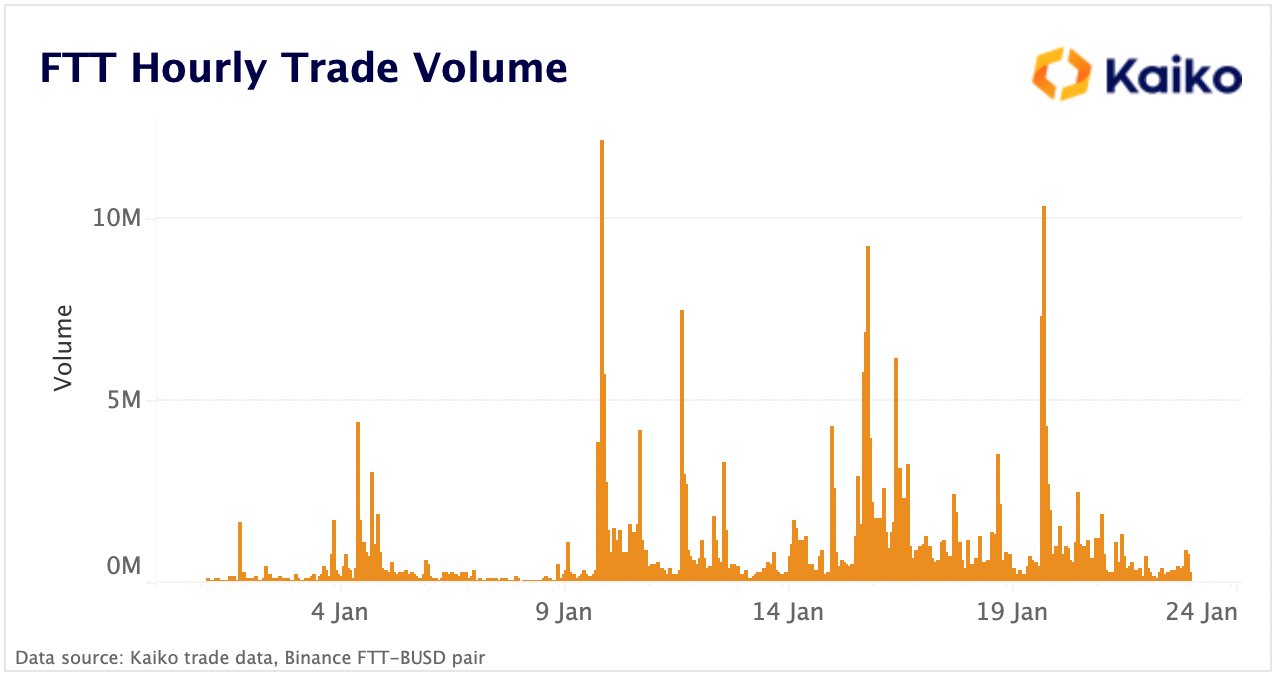

The market for $FTT, the native cryptocurrency of the now-bankrupt FTX exchange, appears to have found an equilibrium after the recent bullish price action. However, the market's ability to absorb large offers at stable prices remains weak, indicating scope for a sudden reversal of recent price gains.

$FTT has rallied nearly 150% this month as a bull revival in the broader market triggered a short squeeze in the battered cryptocurrencies. $FTT crashed 96% in November, reaching a low of $0.81 as its parent exchange, headed by Sam Bankman Fried, went bust.

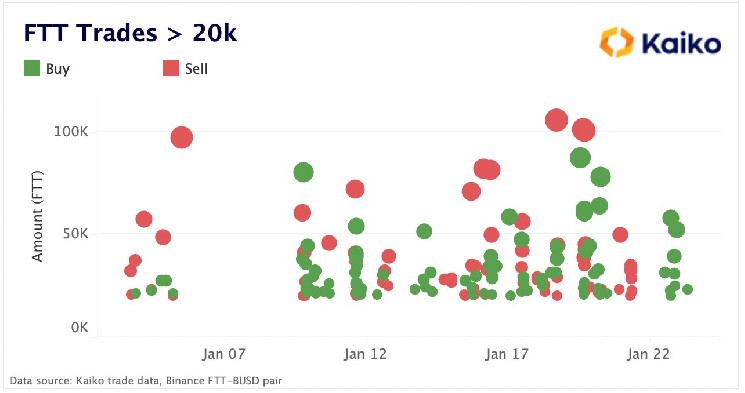

Data tracked by Paris-based Kaiko Research shows a balanced order book in Binance's $FTT-$BUSD market, with the number of buy orders for 20,000 $FTT or more now matching similar-sized sell orders. $BUSD is a stablecoin developed in partnership between Binance and Paxos and is backed 1:1 by U.S. dollars, per the official website.

"When looking at the transaction-level data, we can see that price takers have been placing large market buy orders at the same pace as market sell orders--so it looks fairly balanced right now at current levels," Clara Medalie, research director at Kaiko Research, told CoinDesk.

Price takers are entities that remove liquidity from the order book by taking available orders. Price makers create orders and wait for them to be filled, injecting liquidity into the market.

Medalie added that "overall liquidity remains very thin, so if a wave of selling starts, then it could push prices back down."

Liquidity is often measured by a metric called the 2% market depth – a collection of the buy and sell orders within 2% of the mid-price or the average of the bid and the ask/offer prices. The greater the depth, the less likely that an influx of large buy or sell orders can influence the going market price.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

coindesk.com

coindesk.com