The largest stablecoin by market capitalization Tether (USDT) has just fallen below its dollar peg.

At press time, the asset is trading at $0.996.

Tether's CTO Paolo Ardoino was quick to Twitter, saying that "markets are edgy in these days" and added that the popular stablecoin is "ready as always."

Markets are edgy in these days, so it's easy for attackers to capitalize on this general sentiment.

But at Tether we're ready as always. Let them come.

We're ready to redeem any amount.— Paolo Ardoino 🍐 (@paoloardoino) June 15, 2023

He also said the firm is ready to redeem for anyone interested, referring to holders' ability to swap the USDT token for the underlying dollar it represents. "Let them come," he said.

This dollar-backing has been a key sticking point for the firm over the years, with critics alleging that Tether does not actually have all the money it claims.

Tether has attempted to quell these concerns with regular assurance reports from the accounting firm BDO Italia. The company indicated in its latest report that most of its reserves were held in cash and cash equivalents, with the majority “invested in U.S. Treasury Bills.” Only 1.8% was held in Bitcoin.

At an $83 billion market cap, USDT is the industry's third-largest cryptocurrency after Bitcoin and Ethereum.

Unlike Bitcoin or Ethereum, stablecoins like USDT are pegged to a fiat currency, such as the dollar or British pound. They provide a convenient, low-volatility asset for traders looking to exit more volatile cryptocurrencies.

Naturally, though, if these assets lose their peg to their fiat counterpart, it can stir fears in the market.

Tether did not immediately respond to Decrypt's request for comment.

Tether and the '3 Pool'

Analysts have also pointed to Curve Finance's famed 3pool for further indications of investor sentiment.

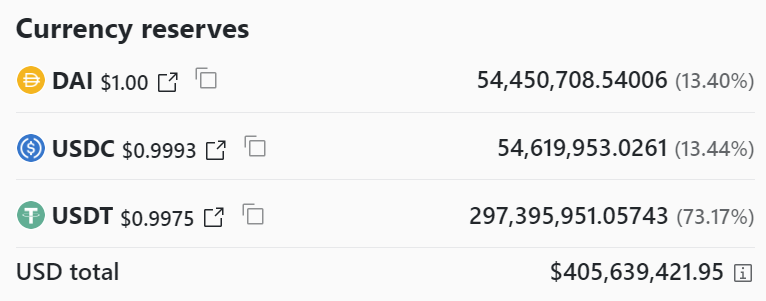

Curve Finance is a popular decentralized exchange that lets users swap between like-assets. The 3pool, for example, is the project's largest pool of assets and is composed of the three largest stablecoins: USDT, Circle's USDC, and Maker's decentralized DAI.

Each asset is dollar-pegged, offering investors an arbitrage trade between all three should any of them lose their peg to the up- or downside.

The USDT pool composition percentage has now reached 61% which is absurdly high.

Someone moving like they know something inflows over the last 24 hours are abnormal.

Not one to speculate but did swap my USDT stack into an array of stables. https://t.co/7YLCSfzYx4 pic.twitter.com/6GY6i2kOmp

— McKenna (@Crypto_McKenna) June 15, 2023

Currently, with the amount of USDT moving into the pool (and USDC and DAI moving out), investors are clearly signaling their interest in exiting Tether's stablecoin.

In fact, the majority of the pool is currently composed of USDT (73%), a percentage that hasn't been seen since November 2022 when Sam Bankman-Fried's FTX filed for bankruptcy.

decrypt.co

decrypt.co