Amid its bankruptcy proceedings, crypto lender Celsius Network LLC, one of the major players in the contagion that struck the industry earlier this year, plans to reorganize as a crypto custody business, according to audio shared by a customer of the company and a report by the New York Times.

See related article:Celsius files for bankruptcy after closing DeFi loans

Fast facts

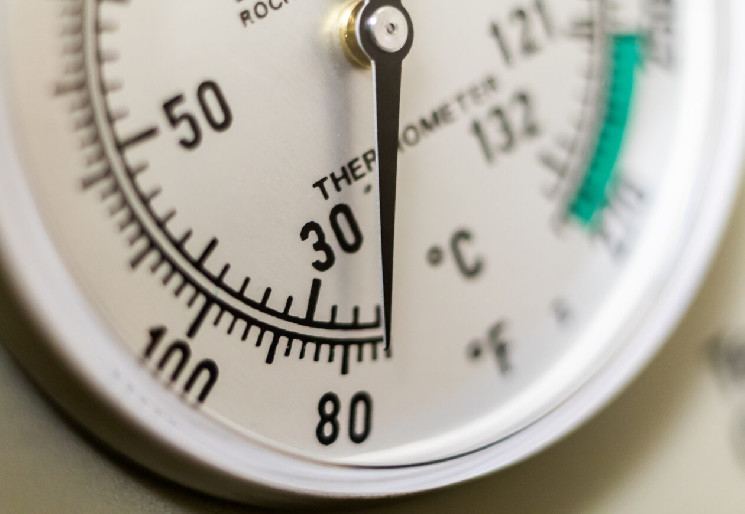

- In a company meeting on Sept. 8, Celsius CEO Alex Mashinsky and fellow company executive Oren Blonstein outlined the custody plan, which would charge customers fees for certain transactions. The project is reportedly code-named Kelvin, after the unit of measurement for temperature.

- Celsius had not charged customers fees in the past, using that as a sales pitch to ask customers to “unbank” from traditional finance; the fact they reportedly are now speaks to their financial situation and possibly the current state of the crypto industry.

- “If the foundation of our business is custody, and our customers are electing to do things like stake somewhere or swap one asset for the other, or take a loan against an asset as collateral, we should have the ability to charge a commission,” Blonstein said in the meeting.

- Celsius, including its crypto mining unit, filed for Chapter 11 bankruptcy in the Southern District of New York in June, claiming the filing would allow it to “stabilize its business and consummate a comprehensive restructuring transaction that maximizes value for all stakeholders.”

- Financial regulators in Vermont recently inferred the company resembled a Ponzi scheme at times, alleging the firm was at times using new investors’ funds to pay old ones, as well as misleading investors about its financial health.

- In the meeting, Mashinsky compared the company’s possible comeback to that of other now successful firms that at one point had filed for bankruptcy, including PepsiCo, Inc. and Delta Air Lines, Inc. “Does it make the Pepsi taste less good?” Mashinsky asked in the meeting. “Delta filed for bankruptcy. Do you not fly Delta because they filed for bankruptcy?”

See related article:Regulator alleges Celsius resembled Ponzi scheme in new filing

forkast.news

forkast.news