Celsius Network’s altcoin holdings have been on the move following a U.S. bankruptcy court’s decision to allow the bankrupt crypto lender to sell the tokens for bitcoin and ether starting this month.

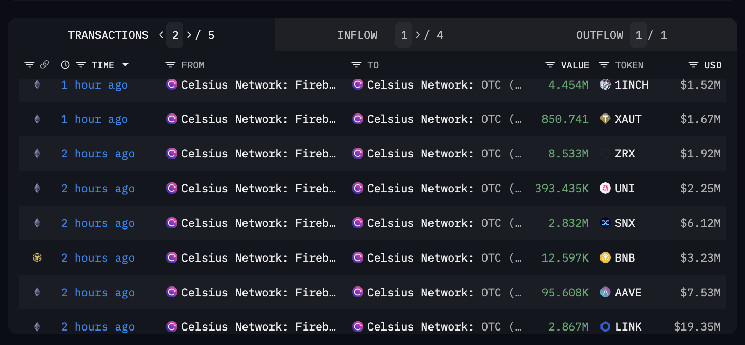

Blockchain data by Arkham Intelligence shows that the firm transferred at least $64 million of cryptocurrencies to a wallet labeled as “Celsius Network: OTC” from the company’s “Fireblocks Custody” wallet in multiple transactions Thursday afternoon.

The largest transactions were $19.3 million in Chainlink’s LINK token, $14.7 million in Polygon’s MATIC, $7.5 million in AAVE and $6.1 million in SNX. Other notable tokens transferred include Uniswap’s UNI, Binance’s BNB and 1INCH.

The transactions happened after the company received approval from the U.S. judge overseeing the bankruptcy case to liquidate its altcoin stash for BTC and ETH starting July 1. Celsius filed for bankruptcy protection in July 2022 after halting withdrawals due to a shortage of customer funds. Alex Mashinsky, ex-CEO of the company, was arrested Thursday on seven counts, including securities fraud, commodities fraud and wire fraud by the Department of Justice (DOJ).

The court's recent decision means that Celsius could potentially sell $170 million of smaller cryptocurrencies, based on court documents. The conversion could apply significant pressure on the markets of smaller tokens, crypto analytics firm Kaiko said in a report earlier this week.

“The market impact could be significant, especially considering liquidity for these tokens has dropped over the past year,” Kaiko said.

coindesk.com

coindesk.com