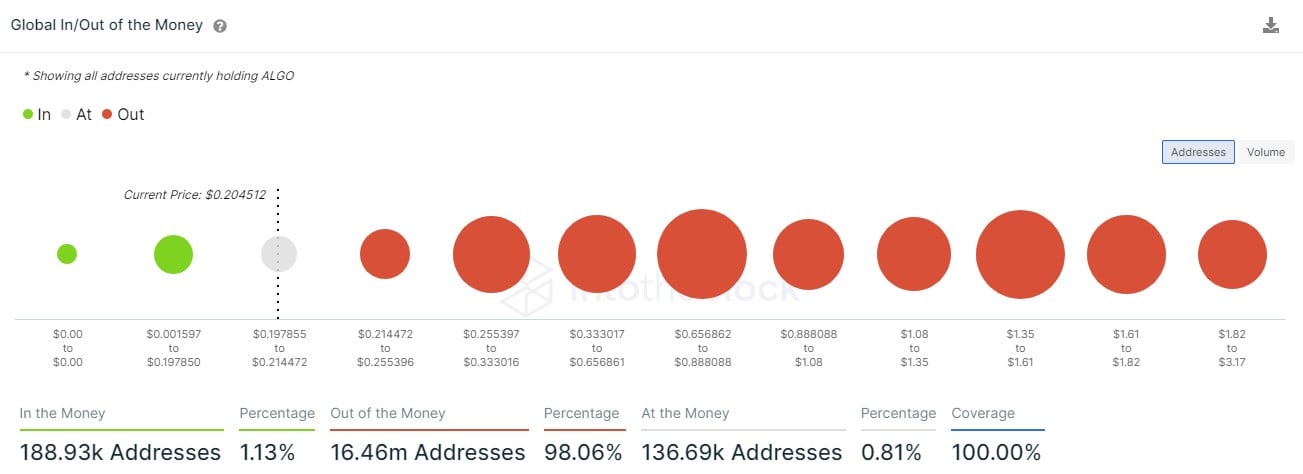

Among the legacy Layer 1 Proof-of-Stake (PoS) protocols, Algorand (ALGO) is exhibiting one of the most bearish records at the moment. According to data from crypto analytics provider IntoTheBlock, more than 16.4 million Algorand addresses are currently "Out of the Money," implying they are trading at a loss.

This represents a little more than 98% of the total addresses registered on the blockchain. The loss printing address metric on Algorand appears directly proportional to its price, with the cryptocurrency now priced at $0.2061, down 5.11% over the past 24 hours.

Algorand has been underperforming its peers, a trend that is confirmed by the slowing trading volume, which has slumped by more than 30% overnight. For a digital currency whose sentiment shot up during the last Fifa World Cup in Qatar owing to its role as the blockchain partner of the organizing body, Algorand has dropped by more than 15.21% in the past month to date.

Compared to the top PoS protocols around, including Ethereum (ETH), Cardano (ADA), Solana (SOL) and Avalanche (AVAX), among others, Algorand has a long way to go to be a truly certified Ethereum killer.

Projected remedies to slow growth

One unique feature that the aforementioned top protocols exhibit is a solid branding and community presence. That Algorand is a unique and versatile protocol is an understatement, as it is fast and scalable, but its community is not as solidly knitted.

One major trend that is powering the growth of protocols like Ethereum is the advent of many functional Layer 2 protocols. With the likes of Shibarium, Polygon, Arbitrum and Optimism making waves, Algorand's developers can trail related innovations to expand their influence across the board.

Although Algorand has its own innovative advantages, adopting what Web3.0 users want is a key to upturning its growth in the near future.

u.today

u.today