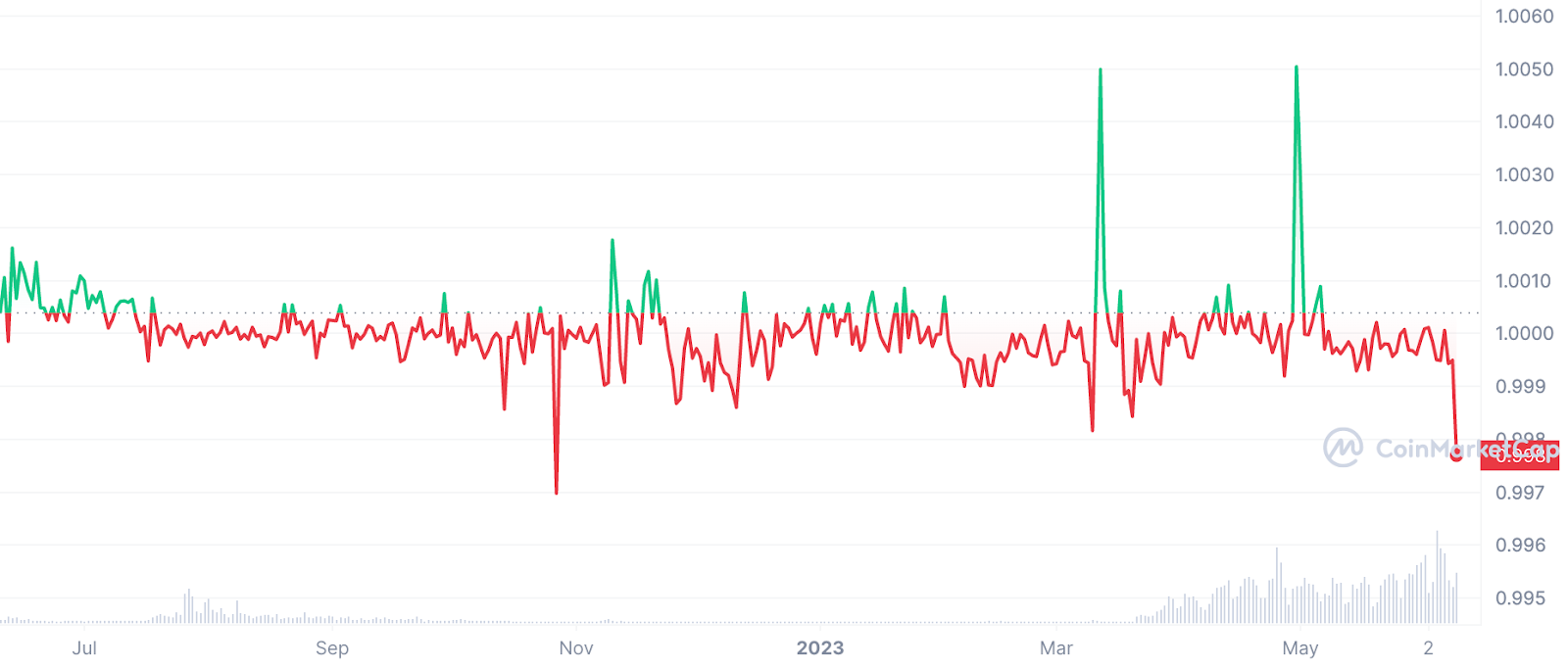

In the early hours of June 10, TrueUSD ($TUSD) deviated from its peg to the US dollar due to a temporary halt in minting activities facilitated by its technology partner, Prime Trust.

At its lowest point, the stablecoin, ranked fifth-largest by market capitalisation, traded at $0.9964. As of the time of writing, according to CoinMarketCap, its value is $0.9981. LedgerLens data reveals that the current supply of $TUSD is $2.04 billion, with collateral worth $2.08 billion.

Announcement:

$TUSD mints via Prime Trust are paused for further notification.

Thanks for your understanding and we are sorry for any inconvenience. Please contact [email protected] for any further questions.

— TrueUSD (@tusdio) June 10, 2023

Over the past 12 months, the stablecoin has experienced multiple instances of deviating from its peg to the United States dollar. Whether the pause in minting activities is connected to recent rumours about Prime Trust’s insolvency remains uncertain. Prime Trust had downsized its workforce by one-third in January.

It had been serving as an intermediary for Binance.US, safeguarding customer funds through banking partners when crypto businesses faced challenges maintaining banking relationships in the United States.

A potential resolution for Prime Trust lies in its acquisition agreement with crypto custodian BitGo. On June 8, BitGo announced the signing of a nonbinding letter of intent to acquire Prime Trust. This deal would grant BitGo access to Prime Trust’s payment rails and cryptocurrency IRA fund, enabling its wealth management services to expand. However, specific details regarding the terms of the agreement have not been disclosed.

This potential acquisition aligns with the U.S. Securities and Exchange Commission’s proposed rule changes, which aim to restrict the ability of crypto companies to serve as custodians for customer assets.

coinculture.com

coinculture.com