In the early months of 2023, the stablecoin sector faced a challenging period due to SVB bank issues. However, the latest data indicates a revival of activity and optimism in the stablecoin market.

Leadership Battle in Stablecoins!

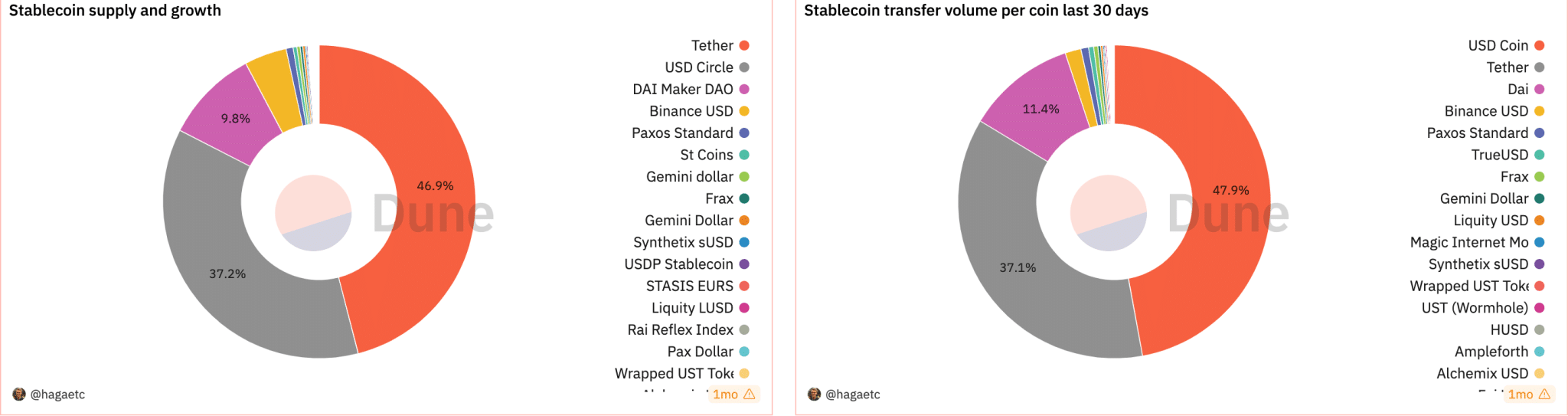

Although less active when analyzing past market behaviors, stablecoin (SC) activity, particularly for $USDC and $USDT, showed significant growth in the size of SC assets compared to their market values. This trend provided insights into both individual and institutional flows of stablecoins. In terms of trading volume, $USDC took the lead in the stablecoin sector, accounting for 47.9% of all stablecoin trading activities. Conversely, according to Dune Analytics data, $USDT led the market in terms of market value and supply growth.

Despite facing challenges in increasing its market value, $USDC may experience growth following its recent collaboration with the Cosmos network. Noble, an application chain designed for native asset issuance on Cosmos, will facilitate easy and secure access to $USDC published on Noble through the Inter-Blockchain Communication (IBC) ecosystem.

This move will make $USDC native to the Cosmos network and establish it as the official form of $USDC for the Cosmos ecosystem. The integration aims to increase native $USDC liquidity in various Cosmos application chains, including dYdX and Osmosis.

Developments in Tether!

Meanwhile, Tether is actively working on renewable energy mining for Bitcoin. This move could positively impact the stablecoins associated with the company. Tether Energy is forming partnerships with local companies worldwide, providing capital, infrastructure support, development expertise, and general support to establish renewable energy production and Bitcoin mining facilities.

These initiatives not only align with the increasing focus on sustainability in the cryptocurrency field but also express Tether’s commitment to environmentally friendly practices, potentially attracting environmentally conscious investors and users to stablecoin offerings.