There have been thousands of crypto projects since Bitcoin popularized blockchain technology. Yet, not many are as controversial as Worldcoin ($WLD). Founded 2019 in Berlin, the project’s leading founder is none other than Sam Altman, the CEO of OpenAI. This once-Musk funded firm, put Large Language Models (LLMs) in the public spotlight, spearheaded by ChatGPT.

Together with Alex Blania and Max Novendstern, Altman managed to raise $240 million in 2021, led by prolific VC firm Andreessen Horowitz (a16z). This was one year after Blania and Altman founded Tools for Humanity (TFH), a tech firm to “ensure a more just economic system”. TFH is responsible for creating Worldcoin’s protocol and deploying its controversial Orbs.

With today’s launch of Worldcoin tokenomics, the purpose behind the project is finally becoming clear.

The Underlying Premise Behind Worldcoin

As Worldcoin’s marketing ramped up, the controversy followed. The project incentivized recruiters to gather as much biometric data as possible. They had globally deployed so-called “Orbs”, cameras the size of bowling balls, to scan people’s irises.

Because iris scans are unique biological markers for each individual, this provides protection against identity theft and fraud.

In turn, those who signed up and had their eyeballs scanned received a World ID, granting eligibility to receive 25 free Worldcoin tokens. This would allow $WLD tokenholders, as verified unique humans, to participate in a global financial and identity network, cutting short the existing cumbersome KYC procedures.

From May 2021 to July 2023, over 2 million users across 30 nations scanned their retinas to receive World IDs, having become eligible to receive over 43 million $WLD tokens.

With the Orb operator system in place, Worldcoin aims to create a proof-of-personhood network, combining global digital ID and tradeable cryptocurrency. Moreover, because $WLD token enables distinction of real humans from online AI bots, it would “eventually show a potential path to AI-funded UBI” (universal basic income).

Primary Worldcoin Implication

Having the ability to globally and uniquely verify identity holds inherent value. To prevent potential abuses, Worldcoin claims that World ID has been anonymized. Specifically, images taken by Orb cameras are deleted after being used to generate unique iris codes.

In this manner, the tokenized asset ($WLD) tied to the iris code retains privacy via cryptographic technique called zero-knowledge proof. However, one could assume that this biometric data, regardless of format, would be cross-referenced down the line.

For example, a publicly deployed iris scanner to access UBI funds would tap into Worldcoin’s ledger. And if that is one of the goals by the project’s own documentation, all the anonymized private information would simply be instanced as a stepping stone toward wide scale biometric surveillance.

Worldcoin ($WLD) Tokenomics: Free Money for Eyeball Scans?

Regardless of privacy and surveillance implications, is the newly deployed Worldcoin ($WLD) likely to rise in value?

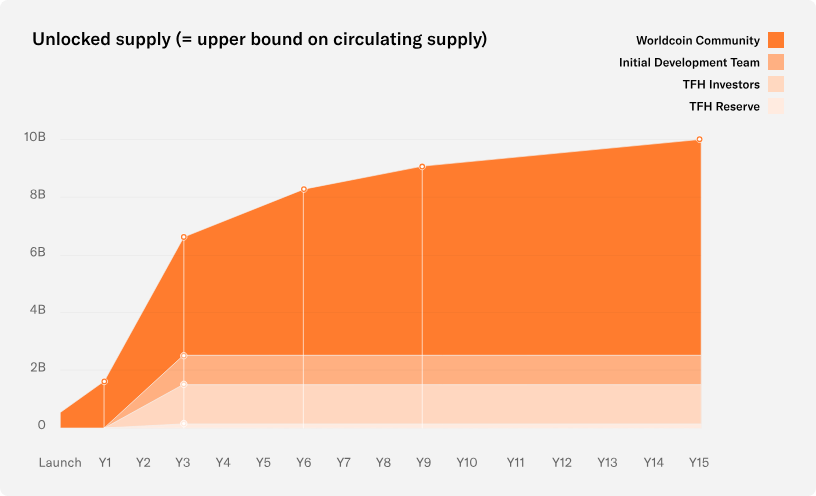

As a native ERC-20 token on the Ethereum network, $WLD token’s initial supply cap is limited to 10 billion $WLD, mirroring future population projection. The initial launch circulation supply is set at 105 million $WLD, with the unlocked supply at 500 million $WLD. Its inflation rate is estimated up to 1.5% annually, but after 15 years.

