Binance’s BUSD (Binance USD) initially experienced substantial growth and strong support from the exchange during its inception. However, recent data indicates a different trend, with BUSD’s market capitalization declining by 21% in the past month, according to CoinGecko.

When Binance introduced BUSD in 2019, it entered the market with confidence and the backing of the world’s largest crypto exchange. BUSD achieved remarkable success, reaching a market capitalization of $1 billion USD in just 261 days, surpassing other stablecoins.

In a short period, Binance listed 97 BUSD trading pairs, eventually exceeding 300, highlighting its popularity in the crypto community. However, circumstances changed over the past year, leading Binance, once a strong advocate for BUSD, to take a different approach.

In February, Paxos, the stablecoin issuer, severed its ties with Binance and ceased minting BUSD in response to a request from the New York Department of Financial Services (NYDFS).

Recent developments within Binance Launchpool have shown a preference for alternative stablecoins as staked assets. BUSD staking, once prominent in the exchange’s token-farming platform, has become less prominent in recent pools.

Instead, the latest Launchpool events have embraced FDUSD, a newcomer in the stablecoin market. Throughout August, participants can accumulate CYBER and SEI tokens by staking BNB, TUSD, or FDUSD.

BUSD’s journey has faced challenges, but it’s essential to recognize that the cryptocurrency market is highly dynamic. While BUSD encounters obstacles, it remains a contender, and its future depends on Binance’s strategy and market dynamics.

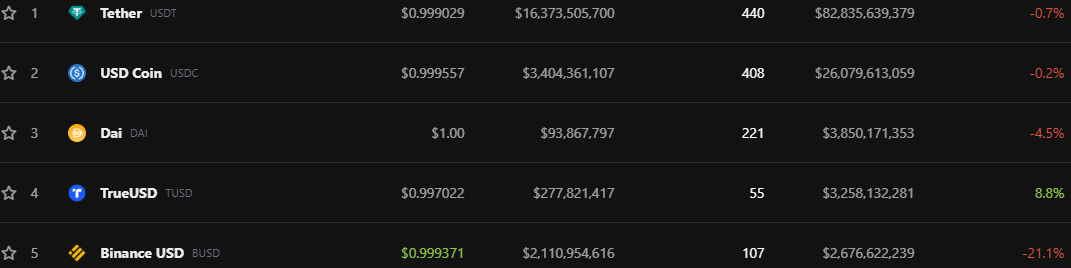

While BUSD currently seems like a less favorable stablecoin, investors are steering their attention towards other stablecoins, including TrueUSD. TUSD has witnessed an 8.8% surge in market cap as opposed to USDT and USDC, which exhibited a drop of -0.7% and -0.2%, respectively.

coinedition.com

coinedition.com