Executive Summary: Since 2021, BNB Chain has made significant strides in the decentralized finance (DeFi) sector, now holding a roughly 8.5% market share and standing as a formidable competitor to Ethereum and Tron. BNB’s user-friendly design, compatibility with the Ethereum Virtual Machine, and lower transaction fees position it as an attractive alternative to Ethereum.

Our investing thesis is that Layer-1 blockchains are like operating systems. Just as most of the world runs on either macOS or Windows, so most blockchain apps will likely end up running on either Ethereum, or some competitor. If you believe in the long-term potential of BNB Chain as a top blockchain platform, then buying and holding BNB is the way to invest in it.

With over 500 DeFi applications, BNB Chain continues to attract robust investor interest, bolstered by Binance’s native token (BNB) being the fourth-largest cryptocurrency. That said, the recent SEC lawsuit against Binance has impacted the BNB token negatively, sending the price roughly 20% lower in a week. That could be signs of worse things to come, or a good way to buy the token at a discount.

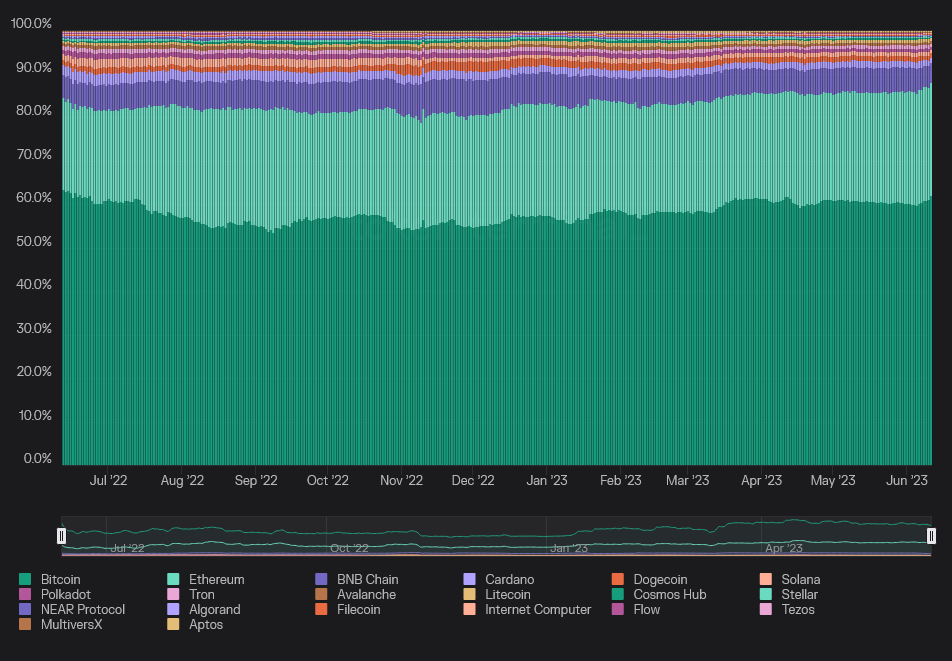

Before 2021, Ethereum monopolized the blockchain applications market, thanks to its intuitive smart contract feature and user-friendly programming language. It accounted for 95% of all DeFi applications. However, the dynamic nature of the crypto space led to the emergence of fierce competition.

Binance, the world’s largest cryptocurrency exchange, launched its own public blockchain as a competitor to Ethereum. Today, it holds roughly 8.5% of DeFi’s total value locked (TVL), making it the third most popular DeFi ecosystem, following Ethereum and Tron.

What is BNB Chain?

