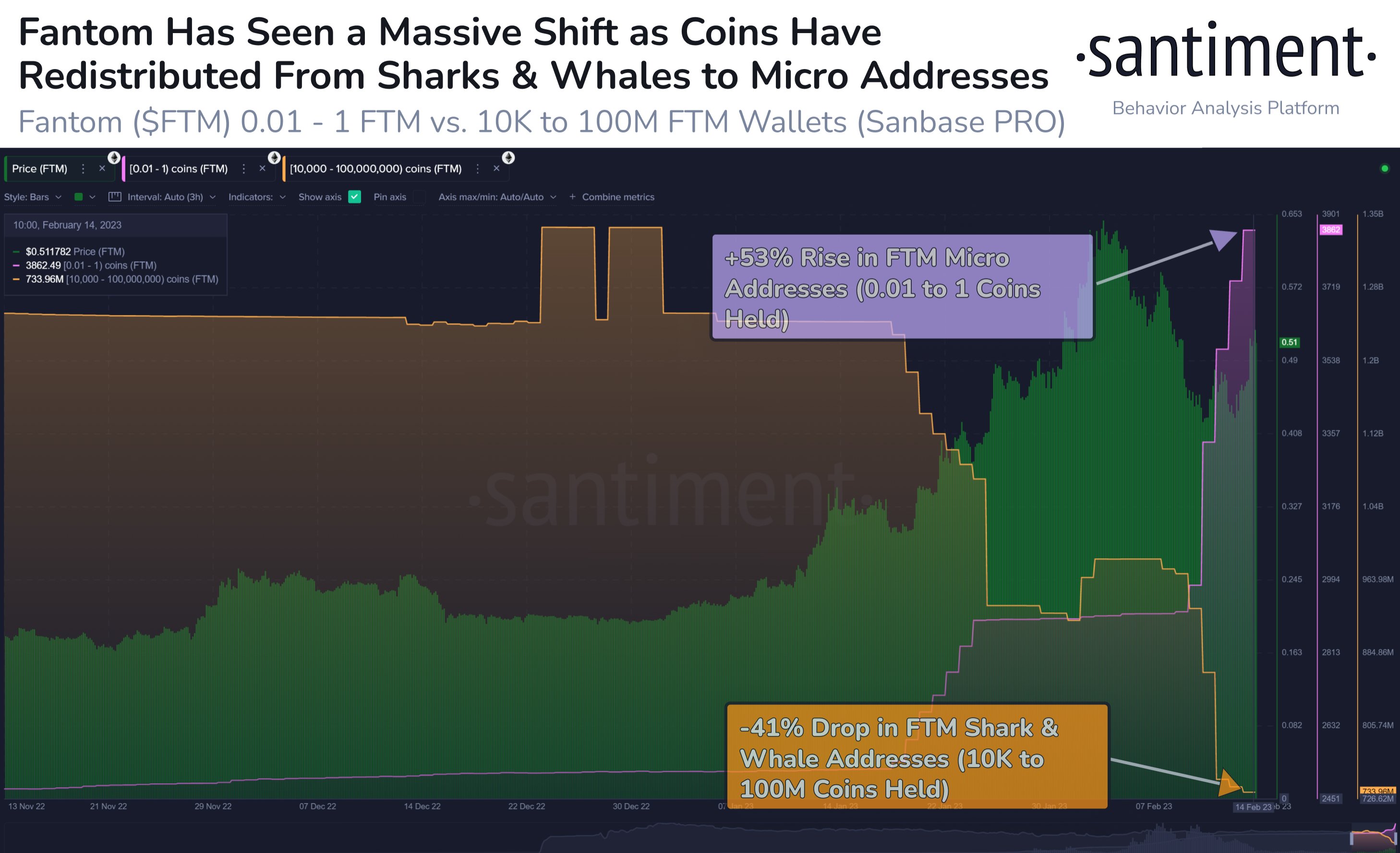

Crypto analytics platform Santiment says investors quickly picked up about $260,000,000 in Ethereum (ETH) rival Fantom (FTM).

Santiment says that as Fantom skyrocketed in price this year, shark and whale addressed unloaded $259.7 million of FTM within weeks.

