XRP has continued to drop to vital support levels, but this decline has attracted whale investors who have taken to accumulating more tokens.

XRP’s collapse from the $0.98 yearly high has elicited concerns among investors and community members. However, amid these apprehensions, whale addresses have accumulated more tokens as the asset drops to significant support levels.

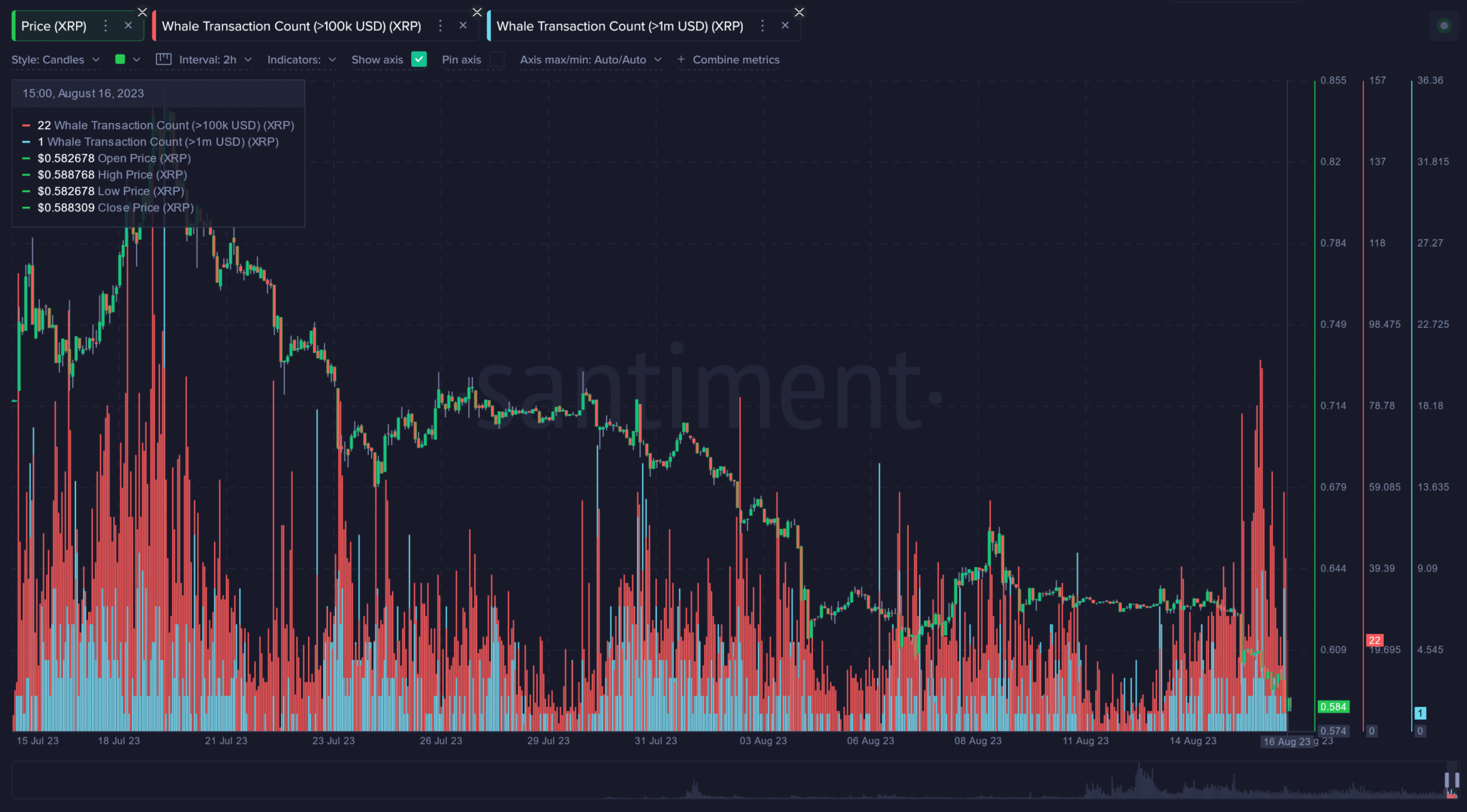

Santiment highlighted this growing pattern in a recent post, noting that XRP is among the few crypto assets witnessing an increase in whale activity despite a downward trajectory.

🐳 As the crowd feels the pain, there are several assets seeing an increase in whale activity. As they attempt to capitalize on the discounted prices, read about the four projects we're seeing some notable activity rises: $SHIB, $XRP, $SAND, & $CAKE https://t.co/SnuKebg7h1 pic.twitter.com/VWKlH95yU0

— Santiment (@santimentfeed) August 17, 2023

In a report, Santiment confirmed that whale transactions on the XRP network have resumed amid the price drop. According to the report, these transactions do not necessarily indicate whale accumulation. Notably, the increase in whale activity could be due to purchases or selloffs.

However, it is doubtful that deep-pocketed addresses are dumping amid a 16.8% decline. Santiment emphasized that these whales habitually accumulate more tokens when an asset plummets.

Interestingly, this increased whale activity began on August 13 after a period of sustained inactivity. As a result, XRP whale transactions worth at least $100,000 have surged to 22, a Santiment chart shows. In addition, the network has witnessed one whale transaction worth over $1 million.

XRP Price Outlook Amid Institutional Interest

Moreover, insights provided by CRU Analysis, a crypto platform focused on analysis, align with Santiment’s data. CRU Analysis highlighted that XRP has continued to print higher lows on the weekly timeframe since June 2022.

(4/5) You can see evidence of institutional accumulation on the #XRP chart, as it has now printed consecutive higher lows going all the way back to the #summer of 2022 pic.twitter.com/SSGLn9kyJE

— CryptosRUs Analysis (@CRUAnalysis) August 16, 2023

The analytical platform stressed that this was evidence pointing to a sustained accumulation by institutional investors. Recall that The Crypto Basic confirmed last month that XRP investment products witnessed a remarkable increase in inflows.

The recent legal clarity accorded to XRP has compounded institutional interest, as investors who dreaded regulatory concerns can now procure the asset. In addition, Phoenix, another crypto-focused analytical platform, asserted that XRP is one of several assets currently in an accumulation zone.

Meanwhile, XRP has broken below the $0.60 psychological support. The asset is changing hands at $0.5892 at the reporting time, down 2.12% over the past 24 hours and 8% in the last week. Prominent analyst Michaël van de Poppe previously pinpointed entry points between $0.6033 and $0.5663.

thecryptobasic.com

thecryptobasic.com