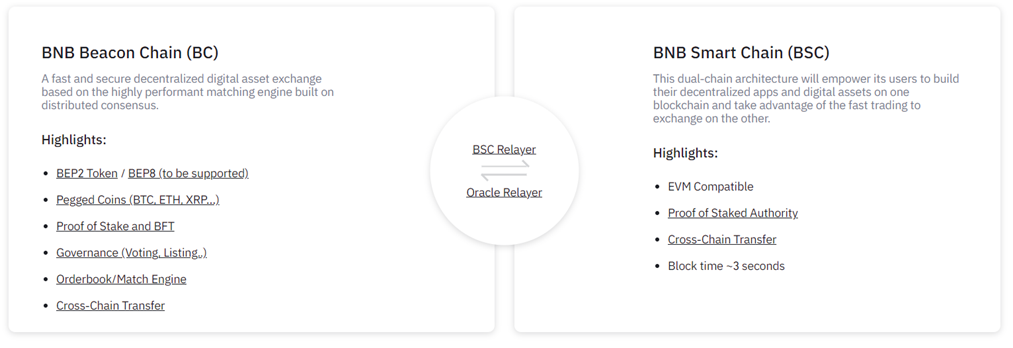

BNB Chain has had several rebrandings, but today is made up of two separate blockchains: BNB Smart Chain (originally called Binance Smart Chain), and BNB Beacon Chain (BC).

BNB Chain uses a Proof of Staked Authority (PoSA) consensus mechanism, supported by 50 validators, to ensure short block times and lower fees. The most-bonded validators become block producers, guaranteeing security, stability, and chain finality. BNB Chain is compatible with the Ethereum Virtual Machine (EVM) and facilitates cross-chain transfers and communications.

BNB Chain offers security and safety through its elected validators. It supports Ethereum tooling, ensuring faster finality and cheaper transaction fees. The native token, BNB, is used for executing smart contracts and staking. Currently, BNB is the 4th largest cryptocurrency, with a market cap exceeding $47 billion.

BSC hosts over 500 dapps, and we’ll discuss the top 10 by total value locked.

Top 10 Protocols on BSC by Total Value Locked

| Protocol / Platform | Year Launched | Total Value Locked (TVL) | Market Cap | Real Volume (30-days) | 1-Year ROI | BMJ Score |

| Pancake Swap | 2020 | 1.9B | $333M | $313.5M | -65.54% | 4.0 |

| Venus | 2020 | $786M | $71.4M | $58.8M | -20.43% | 4.0 |

| BiSwap | 2021 | $178M | $43.4M | $22.5M | -2.97% | 3.5 |

| Radiant V2 | 2022 | $92M | $78M | $329.4M | -7.09% | 3.5 |

| Alpaca Finance | 2021 | $337M | $30M | $5.1M | -50.54% | 3.0 |

| Binance Staked ETH | 2023 | $95M | $125M | $1.2M | -1.31% | 3.0 |

| PinkSale | 2021 | $192M | $14.4M | $294K | 572.53% | 3.0 |

| UNCX Network | 2020 | $86M | $12M | $393K | -7.35% | 2.5 |

| Coinwind | 2021 | $173M | $0 | $33.9 | -17.52% | 2.0 |

| THENA | 2023 | $72M | $3M | N/A | N/A | 1.0 |

PancakeSwap

PancakeSwap

Type of dapp: DEX

BMJ Score: 4.0

PancakeSwap is a decentralized exchange (DEX) built on BNB Chain. It enables users to swap Binance’s BEP-20 tokens seamlessly. Borrowing elements from Ethereum-based Uniswap and SushiSwap, PancakeSwap implements an automated market maker (AMM) system, eliminating the need for a centralized order book or facilitator. This means users trade against liquidity pools funded by other users instead of trading directly with counterparties.

Besides trading, PancakeSwap users can become liquidity providers, earn a share of transaction fees, participate in yield farming to earn CAKE tokens, and even engage in a lottery. Moreover, it supports trading and staking of non-fungible tokens (NFTs).

PancakeSwap accounts for about 44% of all total value locked (TVL) on BNB Chain, so it easily makes the list of the top 10 largest DeFi protocols.

