Last week, digital payment giant PayPal Holdings Inc announced PayPal USD ($PYUSD), a stablecoin pegged to the US dollar, signaling a strategic milestone in the Web3 and digital payment sectors.

Development of PAYUSD in Cryptocurrencies!

$PYUSD is backed by a mix of US dollar deposits and short-term US Treasury bonds. Paxos Trust Company, the organization behind the stablecoin, guarantees a 1:1 parity with the US dollar. PayPal’s move is seen as a response to the increasing importance of stablecoins in the digital finance arena.

Following the announcement, PayPal plans to launch a series of features for its users in the US. These include the ability for $PYUSD holders to transfer to other stablecoins to PayPal and other compatible wallets, peer-to-peer transactions, using $PYUSD in checkouts, and easily switching between $PYUSD and other cryptocurrencies supported by PayPal.

Critical Statement from Bloomberg Analyst!

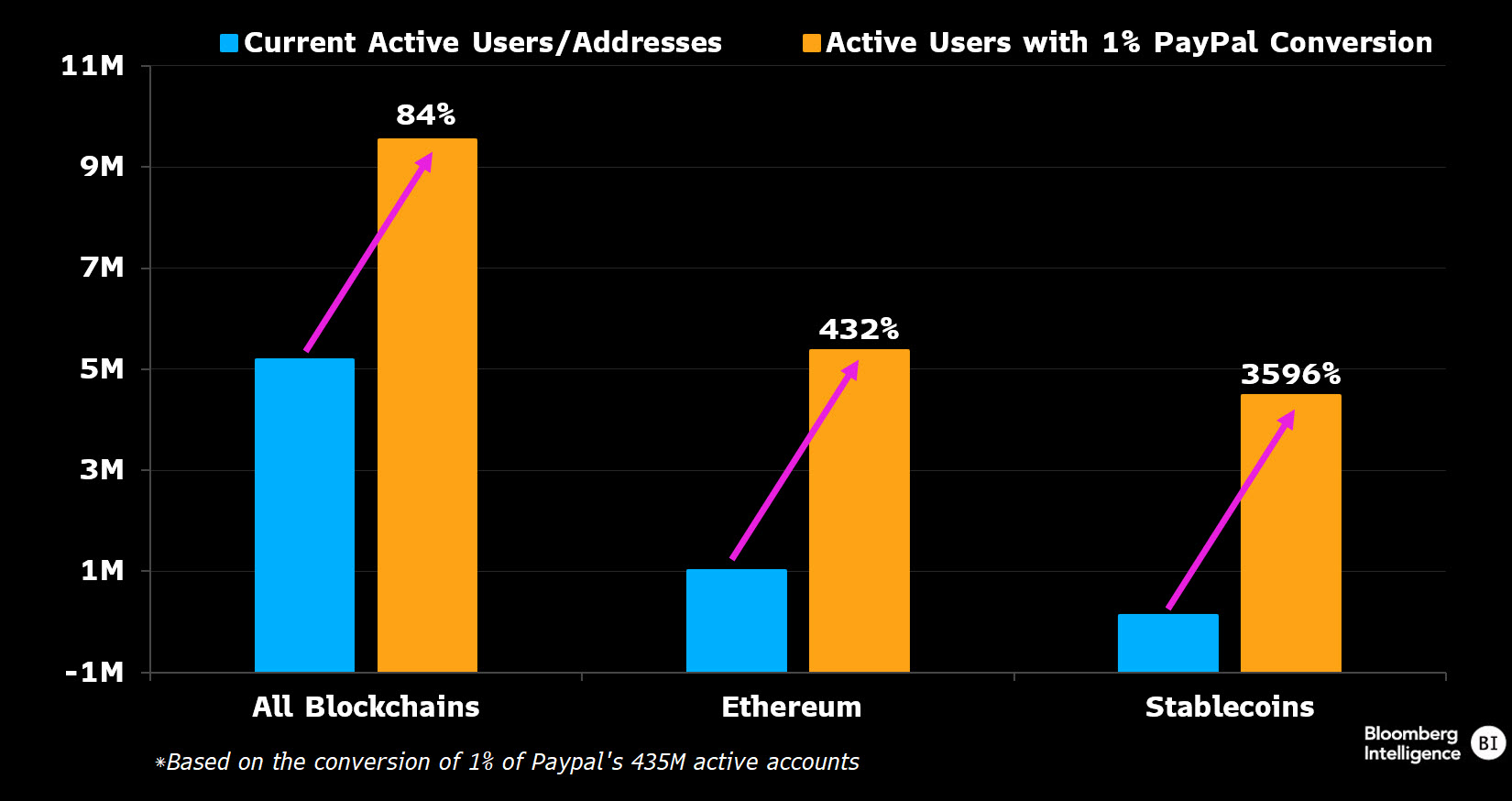

Bloomberg Intelligence analyst Jamie Coutts highlighted the potential impact of PayPal’s new stablecoin on the Ethereum network. Coutts believes that the full effects of PayPal’s stablecoin launch have yet to be fully reflected in the market.

Coutts emphasized the size of PayPal’s user base compared to Ethereum’s. With 435 million active accounts, PayPal’s potential shift to $PYUSD can create significant volatility on the Ethereum network, considering Ethereum only has 1 million active addresses across Layer 1 and Layer 2. To put it in perspective, if only 1% of PayPal users with 4.35 million accounts decide to convert their dollar balances to $PYUSD and start using it, it could have a considerable impact on the Ethereum ecosystem and its native asset, ETH.

Coutts also delved into the current market dynamics of Ethereum. He pointed out that despite significant growth in fee revenue, Ethereum’s value could be low. Specifically, while fees increased by 176% in 2023, the price only rose by 53%. Coutts drew parallels with 2020, where a similar divergence occurred, with fee increases surpassing the price and eventually leading to a bull market.

Coutts also commented on Ethereum’s resilience and performance, noting that the platform has exceeded expectations, particularly with the expansion of Layer 2 solutions, considering the potential erosion of fee revenue. He believes that Ethereum’s competitive advantage has become more evident and its position in the market has strengthened.