The market’s largest decentralized stablecoin got a minor decentralization boost.

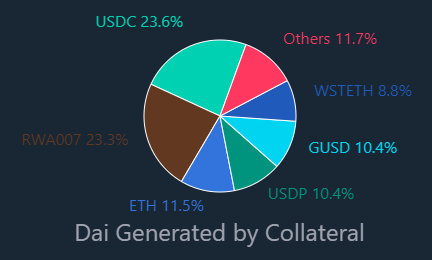

At press time, the amount of Circle’s $USDC stablecoin backing MakerDAO’s $DAI has hit 23.6%. This figure was a whopping 50% last August, sparking concerns over $DAI’s centralization.

$DAI is a U.S. dollar-pegged overcollateralized stablecoin, governed by the MakerDAO decentralization organization. $DAI is the largest decentralized stablecoin with a market capitalization of $4.6 billion, per Coingecko, backed by cryptocurrencies like Ethereum and stablecoins, as well as so-called real-world assets.

Now, as its dependence on $USDC wanes, those real-world assets, or RWAs, are taking up a larger portion of $DAI’s backing. RWAs refer to non-crypto assets and those that are linked to real-world businesses or entities.

MakerDAO currently holds short-term U.S. government bonds worth $1.12 billion, managed and tracked by British Virgin Island-based DeFi asset manager, Monetalis Clydesdale.

After that, Gemini’s GUSD and Paxos’s USDP stablecoin account for 20.8% of $DAI’s collateral share, exposing the asset to the same risks as $USDC.

It’s not all centralized, though. The stablecoin is backed by 11.5% of Ethereum (ETH), and an additional 8.8% is collateralized by Lido’s Staked Ethereum (STETH).

Divesting further from $USDC to T-Bills

Ethereum DeFi applications developer Sébastien Derivaux told Decrypt that the shift to U.S. treasuries to him represents the “same centralization as $USDC.”

Still, it’s an “improvement” he said because the RWA Foundation and custody providers holding $DAI reserves are based outside of the United States.

Insofar as Circle, $USDC’s issuer, is a U.S.-registered firm, it is still subject to a variety of traditional regulatory concerns. This has been seen during the blowback of this year’s banking crisis, during which Circle announced it had $3.3 billion in cash reserves in Silicon Valley Bank. The firm has also blacklisted various addresses on Ethereum wallets per orders from law enforcement.

However, the MakerDAO community has also approved a $1.6 billion $USDC deposit to Coinbase Custody for stable yields.

Another RWA proposal by U.S.-based asset manager BlockTower Capital also went live on May 29 and is currently in the voting phase.

If approved, the pool would open with a debt ceiling of $1.2 billion, which is equivalent to the size of its current $1.2 billion RWA pool with Monetalis, and will likely further contribute to decreasing $USDC collateral.

Though data shows that while $DAI is moving away from $USDC, it will still be exposed to U.S. regulations via companies like Coinbase and BlockTower.

decrypt.co

decrypt.co