Venus

Venus

Type of dapp: Lending

BMJ Score: 4.0

Venus is a DeFi lending platform for the BNB ecosystem. It aims to provide secure and decentralized lending and borrowing of cryptocurrency. Anyone can access this algorithm-based money market by connecting compatible wallets like MetaMask.

Users can lend or borrow supported digital assets, earn token rewards, and participate in governance via Venus’ native token, XVS. The protocol integrates the functionalities of Compound and MakerDAO, enabling users to lend, borrow, and mint stablecoins within a single ecosystem.

On Venus, interest rates are set by the protocol, responding to market demands, but the minimum and maximum levels are determined by the governance process.

The protocol was founded in 2020 by the team behind Swipe. The team’s goal was to bridge traditional finance and DeFi on the BNB Chain. With a TVL figure of $800 million, Venus is the second-largest DeFi protocol on BSC.

Biswap

Biswap

Type of dapp: DEX

BMJ Score: 3.5

Biswap, launched in May 2021, is a DEX offering token swapping on BSC with trading fees starting from as low as 0.1%. Besides providing a platform for trading, farming, and staking, Biswap offers an innovative three-type referral program rewarding users for their referees’ activities in farming, launchpools, and swaps.

The ecosystem also hosts an NFT marketplace and NFT game. Utilizing an AMM model, Biswap ensures swift transactions while maintaining user control over funds. Its native token, BSW, facilitates incentivization across the platform. With a strategic investment from Binance Labs, Biswap enhances its innovative DEX services.

Radiant V2

Radiant V2

Type of dapp: Lending

BMJ Score: 3.5

Radiant is an Arbitrum-native omnichain money market protocol that is also supported on BSC. It aims to facilitate cross-chain deposit and borrowing of major assets.

With the recent launch of Radiant V2, the protocol addresses some of the issues encountered in V1, such as initial emissions, liquidity provision, and fixed unlock times. Enhancements include refined tokenomics, increased utility, the integration of cross-chain capabilities, launches on multiple new EVM chains, and the implementation of LayerZero Omnifungible Token (OFT). V2 is also designed to amass fair value for the DAO, positioning Radiant as a leading fee-generating protocol in DeFi. Notably, the upgrade underwent rigorous security audits by Peckshield, Zokyo, and BlockSec, affirming its robust security framework.

Alpaca Finance

Alpaca Finance

Type of dapp: Yield farming

BMJ Score: 3.0

Alpaca Finance is a decentralized finance (DeFi) platform launched on BSC in early 2021. It offers leveraged yield farming and supports undercollateralized loans for enhanced yield farming positions, improving capital efficiency.

With over $300 million in TVL, it has grown rapidly since its launch, diversifying into single-asset staking, LP staking vaults, and experimental synthetics while actively partnering with other protocols.

Alpaca’s lending mechanism lets users earn yield through Alpaca tokens and popular cryptocurrencies like BTC, ETH, and BNB.

Notably, Alpaca adopts a deflationary buyback and burn model for a percentage of platform fees, reducing total supply over time, which further strengthens the value proposition of the protocol.

Binance Staked ETH

Binance Staked ETH

Type of dapp: Liquid Staking

BMJ Score: 3.0

To compete with the popular Lido, Binance launched its own Ethereum-based liquid staking product. Like Lido, this service enables users to earn staking rewards on ETH without locking up their assets, providing enhanced liquidity and more yield opportunities in DeFi.

Launched initially in response to the Ethereum network’s shift to Ethereum 2.0 and its Proof of Stake mechanism, this product was shifted to a wrapped version of Ether (WBETH) after Binance was served with an SEC lawsuit. Naturally, it caters to the Ethereum community’s increasing demand for staking. Users can stake any amount of ETH and receive WBETH tokens in exchange, which can be eventually used for yield opportunities across the BSC ecosystem. These tokens can be traded, transferred, or used as collateral on Binance, multiplying the options for staked ETH.

