The Tether stablecoin has hit a new market cap milestone, surpassing its previous capitalization high of $83.2 billion from last year.

The numbers indicate a strong demand for stablecoins despite a lukewarm market.

Demand for Tether Remain Strong

The firm behind the most valuable stablecoin, Tether, has surpassed its previous record market valuation of $83.2 billion. It set the earlier record in the bull market of May 2022. It continues to demonstrate an increasing demand for the asset while it continues to play safe with the regulators.

Tether CTO Paolo Ardoino thinks that the demand for Tether stems from people’s desire for financial independence and the fact that it provides a safe haven for the unbanked.

If you weant to learn more about Tether and the other key stablecoins in the crypto industry, be sure to check out our beginner’s guide here!

Meanwhile, Tether is attempting to establish itself as a trusted entity in the cryptocurrency space.

It has been boosting its position ever since the start of the year. It revealed a $1.48 billion net profit for the first quarter, which helped to increas Tether’s reserves.

State of the Stablecoin Market

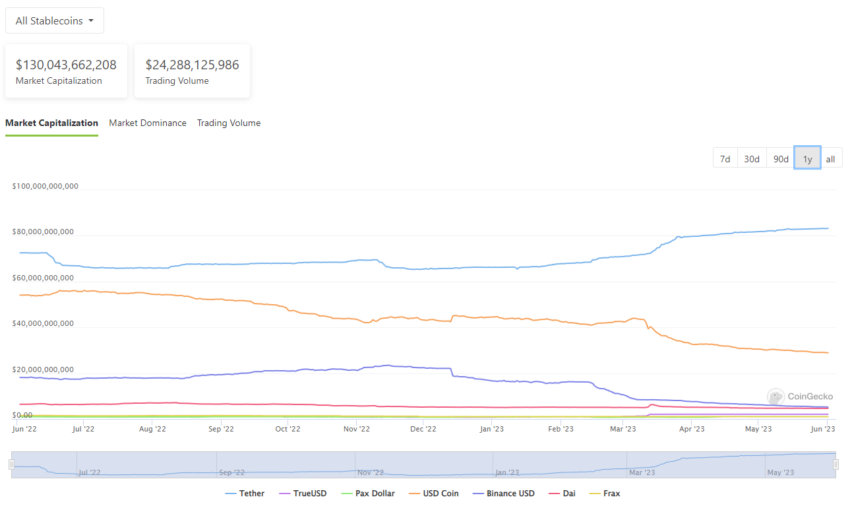

According to data from CoinGecko, Tether’s market cap has increased by roughly 2% over the past 30 days. At the same time, however, other major stablecoins, including USD Coin, Binance USD, DAI, and TrueUSD, have seen losses. USDC’s market cap fell by 5% in the previous month, while BUSD shed nearly 16%.

The total market capitalization of stablecoins has significantly decreased over the last 14 months by more than $50 billion, according to a previous report by BeInCrypto. The market capitalization is just over $130 billion, down from more than $186 billion in May 2022. And Tether, which currently holds about 63.9% of the market share, is swimming against the current.

Notably, the decline in market cap has coincided with a decrease in trading volume.

Regarding the performance of stablecoins, Binance CEO Changpeng Zhao emphasized how Tether has benefited from the declining market for BSUD. The New York Department of Financial Services (NYDFS) has implemented a cap on the overall supply of BUSD at $23 billion before lowering it to $5 billion, according to Zhao.

Essentially, Binance USD cannot mint new tokens beyond this limit. In contrast, USDT experienced substantial growth during this period.

Since USDT is exempt from the BUSD supply cap established by NYDFS, its availability is more flexible. As a result, USDT has expanded and met the growing demand for stablecoin transactions.

In the interim, the market as a whole is still expanding. Hong Kong-based trust corporation First Digital has released a new stablecoin named FDUSD. This stablecoin uses the Binance Smart Chain (BNB) and is tied to the US dollar (USD).

Recently, Stably, a well-known supplier of stablecoin as a service, announced plans to introduce Stably USD, a stablecoin backed by the USD, as a natively-issued BRC20 token.

beincrypto.com

beincrypto.com