Latest crypto news for Tether and its USDT stablecoin, which will soon be natively integrated within the Kava ecosystem, designed as a scalable and efficient layer 1.

Tether’s landing on another blockchain, in addition to those in which it has already set foot, fortifies the company’s dominance in a sector of the market on which there is little competition lately.

Let’s look at the details of the news together.

Tether announces launch of USDT stablecoin on Kava

Tether Operations Limited, based in the British Virgin Islands, announced a short while ago the launch of the USDT stablecoin on the layer 1 Kava, a blockchain founded in 2018 that bases its roots on the concept of scalability.

The landing of Tether’s flagship product on Kava is a win-win for both parties.

The move to Kava ensures a foothold for users in the Cosmos ecosystem who intend to use the stablecoin, who can use the former as an access gateway.

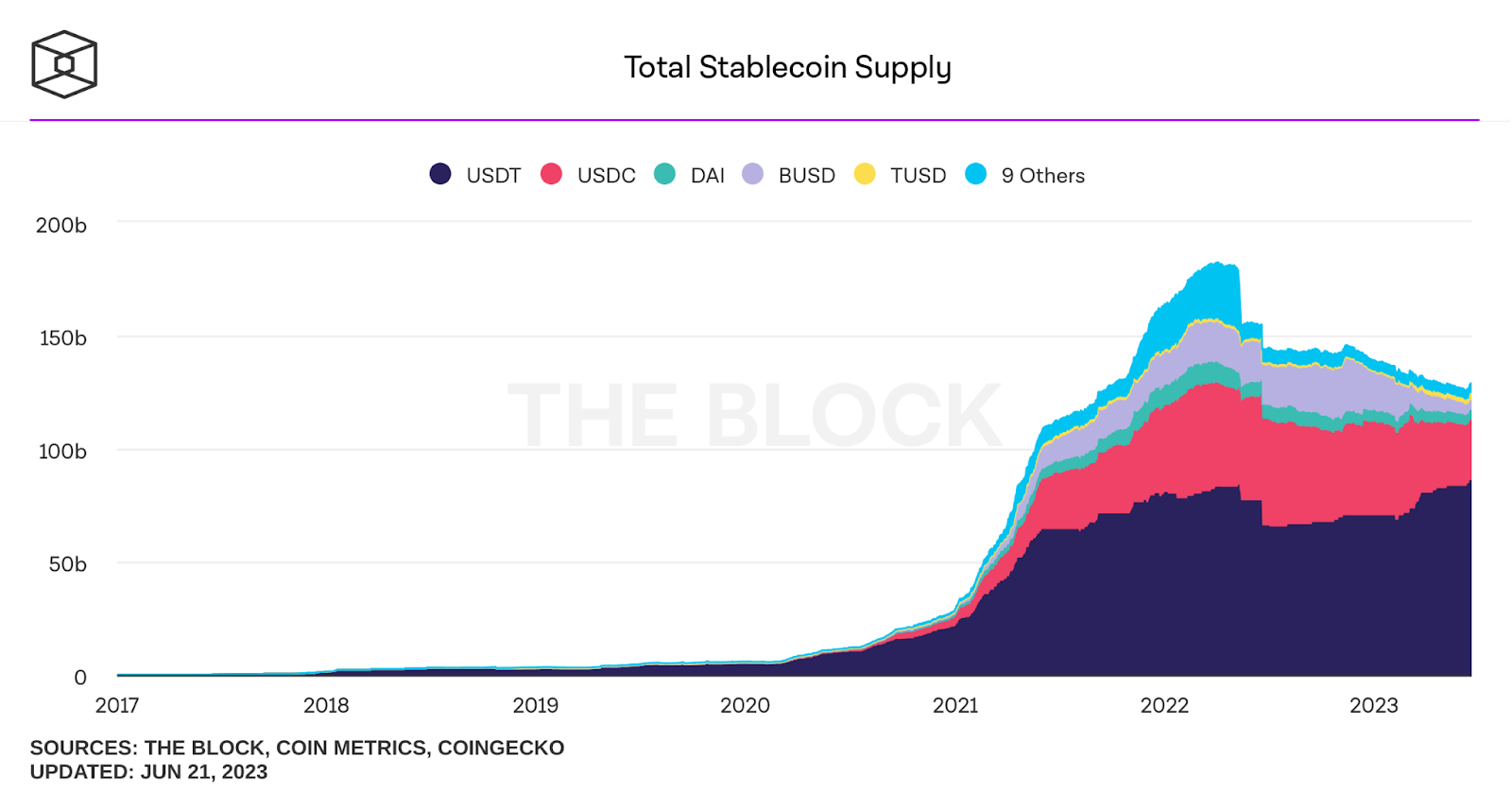

In addition, the integration allows USDT, which a few days ago updated its all-time high in terms of market capitalization, to further strengthen what is its dominance in the stablecoin world.

The crypto represents the cryptocurrency pegged to the value of the dollar par excellence, the favorite of institutional investors for off-shore exchanges and the one with the highest market share, corresponding to 67% compared to its main competitors.