PinkSale

PinkSale

Type of dapp: Launchpad

BMJ Score: 3.0

PinkSale is a decentralized launchpad unveiled in July 2021. It enables token creation and presale funding for projects across various networks, including BSC, Ethereum, Fantom, Polygon, KuCoin Community Chain, and Avalanche. It stands apart with its minimalist toolkit for swift token development and Initial Dex Offering (IDO) sales.

PinkSale integrates innovative features such as an anti-rug pull system, antibot feature, and various token types, ensuring platform safety through regular audits by Certik. With more than 6,000 projects launched, 650,000 participants, and $220 million in TVL, PinkSale has solidified its status as a leading decentralized crypto launchpad while actively preventing scams and maintaining platform decentralization.

Warning: These IDOs are most likely to be considered unregistered securities in the eyes of the U.S. Securities and Exchange Commission.

UNCX Network (formerly UniCrypt)

UNCX Network (formerly UniCrypt)

Type of dApp: Launchpad

BMJ Score: 2.5

Launched in June 2020, UNCX Network, previously UniCrypt, is a one-stop DeFi solution providing five principal services to streamline project development and enhance investor security. With offerings such as Initial Liquidity Offering (ILO) services, liquidity lockers, token vesting, staking-as-a-service, and ENMT Token Minter, UNCX Network facilitates transparency and safety for both project creators and investors.

Developers can create bespoke presales, lock liquidity to protect investors, vest tokens for price stability, and establish staking pools. For those lacking token or solidity skills, the network’s minter creates pre-audited tokens, boosting project credibility. UNCX Network’s integrated platform simplifies project launch and operation while promoting secure investment.

Warning: These ILOs are most likely to be considered unregistered securities in the eyes of the U.S. Securities and Exchange Commission.

CoinWind

CoinWind

Type of dapp: Yield

BMJ Score: 2.0

CoinWind is a smart yield farming platform supported by HECO and BSC. Launched in 2021, it is strategically designed to optimize user revenues by automatically matching pledged tokens (digital assets locked for rewards). As of May 2023, the protocol’s TVL is over $200 million.

CoinWind effectively addresses the issues of low revenues from single-token mining and high risks from LP mining in the DeFi landscape. As a smart decentralized finance management platform, CoinWind aggregates funds from various token pools to participate in diverse liquidity mining opportunities. It combines this with price hedging strategies to lessen impermanent loss, aiming to maximize user returns while minimizing unpredictable losses.

THENA

THENA

Type of dapp: General

BMJ Score: 1.0

THENA is a relatively new project that aims to become the go-to DeFi trading platform on BNB Chain. According to its roadmap, the ecosystem will include a wide range of DeFi products, including ALPHA, an advanced perpetual trading platform, WARP, a launchpad accelerator, and CORE, a social hub promoting user interaction. On top of that, RAMP will ensure seamless fiat transactions – something that other DeFi projects don’t offer.

Investor Takeaway

Since 2021, BNB Chain has demonstrated significant growth and adoption in the DeFi space, capturing nearly 10% of the total market and vying with Tron for the spot as second-largest DeFi ecosystem. Despite Ethereum’s dominance, BSC’s lower transaction costs, shorter block times, and compatibility with the Ethereum Virtual Machine have made it an appealing alternative for many projects.

The BNB Chain hosts a multitude of DeFi applications, with a diverse range of protocols leading the way. Projects like PancakeSwap and Venus have left their mark on the ecosystem, with the former accounting for almost half of BSC’s total value locked.

While BNB is currently maintaining its position among the top 5 largest cryptocurrencies by market cap, investor interest and confidence in the BNB ecosystem has taken a hit due to the lawsuit brought by the U.S. Securities and Exchange Commission against Binance and its founder and CEO Changpeng Zhao. Given the uncertainty surrounding the exchange it would be wise to remain cautious about investing in BNB, as well as any project building within the Binance ecosystem.

bitcoinmarketjournal.com

bitcoinmarketjournal.com