For comparison, following the introduction of the burning mechanic and transition to proof-of-stake (PoS), Ethereum’s present annual inflation is negative, at -0.173%. This means that Worldcoin ($WLD) will gradually lose value, similarly to the value of the dollar.

Case in point, the Fed’s inflation target is 2%, as the ideal threshold that came closer this June, at 3% inflation rate. Presently, Worldcoin’s default inflation is set at 0%. $WLD tokenholders gain governance power to vote on the pace of new $WLD tokens entering supply.

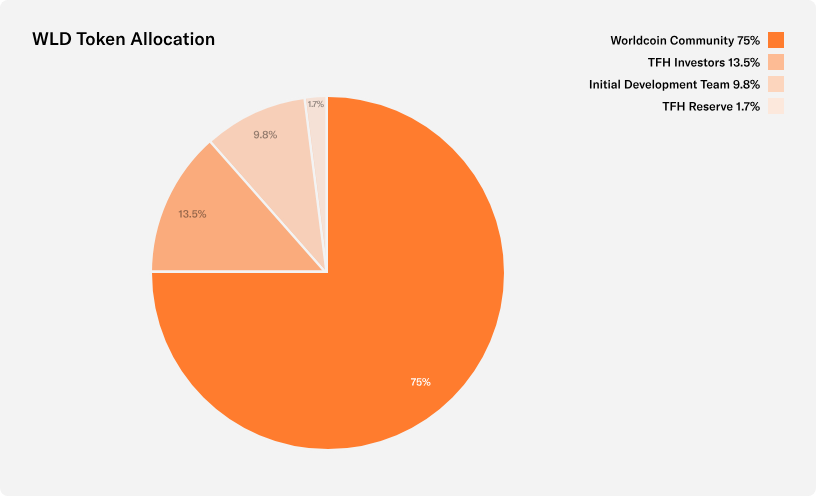

As for $WLD token distribution, 75% of the supply is allocated to biometrically verified individuals, for being a unique human. The rest is distributed to developers (9.8%), Tools for Humanity investors (13.5%) and 1.7% goes to the TFH reserve.

The success of Worldcoin ($WLD) is exceedingly difficult to predict at this point. It depends entirely on the efficacy of Orb operators in their scanning efforts, and the integration of Worldcoin into competitive payment rails. If such killer apps come online, $WLD demand will boost its price significantly.

Worldcoin ($WLD) Availability and Price

For a network aiming to facilitate global financial access and ID verification, even Worldcoin’s official whitepaper is difficult to access. Both in the US and the EU, users report geo-locked restriction.

This is not surprising given that $WLD tokens are officially not even available to US citizens/companies and other restricted territories directly. However, they can access $WLD tokens via WorldApp wallet, which has grown to over 850,000 active accounts.

Furthermore, international exchanges, such as Binance, have listed $WLD tokens, currently priced at $2.3 per coin. As is tradition with new cryptocurrencies, $WLD price has fallen rapidly after the launch.

It also bears noticing that dozens of Worldcoin social media accounts have spawned. Outside of the official WorldApp, no $WLD airdrop is available, so these are all scams. Those who want to gain $WLD without paying can visit registered Orb operators to gain World ID via iris scan, findable via WorldApp’s geolocation.

Worldcoin’s Orb operators are compensated for their scanning efforts in either stablecoins or local fiat currency.

Do you think Worldcoin will integrate into wider WEF/IMF/BIS-supported tokenization efforts? Let us know in the comments below.

tokenist.com

tokenist.com