Six days ago, BUSD worth $2.86 billion were redeemed just before Paxos declared it would no longer manufacture BUSD stablecoins. Presently, Binance is the most active exchange dealing BUSD tokens, and the stablecoin still accounts for around 10.7% of the crypto economy’s $67.71 billion in 24-hour worldwide transaction volume.

You might also like

DeFi Protocol Platypus Suffers $8.5M Attack, USP Stablecoin DePegs

Zksync Rebrands zkSync 2.0 To zkSync Era, Starting New Phase

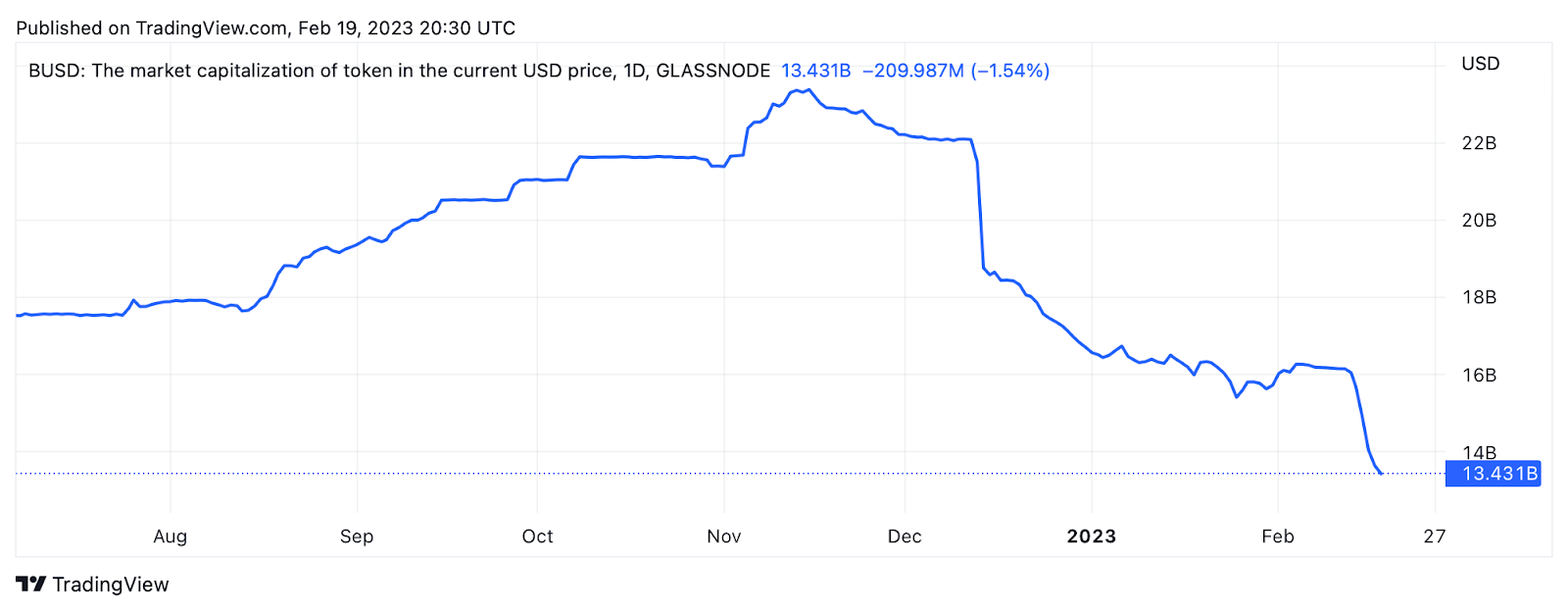

A substantial quantity of BUSD has been redeemed during the previous six days, resulting in a 17.77% decline in supply. In the last 30 days, the BUSD supply has decreased by 19.2%. Paxos, the firm that issues, maintains, and redeems BUSD, declared on February 13, 2023 that it would no longer mint BUSD.

As Paxos made the statement, redemptions accelerated, with $290 million being redeemed within eight hours. When the statement was made, there was $16.1 billion BUSD in circulation. On February 19, 2023, there were about 13,238,824,118 BUSD in circulation. Hence, the redemption of 17.77% of BUSD withdrew 2.86 billion tokens from the market.

Nansen, a blockchain intelligence company, has been watching the Paxos Treasury wallet, which transfers millions of BUSD to the burn address, eliminating stablecoins from circulation. According to Nansen’s exchange portfolio tool, as of February 19, 2023, Binance possesses 10.9 billion BUSD. Measurements indicate that BUSD accounts for 7.24 billion of the day’s global trading volume of $67.71 billion, or 10.7% of the total.

Binance controls most of BUSD’s trading activity, with tether being the stablecoin’s most popular trading pair today. On Sunday, 5.52% of BUSD volume was also linked with the Turkish lira. While BUSD had the most redemptions during the last month, 2.9% of USDC’s supply was redeemed during that time.

Interestingly, the quantity of Paxos’ second stablecoin, pax dollar (USDP), has decreased by 19.3%. In the last 30 days, 11.3% of the circulating pax gold (PAXG) supply has been eliminated, constituting a considerable proportion. In comparison, the supply of tether (USDT) has increased by 5.8%, resulting in a market valuation of almost $70 billion.

coinculture.com

coinculture.com