According to recent reports, the dominant stablecoin, Tether (USDT), has surpassed the volume of settlements processed by top payment operators Visa and Mastercard. This information was shared (1) by Tether in a tweet, and it suggests that USDT handled approximately $ 18.2 trillion worth of transactions in 2022.

2022 Settlement Volume pic.twitter.com/k87FrknKr4

— Tether (@Tether_to) January 14, 2023

According to the tweet, Mastercard handled fewer transactions totaling $ 14.1 trillion in value over the previous year. On the other hand, VISA reported a transaction amount of $ 7.7 trillion, placing it in a distant third place.

The Undisputed Leader of Stablecoins

The settlement volume data provide convincing evidence that there is undeniably an increase in the use of stablecoins, a fact that cannot be disputed. Much more remarkable is the idea that 2022 was unquestionably a challenging year for the crypto currency market as a whole.

Despite this, the use of stablecoins has been steadily increasing as traders look for ways to manage the deteriorating global economic conditions, resulting in the devaluation of the majority of national fiat currencies.

During this time, it is important to note that despite the overall expansion of stablecoins, Tether's condition remained relatively unchanged during the previous year. However, most of this was due to mounting concerns regarding its reserves and financial stability.

Concerns have surfaced due to the catastrophic crash in Terra in May and, more recently, the collapse that occurred in FTX back in November. It indicates that competitors such as USDC and BUSD did better than USDT in 2022.

According to data provided (2) by CoinMarketCap, USDT continues to be the most valuable stablecoin on the market, and it now has a market valuation of $66.37 billion.

But there is a Challenger to USDT

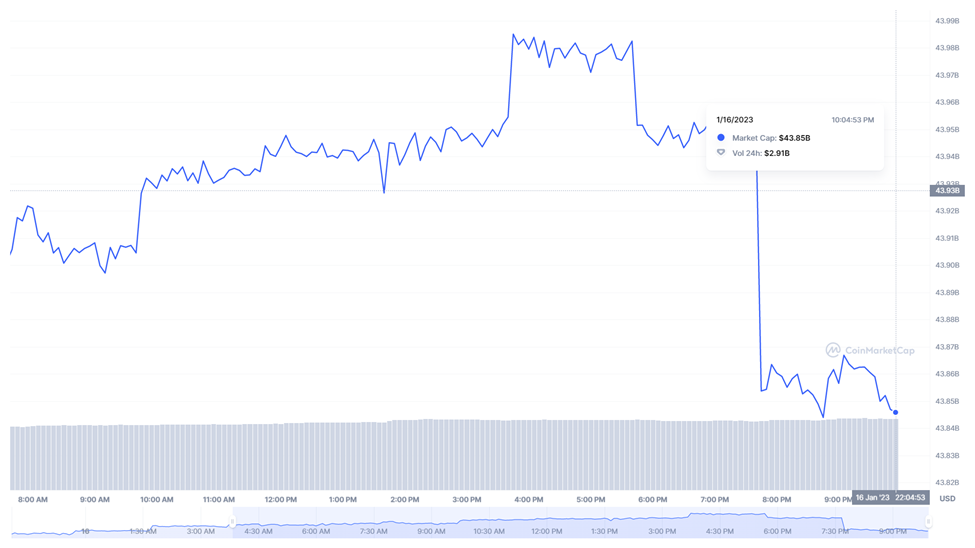

In the meantime, the USDC could be moving to challenge the USDT's leadership position in the stablecoin market. As Tether continues to volley the charges of its lack of transparency in its reserves, the USDC crypto currency, which has its own market cap of $43.85 billion, is gaining overwhelming backing from traders and platforms.

To provide some context for the preceding statement, centralized crypto currency exchanges such as Coinbase have recently encouraged their consumers to transfer their USDT holdings into USDC. That's not even mentioned that Crypto.com has stopped offering USDT to its customers in Canada.

It is not entirely surprising that some crypto fans might be skeptical of the latest study on Tether's trading activity in 2022, given all the unpredictability surrounding the crypto currency. While some continue to advocate that stablecoin issuer disclose its assets publicly, others believe that wash trading is to blame for the metrics.

USDT was introduced to the market by Tether Limited Inc. iFinex Inc., headquartered in Hong Kong, is the owner of both Tether Limited and the crypto currency exchange Bitfinex. iFinex Inc. also owns Tether Limited. As of July 2022, Tether Limited has successfully issued the USDT stablecoin on 10 blockchains and protocols.

USDC digital stablecoin is tied to the value of the United States dollar. Members of the crypto currency exchange Coinbase and the Bitcoin mining business Bitmain, an investor in Circle, are part of the consortium that manages USD Coin. This organization is known as the Centre and was created by Circle. Coinbase and Bitmain are also investors in Circle.

coinnounce.com

coinnounce.com