:

- Transforming IOTA into a multi-asset ledger through the ability to feelessly mint, tokenize, and transfer native assets

- The ability to feelessly mint and transfer NFTs on the IOTA L1

- Smart contract tokenization, which enables the anchoring of L2 Smart Contract Chains on IOTA’s Tangle via the IOTA Chains Framework and enables IOTA to act as a trustless asset bridge between L2 Chains.

- Asset wrapping, which enables assets from L2 chains to be wrapped and unwrapped into L1 native assets.

- The IOTA L1 will become a messaging layer for smart contract requests between L2 networks.

Once the IOTA network has been upgraded to Stardust, the IOTA and Shimmer networks will have feature parity until the Shimmer network advances further to accommodate IOTA 2.0. L2 smart contract chain will be launched on the IOTA network after they have been sufficiently tested and trialed on the ShimmerEVM.

With the Stardust upgrade, the IOTA network will fork. One network will have the tokenomics adjusted to allow for the creation of a new ecosystem fund, while the other network fork will keep the same token supply as today. Technically, two networks will be spawned from the current Chrysalis IOTA network:

- IOTA Stardust: A network upgraded from the current Chrysalis protocol version to the Stardust version, with a total supply of 4,600,000,000 IOTA and a circulating supply of 2,785,272,581. Over four years, tokens will be unlocked through a temporary token release matching roughly 12% of new tokens per year.

- IOTA Stardust Classic: A network upgraded from the current Chrysalis protocol version to the Stardust version, with a total supply of 2,779,530,283 IOTA (under the old denomination).

Tokens in both networks will be accessible by their respective owners using their private keys as used in the current Chrysalis protocol version of the IOTA network. There is no user action required to migrate tokens to either of the upcoming Stardust networks. A simple wallet upgrade is sufficient. Tokens held on exchanges are unaffected by this upgrade.

Node operators need to make a decision on which network they support. Instructions will be provided at the time of the upgrade.

Please note that moving forward, the IOTA Foundation will only support the IOTA Stardust network. Any entity or group eager to take over the operations of the IOTA Stardust Classic network needs to garner sufficient support from the community so the IOTA Foundation can hand over the keys of the distributed validators to them.

The IOTA Foundation will maintain the IOTA Stardust Classic network for four weeks, starting with its launch, but not provide any technical or user support for it, including node software and wallet software, exchange integrations, as well as any adaptations of libraries.

The current Chrysalis DevNet will be deactivated three months after the upgrade of the IOTA network to the Stardust protocol version, to enable large entities and corporations to migrate their applications.

Validator Committee on IOTA Mainnet

Together with the Stardust network upgrade and the new token distribution of IOTA Stardust, the Coordinator node previously operated by the IOTA Foundation, will be replaced by a permissioned validator committee, operated by multiple entities, as introduced this week.

While this new committee setup is only an intermediary step until IOTA 2.0 is introduced on the IOTA network (which will implement fully permissionless and decentralized Delegated Proof of Stake-based validation of the network), it meanwhile offers a higher grade of decentralization, censorship-resistance, and resilience.

We believe this to be a simple but useful intermediary step to further decentralize the network until its next major upgrade to IOTA 2.0 occurs.

The IOTA Stardust Classic network will also receive a validator committee. If an entity or a group gathers sufficient support from token holders to take over the validator committee, that group can take over the nodes in the validator committee and determine who should maintain them.