On the other hand, for Kava, the advantage is on the reputational front as well as on the liquidity front of the chain: Being able to count on USDT’s presence in the internal exchanges of the network, besides lending luster to the infrastructure, allows the volume of liquidity to be amplified, with obvious benefits for the entire ecosystem.

Paolo Ardoinio, CTO of Tether, had the following words to describe the partnership with Kava:

“The Kava network is a unique and widely followed blockchain with a robust track record of four years with zero security issues, which is essential to protecting USD₮ users. Together, we aim to reshape the future of decentralized finance, fostering a robust and inclusive ecosystem that benefits users worldwide.”

A look beyond Kava: the expansion of Tether and its stablecoin

USDT’s landing on Kava represents yet another recognition of Tether’s hegemony in the stablecoin market.

As mentioned earlier, the crypto holds the largest market share in its target industry, with a capitalization of about $83 billion.

The stablecoin’s main rivals are USDC, DAI, TUSD and BUSD. The competition is likely to go down ever more when we consider that the Binance USD cryptocurrency has halted issuance of new supply after the SEC ordered the exchange and Paxos to stop.

True USD‘s presence also does not appear to be particularly threatening to Tether, having emerged only because of Binance and its decision not to charge fees for a limited period in major stablecoin trading pairs.

Tether’s real competitors at the moment are USDC, which has the advantage of being more widely used in DeFi and on the Ethereum blockchain, and DAI, which enjoys the presence behind it of the giant MakerDAO.

