RUNE, the native utility token of the THORChain decentralized liquidity protocol, has emerged as the top gainer among the top 100 cryptocurrencies, while Binance partially suspended the asset’s withdrawals.

RUNE gained 7.6% in the past 24 hours and is trading at $1.61 at the time of writing. The rise comes while the asset’s 24-hour trading volume registered almost 50% incline, currently at $50 million.

Moreover, RUNE’s market cap rose to $546 million, making it the 61st largest crypto asset.

You might also like: Binance will reportedly delist Monero and privacy coins in Belgium

The price hike comes while the largest crypto exchange by trading volume, Binance, suspended RUNE withdrawals on its BNB Beacon Chain (BEP2). The exchange noted that the suspension comes due to high wallet congestion.

However, RUNE’s withdrawals on THORChain and the asset’s deposits on both networks seem to be fully operational, per Binance’s data.

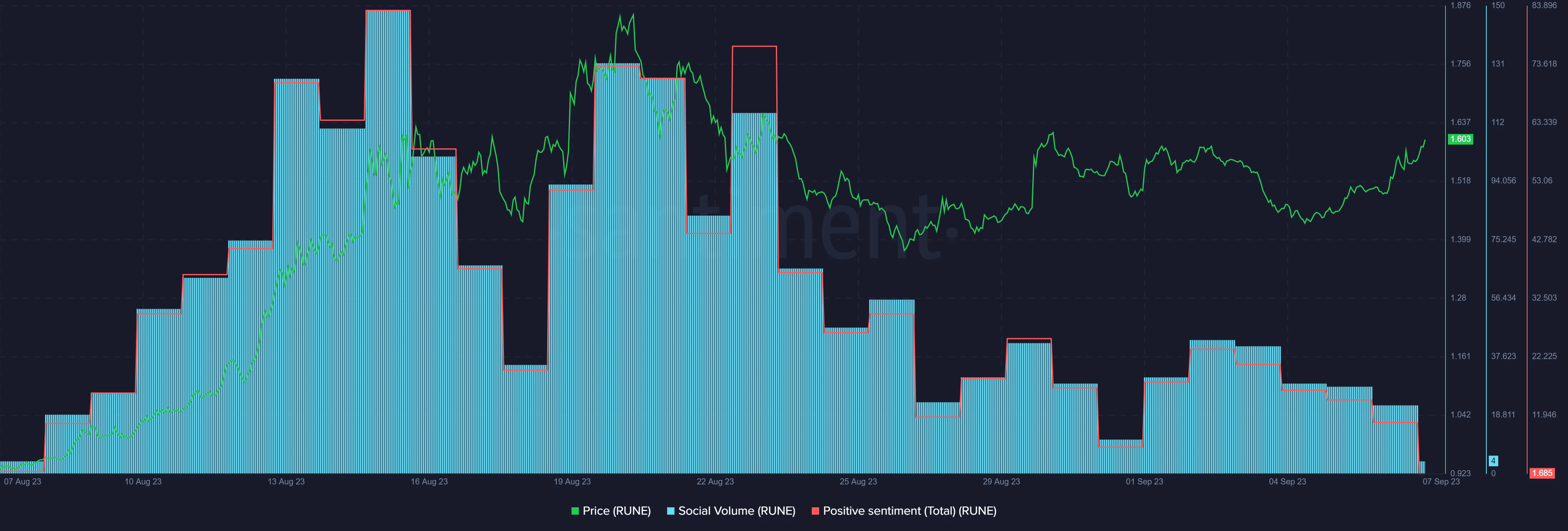

Furthermore, data provided by the market intelligence platform Santiment shows that the positive sentiment around THORChain has been constantly fading over the past week. Per the data, RUNE’s optimistic sensation plunged by around 95% since Sep. 2.

While THORChain registered 72% gains over the past 30 days, its social volume has constantly been declining, with a few gains since Aug. 15, according to Santiment.

Per the market intelligence platform, RUNE’s social volume dropped by 90% over the past week.

This is not the first time that THORChain has faced network issues. The decentralized liquidity protocol halted its operations due to a security flaw in the network in late March. Per a report on March 28, the suspension was made to prevent any potential threats.

Read more: Crypto whales shuffle millions via Binance amid regulatory scrutiny