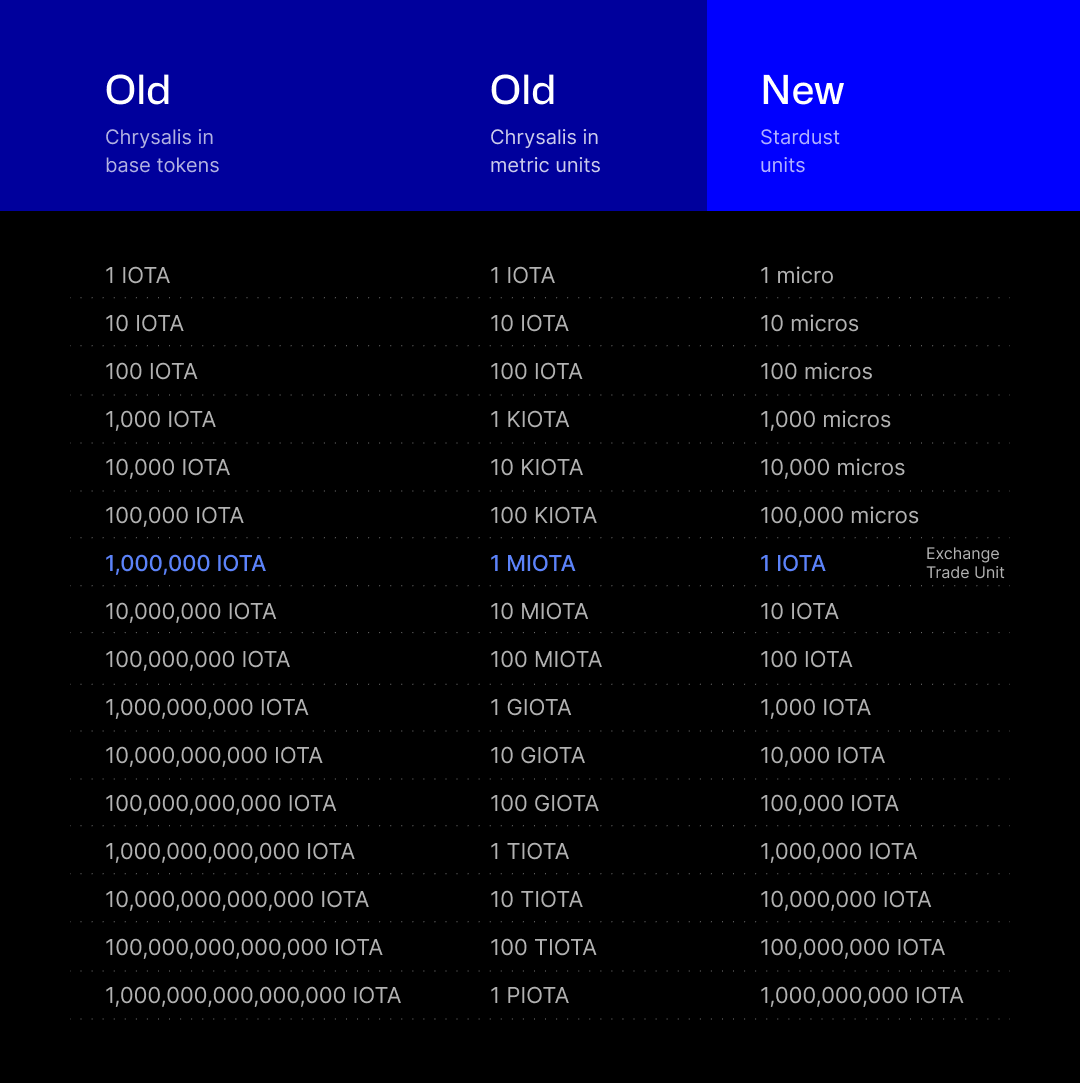

New IOTA token denomination: moving away from metric unit prefixes

At the inception of IOTA, we intended to adhere to standards by using metric system prefixes. However, indicating a multiple or submultiple of the unit has been proven impractical to deal with daily, especially since, at most, one of those units is used (MIOTA). With the Stardust upgrade, we will therefore change the units of measurement.

Instead of kilo (KIOTA), mega (MIOTA), giga (GIOTA), tera (TIOTA), peta (PIOTA), the new smallest unit in IOTA is called “micro”, or “micros'' for multiple units. What was previously 1 MIOTA will now simply be one IOTA. 1,000,000 micros equal 1 IOTA.

These units of accounts are already in place with Shimmer today, where glow is the smallest unit.

Finally, the following timeline outlines the main ETAs detailed in this blog post:

iota-news.com

iota-news.com