However, most of the unloaded tokens were snapped up by small addressees holding anywhere between 0.01 to one FTM token.

“Fantom’s shark and whale addresses have dumped heavily during this 2023 rise. Addresses holding 10,000 to 100 million FTM dropped $259.7 million worth of coins in the past four weeks. These coins have largely been scooped up by micro addresses holding 0.01 to 1 FTM.”

Fantom opened the year at $0.200 and hit a high of $0.656 on February 3rd, a 228% increase. Fantom is trading for $0.55 at time of writing.

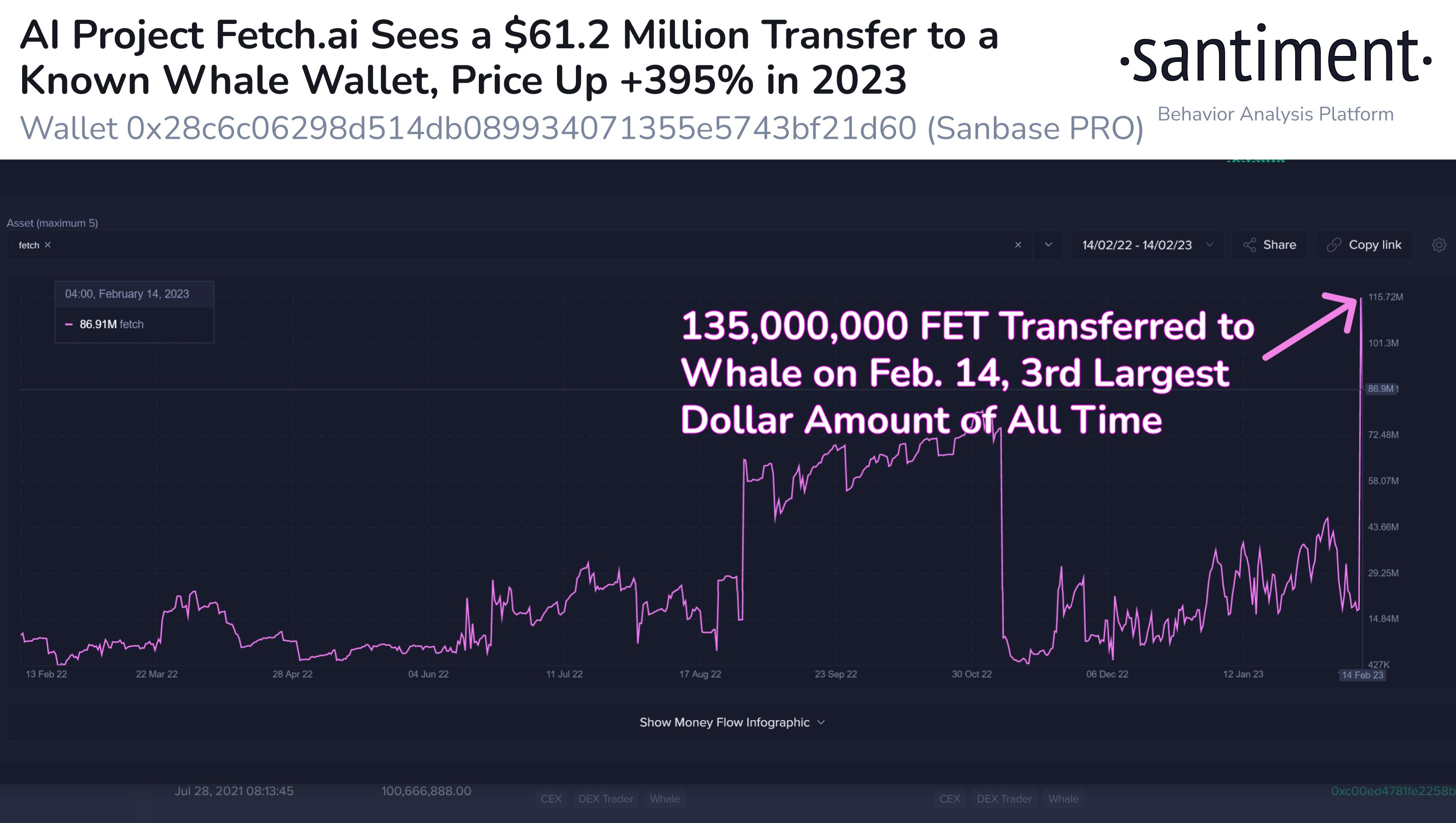

Santiment also looks at the meteoric rise of the artificial intelligence (AI) blockchain project Fetch.ai (FET), calling attention to a huge whale transaction of 135,000,000 FET on February 14th.

