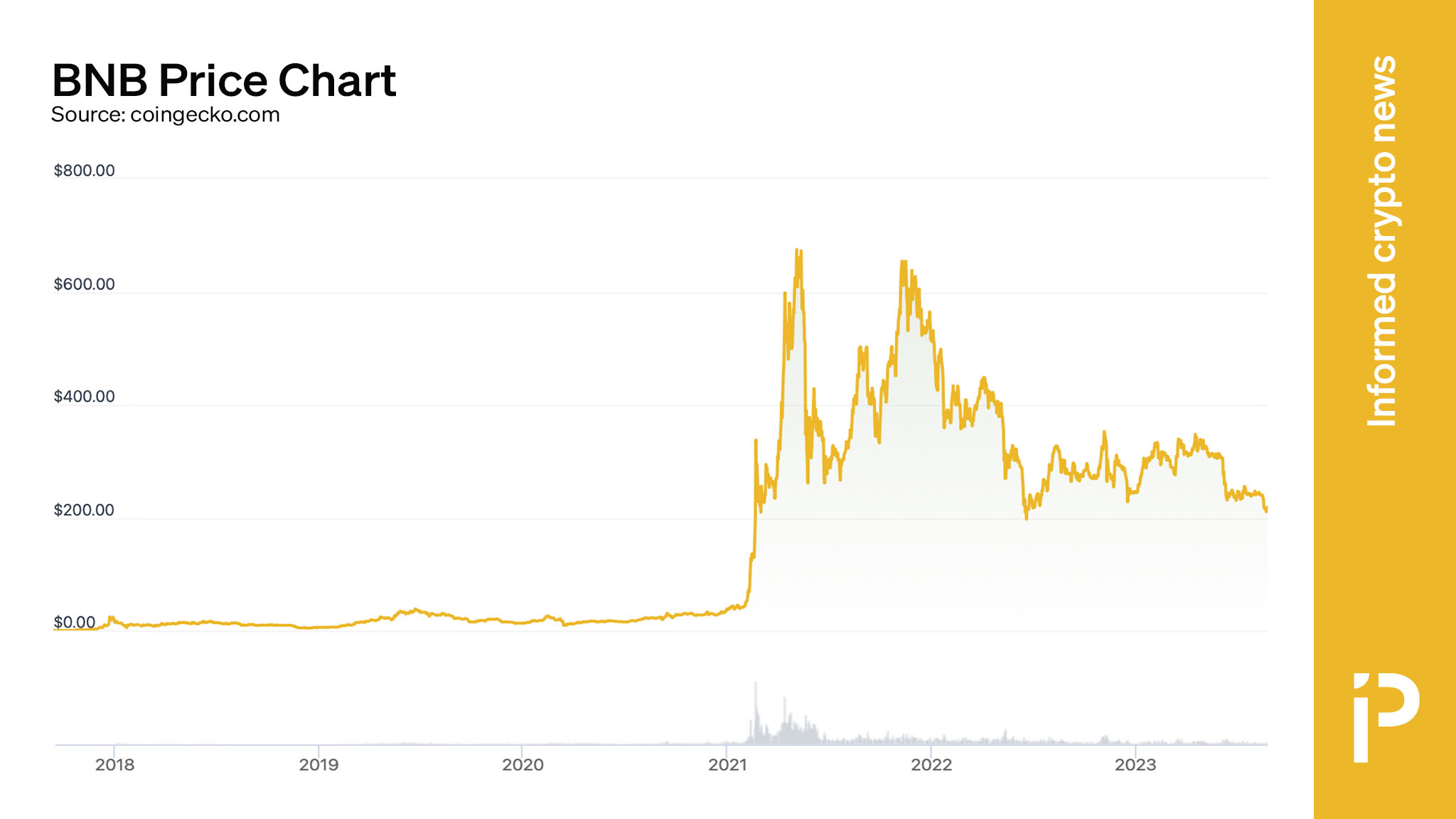

Binance’s $BNB coin tumbled as low as $204 on August 22, though it has tentatively recovered to around $217. Binance would naturally be interested in keeping $BNB from tumbling too far, though that’s difficult given increased regulatory scrutiny and its dwindling access to fiat off-ramps.

