In recent weeks, the crypto market has been dominated by rising interest in meme coins. These digital currencies, often with no practical use cases, have gained significant popularity among investors seeking quick profits.

Tron (TRON) founder Justin Sun said in a tweet on May 11 he plans to start trading meme coins using his public crypto wallet address. Sun added he will bear all losses from his future meme coin trades, and give any potential profits to charity.

“I’ve decided to begin actively trading meme coins and promising projects through my public address. Please note, I will personally bear all potential losses from these trades, and any profits made will be donated entirely to charity.”

– Justin Sun wrote in the tweet.

Sun also warned his followers that he will trade meme coins simply “for fun,” adding that there are no guarantees that any of these tokens would be listed on Huobi Global (HT) and Poloniex – crypto exchanges he previously invested in.

PEPE – the most popular meme coin right now

Sun’s announcement comes amid the latest meme coin craze led by the recent meteoric rise of Pepecoin (PEPE).

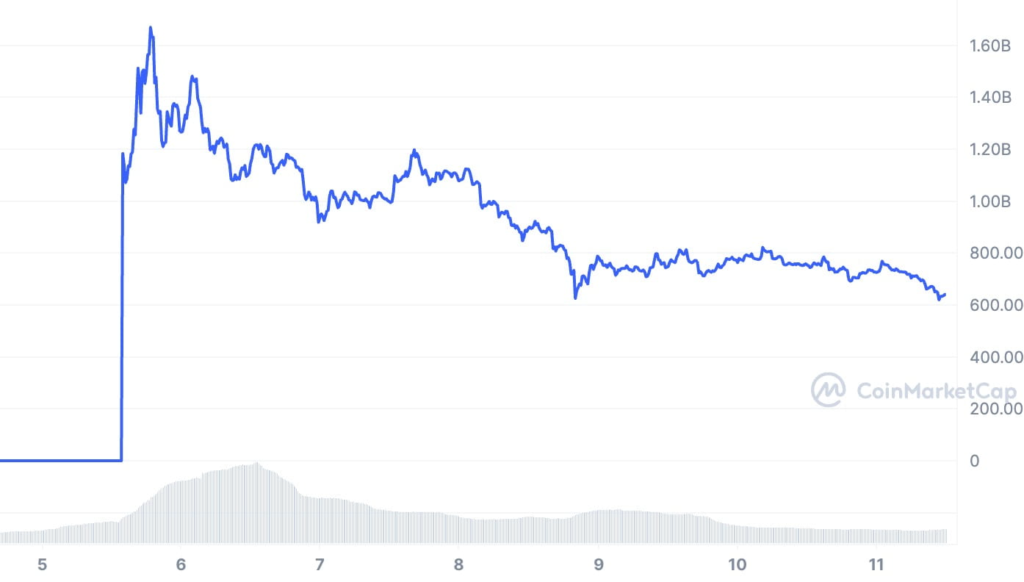

PEPE, a meme coin inspired by the popular internet meme “Pepe the Frog,” was launched in April. Over the past few weeks, PEPE saw a meteoric rise of a whopping 5,000,000%, reaching an all-time high (ATH) of $0.00000431 on May 5. It is now the third-biggest meme coin by market cap, trailing DOGE and SHIB.

But the cryptocurrency saw its price plummet significantly since then, likely due to investors taking profits. At press time, PEPE was trading at $0.000001635, down 13.6% in the past 24 hours and more than 60% from its ATH.

Bitcoin transaction fees hit new multi-year high amid meme trading frenzy

It is safe to say that the meme coin craze was not welcomed in the Bitcoin (BTC) community. To be more specific, the unprecedented trading activity in PEPE and other meme-inspired coins was one of the factors driving Bitcoin transaction fees to a new record high.

On May 3, the total amount of fees paid on the Bitcoin network rose to $3.57 million, up around 400% from late April.

Another factor that fueled the surge in transaction fees was the recent interest in Bitcoin ordinals, also known as Bitcoin NFTs.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com