Tether CTO, Paolo Ardoino, has raised speculation by tweeting a cryptic message. Amid increased stablecoin launches, Ardoino has questioned the legitimacy of recent market movements without naming a particular coin.

“Isn’t it interesting that $USDT is being pressured down… while suddenly a competitor born 2 days ago is getting it all? Exactly! It feels definitely organic and not manipulative at all,” said Ardoino.

Is Tether CTO Taking a Dig at the $FDUSD Stablecoin?

Last month, $USDT briefly lost its dollar peg and traded at $0.9996. At the time, CTO Paolo Ardoino framed it as a planned attack on the asset.

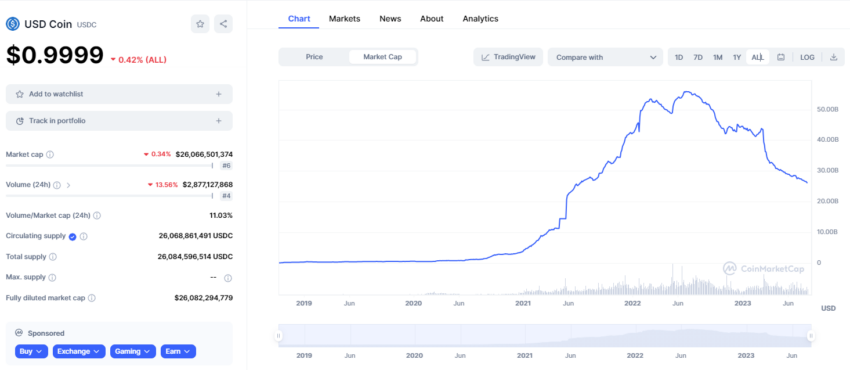

Earlier today, he shared a cryptic post to further hint at a market manipulation as $USDT dipped to $0.9986. He expressed surprise that the second largest stablecoin, $USDC, is also seeing liquidity outflow and has not gained from the situation.

He noted,

“$USDC, the main competitor that you would expect being gaining from the situation, is redeemed heavily nevertheless, while suddenly a competitor born 2 days ago is getting it all?”

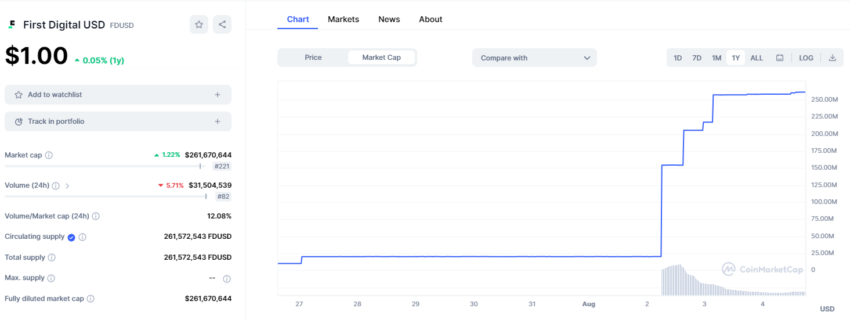

The comment comes as First Digital’s stablecoin $FDUSD gained significant traction at the beginning of August. $FDUSD, like Tether, is a 1:1 USD-backed stablecoin. Binance listed it on July 26 with a zero trading fee offer for selected pairs.

Since its debut, $FDUSD has seen a massive surge in activity. CoinMarketCap data currently shows a supply of over 261 million $FDUSD with a 24-hour trading volume of $31.5 million.

It’s worth noting that the market cap of $FDUSD skyrocketed from close to $154 million on Aug. 2 to nearly $261.5 million by Aug. 4 — an almost 70% increase in just two days.

Meanwhile, BeInCrypto reported that $USDC volume has hit a two-year low.

Market Pressure Building

Apart from $FDUSD, Aave’s GHO has also experienced a period of high traction. However, recently, it lost its $1 peg briefly on July 31, in what is believed to be a consequence of a hack on Curve Finance.

Tether has meanwhile been mired in regulatory disputes. It was penalized in 2021 for ‘misleading’ customers about being fully backed by reserves. Since then, it has revealed its holdings, but a full audit has not been completed.

The company operating the top stablecoin recently added 1,529 Bitcoins to its holdings in Q2, 2023. Ardoino confirmed the purchase at an estimated cost of $45.4 million.

Visit our guide to understand what algorithmic stablecoins are here:

What Are Algorithmic Stablecoins?

Recently, Jameson Lopp, Co-founder & CTO of Casa, claimed that Justin Sun controls most of the Staked Tether (stUSDT) supply.

Lopp noted,

“stUSDT claims to be run by a DAO, but no DAO can be found. It claims to be investing in ‘real world assets,’ but no disclosure is provided.”

New Kids on the Block

Stablecoin regulations continue to stir debate globally. In December 2022, Wall Street Journal reported that a Tether official was alarmed that Sam Bankman-Fried was destabilizing the stablecoin to save FTX.

In a recent Twitter session, Binance CEO Changpeng ‘CZ’ Zhao discussed introducing smaller algorithmic stablecoins.

He raised concerns that came with top stablecoins like Tether and Binance USD and said, “I personally have not seen any audit reports of $USDT… So it’s kind of a black box because we just don’t know.”

In February, due to regulatory scrutiny, CZ raised doubts about the future of dollar-linked stablecoins. But as the stablecoin market heats up, Argentine cryptocurrency trading platform, Ripio recently launched its own USD-tied stablecoin, UXD. Many people living in Latin America considered it as an alternative stable asset to protect them from inflation.

beincrypto.com

beincrypto.com