$BNB has rarely traded lower than $200 since February 2021. Binance holds at least $4 billion worth of assets on its $BNB blockchain. In addition, its founder Changpeng Zhao (CZ) beneficially controls a substantial percentage of $BNB’s $33 billion market cap. Bloomberg estimates CZ’s personal net worth at $27 billion, including his bitcoin, $BNB, and equity in Binance and Binance US. However, CZ and Binance officials have disputed this number.

As is the case with many crypto exchanges, Binance’s proprietary token can collateralize various forms of loans, reserves, and attestations. As we know from the dubious history of Tether, assets can move on and off a balance sheet within hours of an attestation.

As demonstrated in spectacular fashion in November 2022, once FTX’s proprietary token ($FTT) fell below $22, the entire exchange collapsed within two days. Various forms of $FTT-backed collateral on margin cascaded into liquidations. FTX filed for bankruptcy.

Importantly, Binance US admitted that Merit Peak has traded on its exchange, which caught the SEC’s ire. In addition to revelations that Binance US commingled customer deposits with corporate funds, Merit Peak further spurred the SEC’s plea for an emergency freeze of Binance US assets. Because CZ is a controlling member of Merit Peak which traded against Binance’s own customers, the SEC pleaded to a judge that CZ could be trading against US citizens or mismanaging funds.

Read more: SEC probes Binance, Reuters finds billions in crypto washed via the exchange

Plenty of misbehavior at Binance

CZ certainly questioned the SEC’s pre-lawsuit investigation into whether $BNB was an unregistered security. No matter: The SEC has designated $BNB and Binance’s stablecoin BUSD as unregistered securities.

Binance became a target of scrutiny from the SEC due to CZ’s alleged control of Binance US through proxies like BAM Trading Services Inc. and the above mentioned Merit Peak. It announced a partnership with BAM to launch Binance US in 2019, saying it would license its matching engine and wallet technologies to BAM.

It said Binance US was going to operate independently from Binance. However, significant evidence suggests otherwise. The SEC alleged in court that CZ and Binance have controlled substantially all funds of Binance US customers since inception. Moreover, Silvergate Bank authorized a Binance executive, Guangying Chen, to move funds held in Binance US bank accounts in 2019 and 2020. An employee in Chen’s department also moved $400 million from Binance US to Merit Peak. That CZ-controlled entity became a major market maker on Binance US.

All of this commingling of funds is, needless to say, extremely problematic and possibly illegal. The SEC’s lawsuit against Binance US is proceeding in court.

Binance has denied various reports that it commingled customer and corporate funds when moving money between the Binance US account and the Merit Peak account. CZ also reportedly blew off regulatory concerns about Binance US being unable to access its own bank accounts. He insists that he and Binance remain happy to comply with all of their legal and financial obligations.

Nevertheless, now that CZ has been supposedly caught using proxies and controlling things behind the scenes, his ability to survive a crash in $BNB’s price may start to falter. If the situation gets bad enough, one could imagine some sort of last-ditch effort to establish a floor price for $BNB, like Alameda Research’s Caroline Ellison attempted to do with FTX’s native $FTT token just before FTX and Alameda Research filed for bankruptcy.

@cz_binance if you're looking to minimize the market impact on your $FTT sales, Alameda will happily buy it all from you today at $22!

— Caroline (@carolinecapital) November 6, 2022

Read more: Binance loses yet another payment processor, Checkout.com

A few digital asset followers have speculated that CZ and Binance are already in crisis mode regarding $BNB. Some have claimed that they might be selling some of their bitcoin holdings to bid for $BNB.

Binance loses access to fiat off-ramps

Very recently, Binance suspended withdrawals of US dollars, citing banks’ plans to suspend service to its Binance US exchange. It quickly found an alternative called MoonPay, which enables the purchase of digital assets using debit and credit cards, Google Pay, and Apple Pay. Although not quite a cash withdrawal, MoonPay has a popular brand recognition for US audiences because of its many celebrity endorsements.

More recently, Binance restricted fiat currency withdrawals in Europe due to SEPA transfers. Other fiat off-ramps for Binance appear to be nefarious operations.

The SEC’s scrutiny of Binance’s improper access to Binance US customer assets might have finally caused US banks to back out. As Binance US has suspended deposits, withdrawals, and trading with actual US dollars (though customers could still withdraw stablecoins like Tether plus a bit of MoonPay cards), everyone is watching the price of $BNB like a hawk.

protos.com

protos.com