Lido, Rocket Pool Lead the Way

A rising tide lifts all boats, and the renewed bullishness on Ethereum following the successful Shapella upgrade is already transferring to the broader crypto ecosystem, starting with liquid staking derivatives protocols.

The LSDs are closely intertwined with the narrative of the Shapella (aka Shanghai) upgrade, which enabled stakers to withdraw their $ETH deposits and rewards from mainnet. A prevailing belief was that the enhanced flexibility would make LSDs an even more attractive option for users who wish to stake their $ETH while preserving Decentralized Finance (DeFi) utility of their coins.

In the immediate wake of Shapella, so far that’s held true. Ether is up 6.3% in the past 24 hours, according to CoinMarketCap, and the governance tokens of the largest LSD protocols are up even more than that.

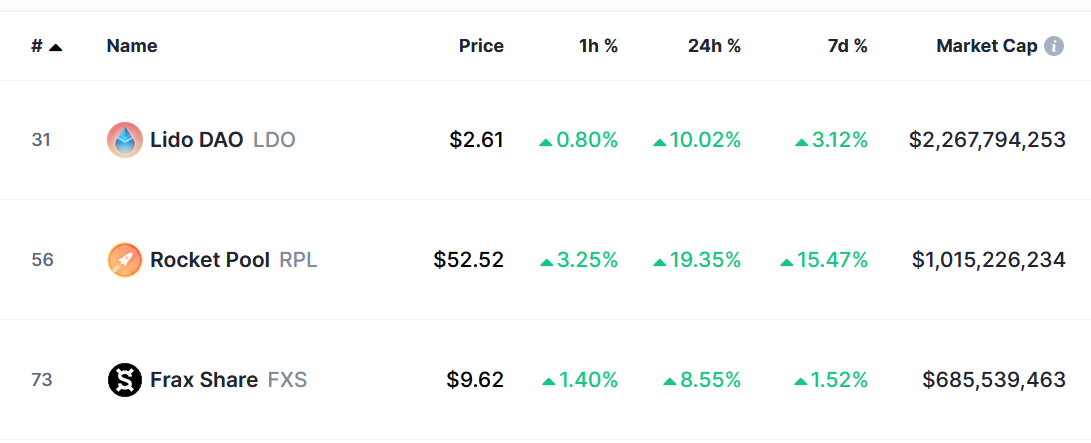

Lido is far and away the most popular LSD, with 74% of the liquid staking market share on Ethereum, according to DefiLlama. Its LDO token has increased in price by more than 10% in the past 24 hours.

Rocket Pool has nearly 6% of the liquid staking market share, and its RPL token has demonstrated the greatest increase among major LSD protocols in the past 24 hours, at more than 19%.

Rounding out the top three, Frax has nearly 2% of the liquid staking market share, and its FXS token has increased by nearly 9% in the past 24 hours.

What is Ethereum:

Ethereum is an open-source, distributed computing platform based on blockchain technology that can execute smart contracts - that is, the terms written in the contract will be executed transparently, automatically when the previous conditions are satisfied, and no one can interfere. At the same time, Ethereum also allows developers to build decentralized applications (DApps) and decentralized autonomous organizations (DAO).

Find more about Ethereum here:

Website | Twitter | Documentation | Whitepaper | Reddit | Discord | Youtube | GitHub | Ethereum Foundation Blog |

bsc.news

bsc.news