The long-awaited crypto volatility explosion has arrived and it is signaling panic for the Solana's SOL token.

SOL's seven-day implied volatility, a measure of expected price turbulence in the short term, has skyrocketed to an annualized 270% – twice as high as bitcoin's 135%, according to digital assets data provider Amberdata. SOL's 30-day implied volatility has surged to 190% versus bitcoin's 95%.

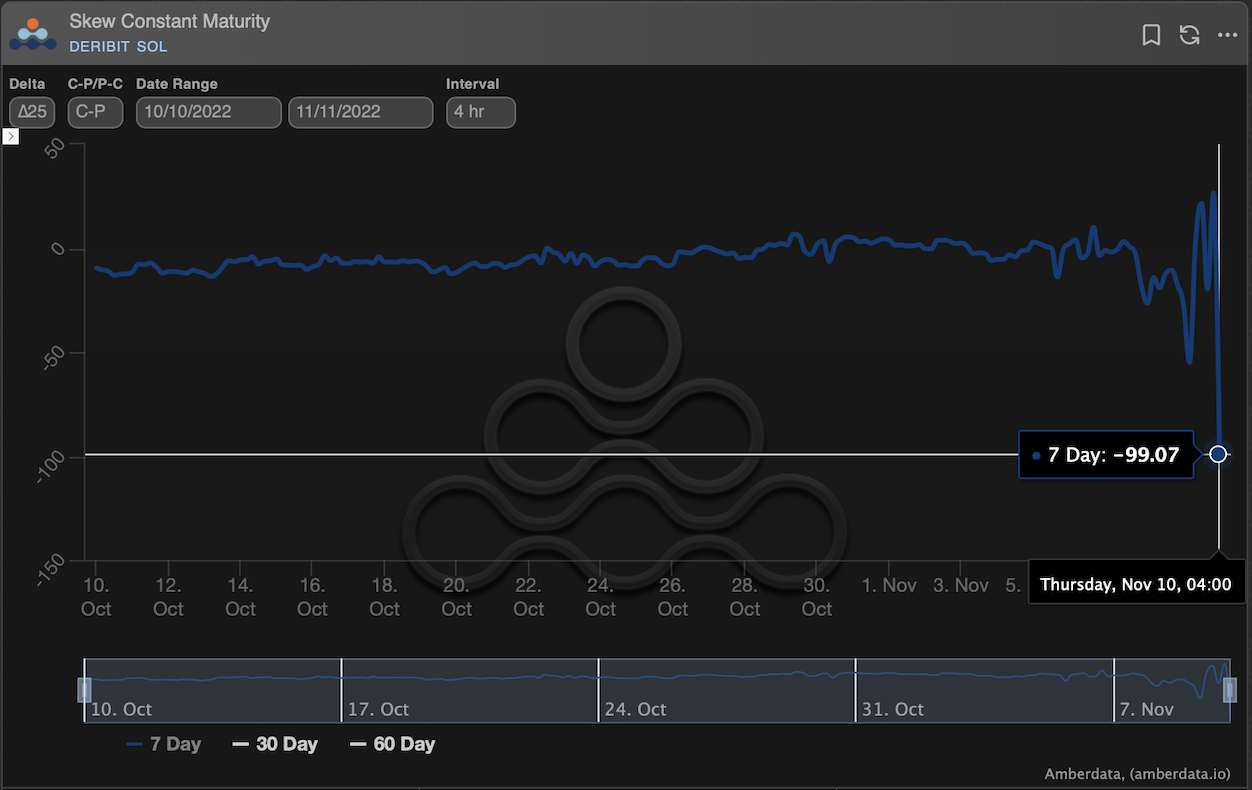

SOL's seven-day call put-call skew has dropped to a lifetime low of -99%, a sign of record demand for bearish puts relative to bullish calls. Investors typically buy puts when anticipating a price slide.

"There is panic in the SOL market," Gregoire Magadini, director of derivatives at Amberdata, said, noting the spike in implied volatility.

"Traders are nervous about the value of SOL and the potential for massive liquidations. SOL is a collateral asset, it's likely to get liquidated as FTX/Alameda needs to raise cash... Therefore, the options market is pricing more volatility in SOL vs BTC," Magadini added.

(Amberdata)

Rumors of troubled exchange FTX's sister concern Alameda liquidating its Solana holdings has already sent SOL into a freefall. The token has dropped 58% to nearly $10 in four days, according to CoinDesk data.

Additionally, an incoming supply deluge seems to have spooked investors in both the spot and derivatives markets.

Solana validators who provide security to the blockchain are set to unlock nearly $800 million worth of their SOL holdings in a few hours, amounting to 5.4% of the cryptocurrency's total supply.

Further, there could be continued token emissions over the short term, keeping supply-side pressures strong.

"In addition to continued withdrawal of SOL from validators, our emissions & unlock tracking for the token flagged an upcoming core team allocation vesting in 11 days. This unlock represents 2,558,000 SOL coming to market. Emissions will continue at their standard rate of 68,493 SOL/day," The TIE Research said in a note on Wednesday.

"We expect a minimum that an incremental 32,214,758 SOL will arrive for potential sale on the secondary market. This number will increase as a result of any further validator deactivation," The TIE Research added.

coindesk.com

coindesk.com