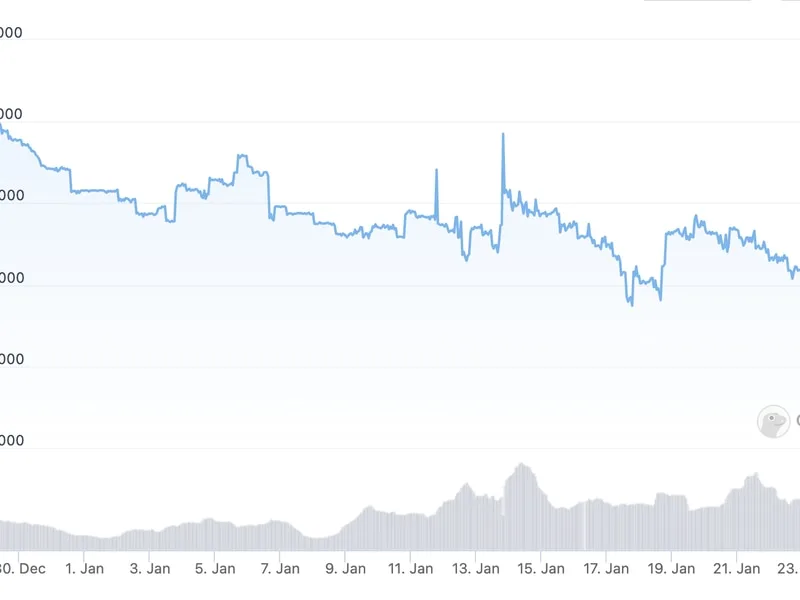

Binance stablecoin BUSD has continued its recent falls due to mismanagement concerns regarding the exchange’s pegged tokens.

You might also like

Polygon Hard Fork Completed, MATIC Sees $2 Price High

Stellar (XLM) Reclaims Resistance After Ukrainian Bank’s Successful Pilot

According to CoinGecko, the total supply of BUSD dropped to $15.4 billion on March 20, down $1 billion from the previous week and $2 billion from the last month. After Binance flubbed a disclosure about its digital asset holdings in early December, worried users rushed to withdraw funds, sending BUSD down from $22 billion.

BUSD is a dollar-pegged stablecoin produced by the New York-based fintech business Paxos Trust under the Binance name, with reserves in cash and U.S. Treasury bills. Stablecoins are used as a bridge between regular fiat currency and the cryptocurrency market.

The current drop follows news of mistakes concerning Binance-peg tokens, wrapped token derivatives traded on the exchange.

This month, the blockchain research firm ChainArgos discovered that BUSD was not always entirely supported by reserves in 2020 and 2021. Binance stated that it is no longer vulnerable to attacks. According to Bloomberg, the exchange had intertwined user assets with Binance-peg coins, which served as collateral.

Traders at the retail level will take a hit on February 1, when Binance’s banking partner Signature Bank will stop processing SWIFT interbank messaging system transfers of less than $100,000.

Due to the current problems, BUSD has fallen farther behind competitors in the stablecoin market. According to DefiLlama, which follows the value of digital assets, BUSD lost 11.3% of its market capitalisation in a month, whereas USDT gained 1.3% and USDC fell merely 1.9%. However, only BUSD of the top three stablecoins saw an increase in market value throughout the past year.

According to crypto analysis firm CryptoCompare, the total market worth of stablecoins dropped to $137 billion over a 10th-month period from January. The percentage of the whole market held in stablecoins has declined to 12.4% from a record high of 16.5% in December. This suggests that traders are moving away from stablecoins and into riskier assets.

coinculture.com

coinculture.com