The ISO 20022 standard has gained significant importance in the financial industry as a unified messaging standard for electronic data exchange between financial institutions. While initially developed for traditional financial transactions, the standard has now expanded to include the world of cryptocurrencies.

ISO 20022 brings standardization and interoperability to the crypto space, ensuring smoother communication between various platforms and participants.

In this article, we are going to explain what are the potential benefits of ISO 20022 coins and examine which cryptocurrencies currently support the standard.

What is ISO 20022?

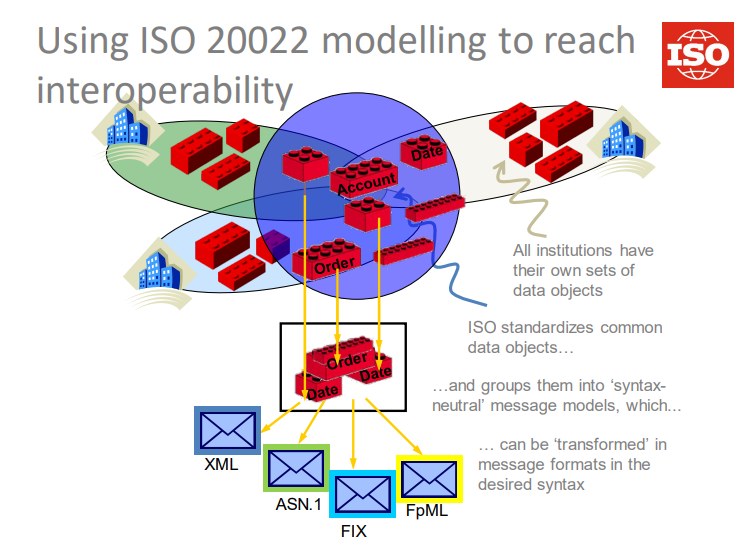

ISO 20022 is an international standard for financial messaging that provides a common language and structure for the exchange of electronic data between financial institutions and international payment systems like SWIFT.

The goal of ISO 20022 is to replace the multitude of different messaging formats and protocols used by various financial systems with a unified and standardized approach. By adopting ISO 20022, financial institutions can streamline their operations, reduce complexity, and improve the accuracy and reliability of data exchange.

Its flexibility makes ISO 20022 suitable for a wide range of financial transactions across different industries, including crypto. Source

Cryptocurrency projects that are ISO 20022 compliant can seamlessly integrate into traditional financial systems and introduce blockchain immutability and data decentralization to the financial sector.

It is worth noting that not all institutions have adopted the requirements to be ISO 20022 ready yet – according to a Forbes report from earlier this year, about 72% of banks are ISO 20022 compliant. The institutions that haven’t yet taken the necessary steps to become ISO 20022 compliant will have until 2025 to do so.

It is also worth mentioning that “ISO 20022 compliant coin” could be considered a misnomer, as the coin or token itself is not compliant. Instead, what we mean when referring to a project as ISO 20022 compliant is that it leverages some of the messaging language defined by the standard to more easily communicate and exchange data between the project’s own solutions (for example, Ripple’s payment network) and external financial systems (for example, SWIFT).

List of ISO 20022 compliant cryptocurrencies in 2023

As the adoption of ISO 20022 continues to grow, several crypto projects have embraced the standard to enhance their compatibility and streamline their operations.

Here’s a full list of ISO 20022-compliant crypto projects:

- $XRP ($XRP)

- Quant ($QNT)

- Algorand ($ALGO)

- Stellar ($XLM)

- Hedera HashGraph ($HBAR)

- $IOTA (MIOTA)

- $XDC Network ($XDC)

In the following sections, we are going to examine ISO 20022 tokens and coins and discuss the implications related to the standard’s implementation.

$XRP ($XRP)

$XRP, the native token of the $XRP Ledger, has gained prominence in the realm of cross-border payments and remittances. $XRP acts as a bridge currency and facilitates liquidity between different fiat currencies. It operates on a consensus algorithm and aims to provide an efficient alternative to traditional banking systems.

As Ripple continues to build its global payment settlement infrastructure, adopting the ISO 20022 standard becomes essential. By embracing ISO 20022, $XRP can seamlessly integrate with existing financial systems, facilitating faster and more efficient cross-border transactions and potentially making $XRP a good investment.

Key features:

- Fast and cheap cross-border payments

- The $XRP ledger can handle up to 1,500 transactions per second

- Uses the cost and energy-efficient $XRP Ledger Consensus Protocol

- Ripple has established partnerships with numerous traditional financial institutions, including Bank of America, Santander Bank, and Intesa Sanpaolo

Quant ($QNT)

Quant is a blockchain platform that focuses on interoperability and the seamless connection of multiple blockchains. It uses the Overledger protocol to connect and exchange information between various blockchain networks. $QNT facilitates collaboration and innovation by enabling developers and enterprises to build decentralized applications that interact with multiple blockchains.

By adopting the ISO 20022 standard, Quant aims to enhance its compatibility with traditional financial systems and facilitate the secure exchange of information between different networks. Being compliant with ISO 20022 could enable Quant to play a crucial role in bridging the gap between various blockchain platforms.

