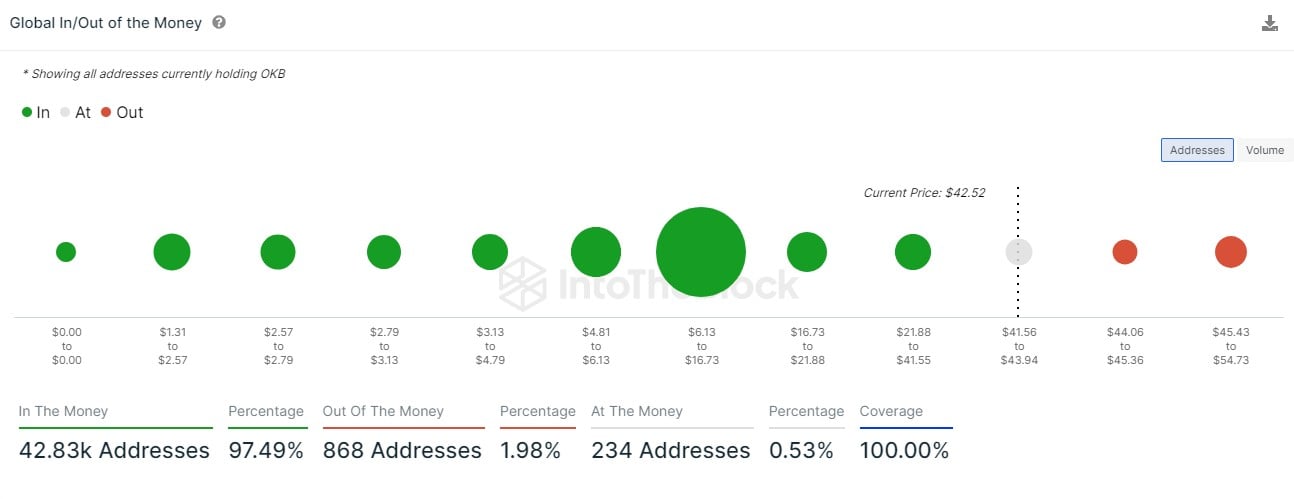

The ongoing market rout that has seen more than $1 billion liquidated on trading platforms has been an all-encompassing one. Despite its price slumping as much as 5.4% in the past 24 hours, OKB is exhibiting features that have continually helped it sustain its luster as an exchange-affiliated altcoin. Per data from IntoTheBlock, OKB addresses in profit have remained at 97%.

Per the chart above, a total of 42,830 addresses holding OKB are "In the Money," a metric used by the analytics platform to depict profitable wallets. Of the total active addresses, just about 868 are in losses at the moment, with a total of 234 currently holding the OKB tokens at neither profit nor loss.

Prior reports indicate similar trends on OKB, a situation that lends itself to many bearish theories for the token.

One of these theories is whether there are limited activities or new acquisitions of the token on the secondary market. To showcase that this massive profitability rate is legitimate, data from CoinMarketCap revealed a 165.9% jump in the trading volume of OKB, with a total of $7.9 million traded in the past 24 hours.

Sharp contrast to competing coins

As an exchange-affiliated token, it is worth comparing the profitability of both OKB and tokens like Bitcoin (BTC) and Ethereum (ETH), both of which are known for their established community and liquidity. Per data from IntoTheBlock, Bitcoin has only managed to keep as many as 49% of total wallet addresses resident on its network as profitable.

Despite the current gloom, Ethereum shares a similar sentiment but with more wallets, or 54.7% of all active holders, maintaining profitability at the moment. While the comparative figure count is brought into perspective, it will be revealed that OKB even outshines projects of its size, influence and related addressable market.

u.today

u.today