“Fetch.ai now the #102 asset by market cap in crypto after skyrocketing +395% in 2023, has seen its largest transaction in 567 days. $61.2M worth of FET has been transferred to an existing whale address, which also holds 224.46 million in Ethereum (ETH).”

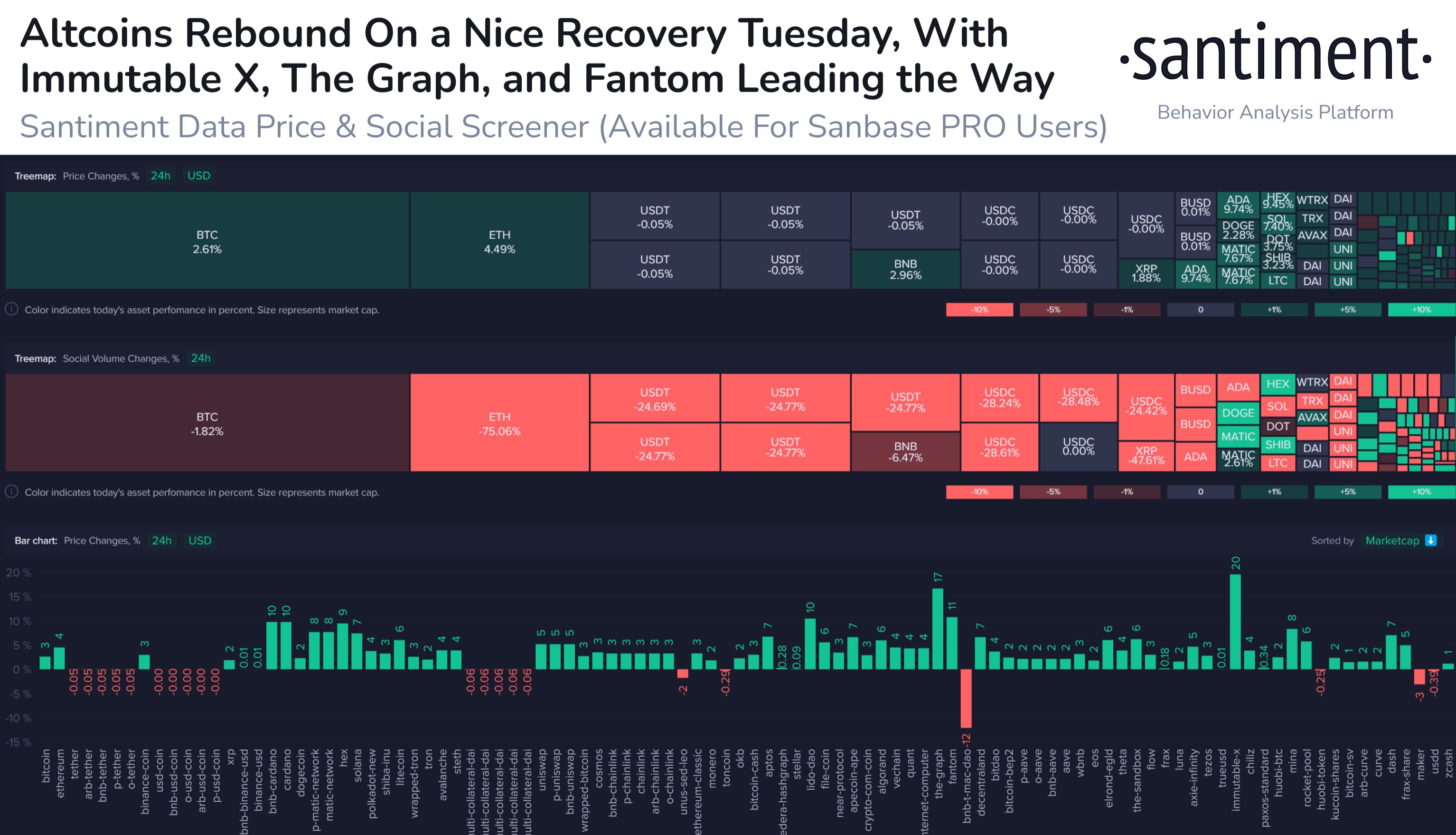

Sanitment says that overall altcoins are showing a lot of strength again as the NASDAQ and tech stocks moved up on February 14th. They say the strongest performers are FTM along with Immutable X (IMX) and The Graph (GRT).

“Altcoins are bouncing back big as Nasdaq and tech stocks performed well on Valentine’s Day. There is still an evident correlation between equities and cryptocurrencies that traders are hoping dissipates, as a correlation break historically foreshadows bull runs.”