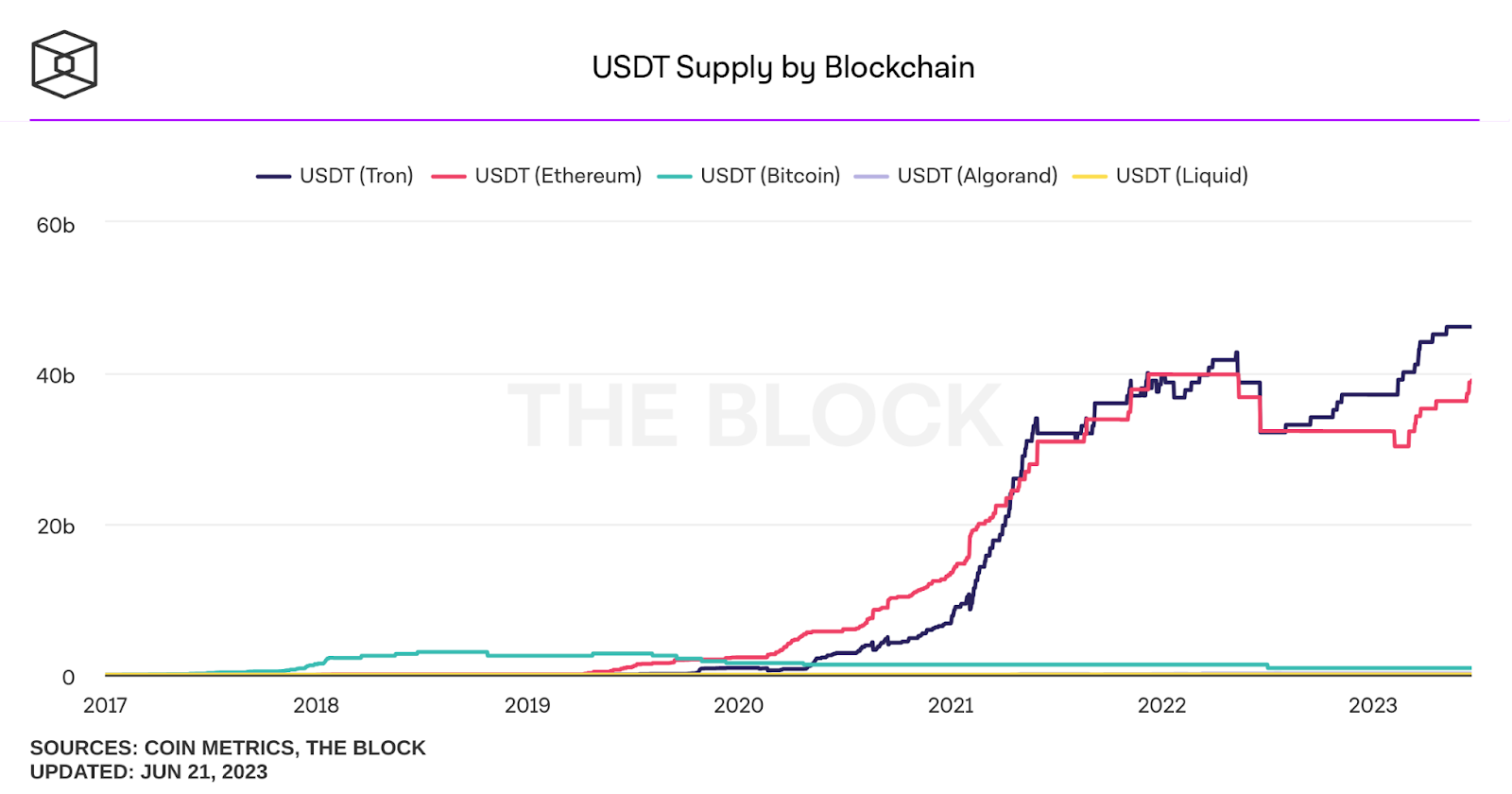

USDT is currently supported by several networks including Ethereum, Solana, Tron, Algorand, Eos, Liquid Network, Omni, and now on Kava.

Such a massive presence on a variety of chains allows for greater interoperability and simplified transactions for Tether’s clients.

However, to become truly unstoppable, the stablecoin should aim in the coming years to increase its position on Ethereum, where it plays a marginal role compared to USDC, and to raise liquidity on the smaller chains.

Indeed, if we take only Tron and Ethereum, we find that almost all of USDT’s supply is on these two networks.

Focus on the Kava network and the KAVA coin

The integration of Tether’s stablecoin is positive for the entire Kava ecosystem, which is a marginal infrastructure compared to the biggies of the web3 industry.

Following the news, the cryptocurrency KAVA, which is native to the network of the same name, rose on a daily candle of 4.3%.

Right now the coin marks a price of $0.9 with a market capitalization of $529 million and a trading volume of around $70 million.

KAVA’s all-time high is set at $9.2, touched in August 2021: since then the price action for the crypto has been entirely focused downward, in a trend that has continued undisturbed for almost two years now.

Perhaps the recovery of the market’s macro situation and the excellent news of USDT stablecoin support will be able to bring KAVA’s prices back to shine.

Going in order, before talking about the bull market, it is necessary to see a break of the $1.2 level, with adequate accompaniment in terms of volume.

Above that value, the next steps will be $1.6 and $2.2. There is still a long way to go before a return to the ATH.

On the front of chain activity in the DeFi world, we can see how Kava has suffered slightly less from the bear market as far as its TVL is concerned.

As of August 2021 (the period of the ATH of the KAVA coin), the share of the “total value locked” of all capital allocated in the layer 1 protocols, has dropped by 50%.

This is a very marked downsizing, but nevertheless less heavy when compared to the speculative position of the network’s native currency.

Right now there are about $223 million running on Kava, mainly on the dApps Kava Lend, Kava Mint, Kava Earn and Kava Liquid, Mare Finance, and Curve.

The remaining slice of decentralized applications that are part of this infrastructure include projects that are unknown and little used by the community.

en.cryptonomist.ch

en.cryptonomist.ch