Tether, one of the leading stablecoin companies in the world, is drawing attention with its significant investment in US Treasury bonds. According to Paolo Ardoino, the Chief Technology Officer of Tether, the company currently holds $72.5 billion worth of Treasury bonds. This investment makes Tether one of the largest 22 holders globally, surpassing many countries. Ardoino states that this development demonstrates the adoption of $USDT as a safe haven against inflation in national currencies.

$USDT, a Lifeline for Users

According to Paolo Ardoino, the Chief Technology Officer of Tether, Tether, one of the largest stablecoin companies in the world, has become one of the largest buyers of US Treasury bonds. In a social media post, Ardoino emphasized that Tether currently holds $72.5 billion worth of Treasury bonds. He highlighted that this amount places the issuer company among the top 22 holders, including Spain, Mexico, Australia, and the United Arab Emirates.

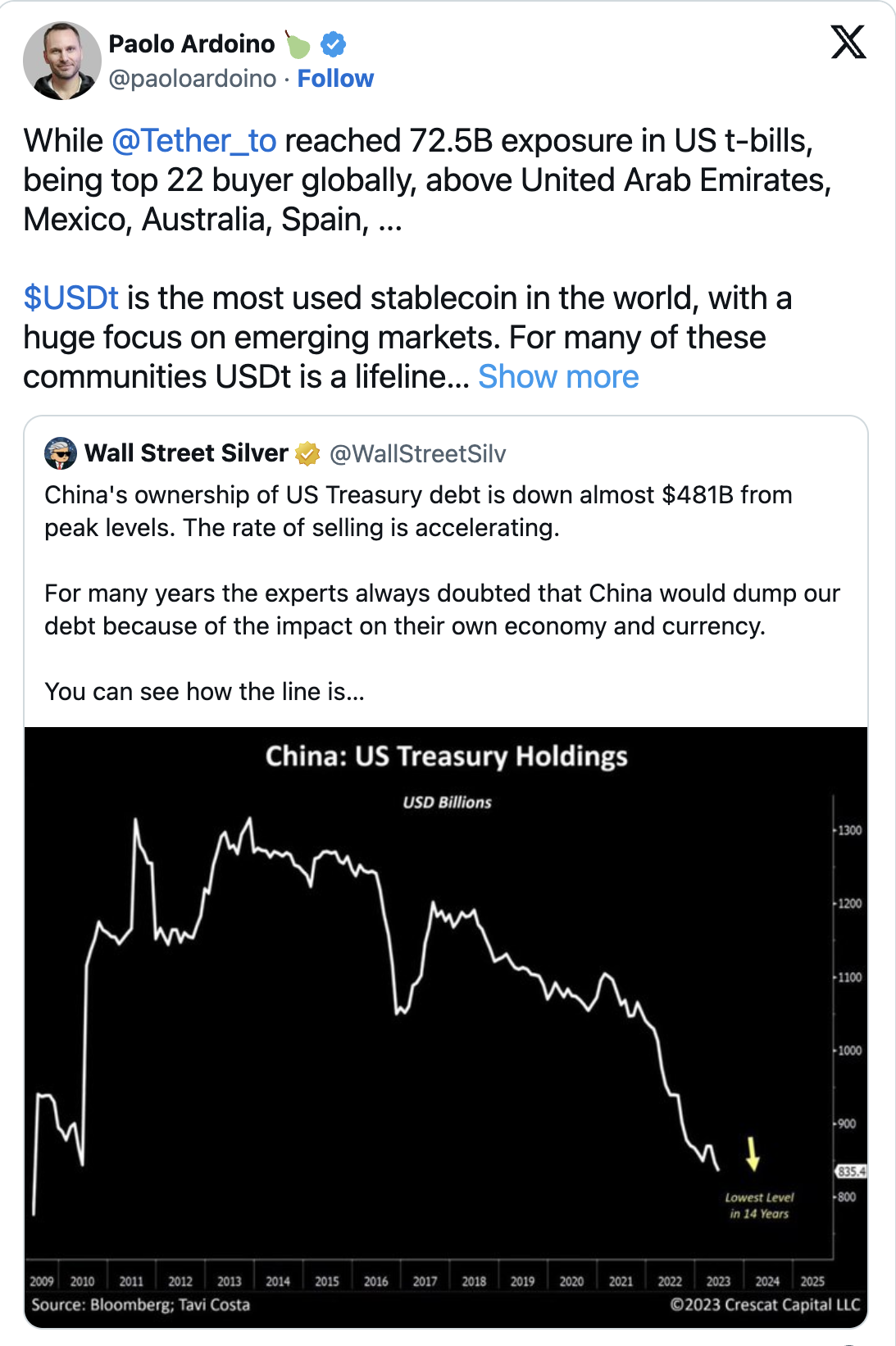

Ardoino believes that this development showcases the importance of $USDT in various emerging markets worldwide. According to him, $USDT provides communities with a lifeline to protect themselves against rampant inflation in national currencies. The executive shared this development in response to another social media post highlighting China’s declining ownership of US bonds and their shift towards safer investment instruments like gold.

Tether Continues Investments and Collaborations

Prior to Paolo Ardoino’s post, it was reported by the company earlier this year that Tether holds billions of dollars in bonds. On July 31, the company issued a reserve statement stating that it holds up to $3.3 billion in reserves for $USDT.

Meanwhile, Tether continues to expand its access. On August 29, it added Britannia Bank & Trust, a private bank in the Bahamas, as a partner to process dollar transfers on its platform. The company joined the list of banking partners, which includes Deltec Bank and Capital Union Bank.