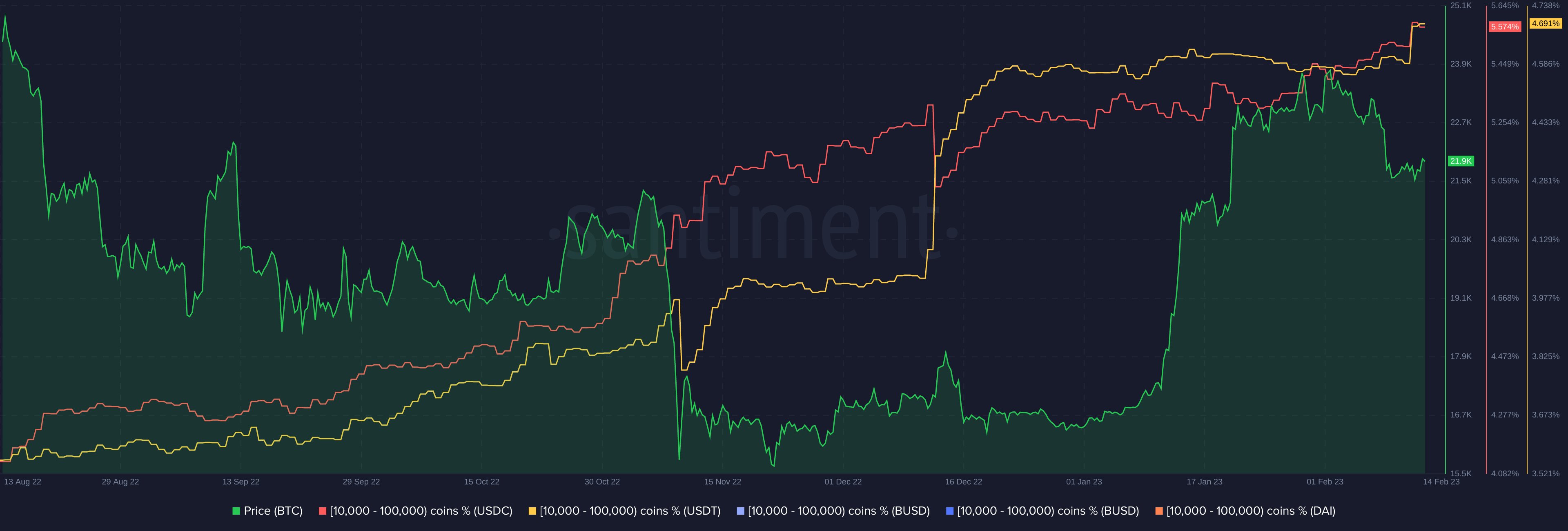

Lastly, the analytics firm says small shark investors are fleeing stablecoin Binance USD (BUSD) after the Wall Street Journal reported that the U.S. Securities and Exchange Commission (SEC) intends to sue its minting company Paxos for allegedly violating investor protection laws. Paxos has already agreed to shut down issuance of the stablecoin but will continue to honor redemptions. BUSD sharks are instead investing in Tether (USDT) and USD Coin (USDC).

“With BUSD being in hot water, small shark addresses are declining rapidly for Binance’s stablecoin that is being sued by the SEC. Instead, these sharks are increasing their positions in USDT and USDC instead.”

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com