The stablecoin dominance has hit the lowest level since August 2021 as a result of 16 months of decline. As per the data shared by the cryptocurrency analytics platform, CCData, the stablecoin market cap experienced a decline of almost 0.82% from the start of the month till July 17. Therefore, the decline ended up taking the market cap to approximately $127 billion. At the same time, the stablecoin dominance experienced a minor decline and is currently 10.3% in comparison to 10.5% last month.

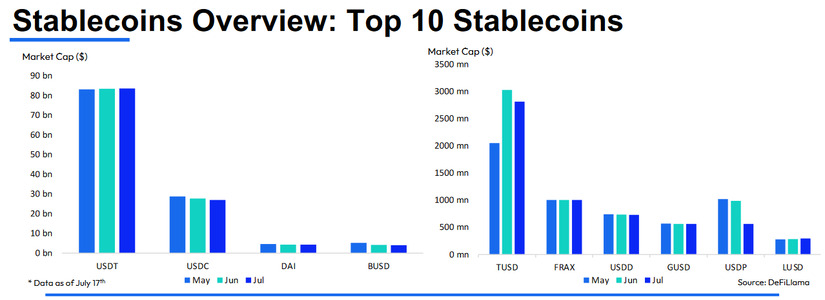

Out of the top 10 stablecoins, Pax Dollar, USDP, suffered the hardest as it fell by a staggering $43.1 to $563 million in July. The decline marks the lowest figure for USDP since December last year. CCData believed that MakerDAO was largely responsible for the fall as the platform vowed to remove USDP worth $500 million for its reserves as it failed to accrue additional revenue. As long as Tether is concerned, it managed to record an all-time high market cap of almost $83.8 million in July, taking its dominance to 65.9%.

Furthermore, the overall market caps of BUSD and USDC declined by 3.01% and 4.57% to $26.9 billion and $3.96 billion respectively. When talking about USDC, this is the seventh consecutive month of decline in the market cap of the stablecoin. Despite the continuous decline, overall stablecoin trading volumes increased by 16.6% to $483 billion in June, signifying the first monthly increase since March.

What Might be the Reason for the Increase in Stablecoin Trading Volume?

CCData believes that the recent lawsuits against Binance and Coinbase from the SEC, coupled with the drastic surge in spot Bitcoin exchange-traded fund filings played a major role in contributing to the increase in the trading volume of stablecoins last month. Another major event that might have impacted the trading volume is the suspension of fiat deposits on Binance.US as a result of the SEC lawsuit against the firm.

Keeping this situation in mind, CCData highlighted that this was the reason that led to the depeg of USDT and USDC from the US dollar. The decentralized stablecoin market experienced a surge in its market cap by 0.43% to $7.52 billion in July. However, the market cap is still down by 78.1% from its all-time high of $34.3 billion.

crypto-economy.com

crypto-economy.com