The stablecoin economy continues to shrink, with more than $3 billion in value removed from today’s top stablecoin valuations in less than 40 days. The dollar-pegged tokens USDP and GUSD experienced the largest 30-day reductions, shedding 45.1% and 27.2%, respectively.

Top Stablecoins Tumble: $3 Billion Evaporates in Less Than 40 Days

Statistics reveal a significant contraction in the stablecoin economy, as billions of dollars have been withdrawn from dollar-pegged projects over the past year. About 39 days ago, the stablecoin economy was valued at $129.80 billion, but it has decreased to $126.70 billion today, with more than $3 billion vanishing since June 16, 2023.

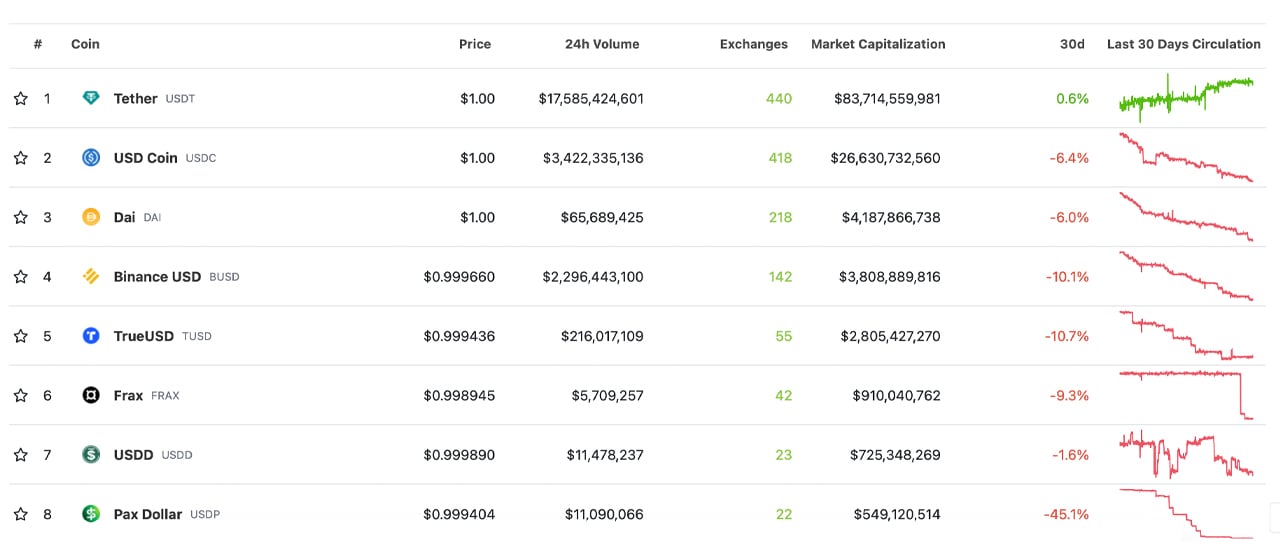

The entire top ten stablecoins by market capitalization, except for tether (USDT), have experienced notable 30-day reductions. While USDT’s supply has increased by 0.6%, usd coin (USDC) has recorded a 30-day decrease of 6.4%. As of Tuesday, July 25, USDC’s market capitalization is $26.63 billion, down from $28.25 billion 39 days ago.

In the past month, DAI has lost 6% of its value, and BUSD has decreased by 10.1%. The stablecoin TUSD saw a reduction of 10.7%, while frax dollar (FRAX) dropped 9.3%. Meanwhile, Tron’s USDD recorded a modest 1.6% loss, and the Paxos-issued pax dollar (USDP) saw its supply dwindle by 45.1% over the same period.

Gemini dollar (GUSD) also experienced a significant loss, dropping approximately 27.2% over the past 30 days. On June 16, the 24-hour trading volume of stablecoins was around $30 billion, but it has since decreased to $23 billion. The global trading volume linked to stablecoin assets has notably declined over the past year.

Conversely, while the value of U.S. dollar-pegged stablecoins has dwindled, euro-anchored projects have recorded growth in the past month. Yet, it’s crucial to note that the volume of these euro-backed stablecoin initiatives significantly trails that of the towering USD token behemoths.

news.bitcoin.com

news.bitcoin.com