Circle has ditched the US Treasury bonds from its USD Coin (USDC) reserves to protect the stablecoin from the ongoing debt ceiling crisis in the US.

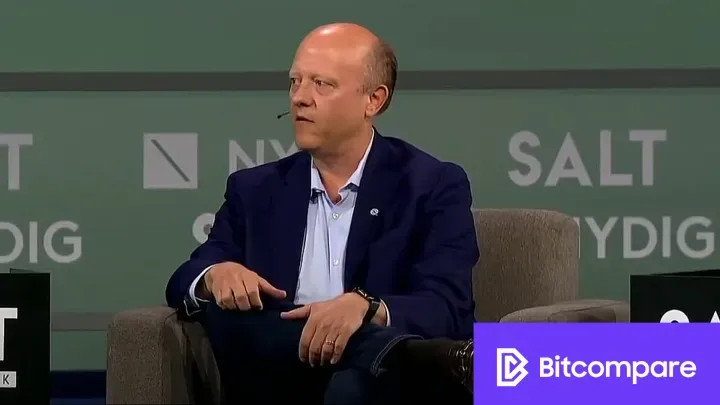

Earlier in May, Circle CEO Jeremy Allaire said the stablecoin issuer does not hold Treasuries that mature after June, adding that the firm does not want to expose USDC to a potential debt default from the US government.

In line with his views, Circle’s last remaining Treasury bond matured on May 31, effectively removing Treasuries worth $24B from its portfolio. As a result, Circle’s cash and repurchase agreements remain the only assets backing its USDC reserves.

Furthermore, Circle recently acquired $8.7B worth of tri-party repo agreements to replace its US Treasuries. The collateral for these investments does not comprise securities that mature in three days.

As reported by Coindesk, Circle initiated the plan months ago to avoid exposure in case the government breaches the debt ceiling, with a spokesperson for Circle adding,

“While this plan has been underway for many months, the inclusion of these highly liquid assets also provides additional protection for the USDC reserve in the unlikely event of a US debt default.”