Key features:

- A blockchain interoperability protocol, allowing different blockchains to communicate with each other

- It can handle a large number of transactions without sacrificing performance

- Governed by a decentralized body of stakeholders

- A strong community of developers and users

Algorand ($ALGO)

Algorand is a scalable, secure, and decentralized blockchain platform designed for both financial and non-financial applications. It uses a unique proof-of-stake consensus algorithm and offers fast transaction confirmation times. Algorand supports decentralized applications (dApps) and has its native cryptocurrency called $ALGO.

By adopting the ISO 20022 standard, Algorand can enhance its compatibility with traditional financial systems, enabling seamless integration with existing infrastructure. This move could foster broader adoption of Algorand's technology and attract more developers and enterprises to build on the platform.

Key features:

- Algorand can be used to send and receive payments quickly and easily

- Can be used to create and deploy smart contracts

- Supports decentralized applications (dApps)

- Uses a proof-of-stake consensus mechanism, which is very energy-efficient

Stellar ($XLM)

Stellar is a blockchain-based platform designed for fast and low-cost cross-border transactions. It aims to connect financial institutions, serve the unbanked, and uses Stellar Lumens ($XLM) as its native cryptocurrency. Stellar focuses on financial inclusion and has partnerships with various organizations.

With its focus on interoperability and connecting financial institutions, Stellar is well-suited to adopt the ISO 20022 standard. By integrating ISO 20022, Stellar can enhance its capabilities to facilitate cross-border transactions and improve communication with traditional financial systems.

Key features:

- Fast and cheap transactions

- Uses a unique consensus mechanism called the Stellar Consensus Protocol (SCP)

- Stellar transactions are cheaper than traditional remittance methods, such as wire transfers

- Stellar can be used to build decentralized applications

Hedera HashGraph ($HBAR)

Hedera Hashgraph is a distributed public ledger that aims to provide fast, secure, and fair decentralized applications (dApps). It utilizes a unique consensus algorithm called Hashgraph to achieve consensus among network participants. It is designed for decentralized applications (dApps) and enterprise solutions.

By embracing the ISO 20022 standard, Hedera can enhance its compatibility with traditional financial systems, allowing for seamless integration of dApps with existing infrastructure. This move will foster greater trust and adoption of the Hedera network.

Key features:

- $HBAR is used to pay for transactions on the Hedera Hashgraph network

- The $HBAR token can also be used to participate in staking in exchange for staking rewards

- Heder HashGraph supports smart contracts and dApps

- Very energy efficient and suitable for high-volume applications

$IOTA (MIOTA)

$IOTA is a distributed ledger designed for the Internet of Things (IoT) ecosystem. It uses the Tangle, a DAG structure for secure and scalable transactions. $IOTA enables feeless microtransactions and aims to facilitate machine-to-machine communication in the IoT ecosystem.

As IoT devices generate vast amounts of data, interoperability is crucial for effective communication and data exchange. By adopting the ISO 20022 standard, $IOTA can ensure standardized and secure data transfers between IoT devices, enabling seamless integration of $IOTA into the broader IoT infrastructure.

Key features:

- $IOTA transactions do not require any fees

- Designed to be date-from="2023-08-23" date-to="2023-08-23" lock="false" noenddate="false" symbol="IOT">

$XDC Network ($XDC)

$XDC Network is an enterprise-grade blockchain platform that focuses on facilitating global trade and supply chain finance. It uses the XinFin Hybrid Blockchain protocol and focuses on sectors like finance, supply chain, healthcare, and trade finance. $XDC is the native cryptocurrency, used for transactions and governance.

By embracing the ISO 20022 standard, $XDC Network aims to enhance its interoperability with traditional financial systems and provide a standardized framework for secure and efficient cross-border transactions. This integration will position $XDC Network as a reliable and compliant solution for global trade.

Key features:

- The $XDC Network is a hybrid blockchain, meaning that it combines the benefits of both public and private blockchains

- Can handle up to 2,000 transactions per second

- Designed to be compliant with regulatory requirements

- Can be used to track the movement of goods and materials through a supply chain

$XDC"> The bottom line: ISO 20022-compliant digital assets could bridge the gap between traditional finance and crypto

As the adoption of ISO 20022 expands, the cryptocurrencies presented in this article are at the forefront of embracing the standard to enhance their compatibility, improve communication with traditional financial systems, and foster broader interoperability in the crypto space. ISO 20022-compliant currencies could also play a major role in the Quantum Financial System, a new financial paradigm that aims to leverage blockchain, AI, and decentralized network tech to create a financial system that needs no intermediaries to operate.

ISO 20022’s primary aim is to modernize the traditional financial sector, making it easier for institutions to handle data. The standard could help cryptocurrencies integrate with the traditional sector in ways that were previously impossible. If you want to learn more about crypto projects at the cutting edge technology-wise, read our article on the best artificial intelligence (AI) cryptocurrencies.

coincodex.com

coincodex.com