Predictions markets like Polymarket are becoming increasingly popular due to the perception of increased transparency compared to traditional gambling.

This article will explore how the Polymarket predictions market works, including how to use it and whether or not it is a safe place to store and trade funds.

Table of Contents

What are prediction markets?

Prediction markets are online, peer-to-peer gambling platforms that allow people to trade shares tied to the outcome of a future event. Similar to a traditional gambling platform, users can place bets on sporting events, political events, and much more. However, rather than simply placing a bet, they buy shares that fluctuate in value based on the current market sentiment towards the outcome of the event.

For example, users might bet that Candidate X will win a political election. Shares would typically begin trading at $0.50, indicating a 50/50 likelihood of success or failure. They can be sold at any value provided the market has liquidity to sell. If Candidate X wins, the share will be worth $1.00, and if they lose, the price drops to $0.00.

These markets often accept cryptocurrency in exchange for shares.

What is Polymarket? Polymarket explained

Polymarket is a prediction market hosted on the Ethereum blockchain. Users can buy shares using USD Coin (USDC).

So what is Polymarket used for?

Overview of Polymarket

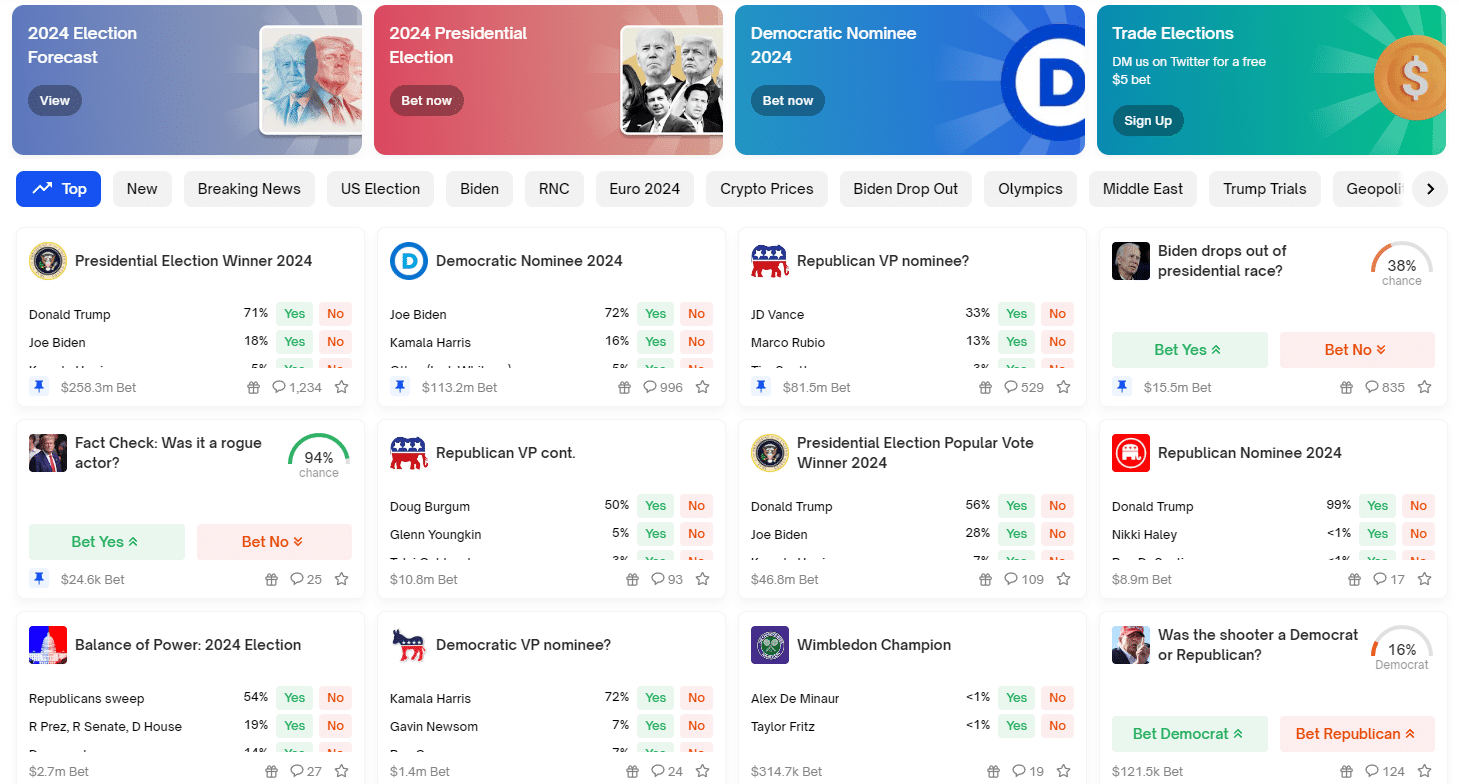

Polymarket offers trading on the outcome of US politics, crypto prices, sports, world politics, and other aspects of trending and breaking news.

Market fluctuations when staking can cause impermanent loss, where staked funds are consumed by the needs of the market the user is contributing to.

Key features of Polymarket

Polymarket styles itself as a decentralized predictions market. Of course, true decentralization is hard to come by, and Polymarket staff control many different aspects of the platform including disputes, market creation, maintenance, and other decision-making.

Despite not being fully decentralized, it is often viewed as a fairer and more transparent way to speculate on future events compared to the more opaque systems used in traditional gambling where odds are set by bookmakers at will.

How does Polymarket work?

The platform uses liquidity pools provided by users to facilitate trading, and likewise, the prices of event shares are established based on trading activity and real-time market valuations by the community. Smart contracts are used to automate aspects of exchange activities.

The CLOB (centralized limit order book) allows for on-chain, non-custodial settlement of trades while in the background, off-chain matchmaking services are also at work, making the system hybrid-decentralized.

Although online documentation states that Polymarket does not charge fees for trading, this appears to be a semantic statement, and in practice the platform does charge a net 2% on earnings from trades.

Benefits of using Polymarket

Polymarket is seen as more transparent than other gambling platforms due to its use of smart contracts and blockchain technology. Users have a lot more insight into how the prices of their shares are calculated compared to simply placing a bet at a bookies.

Likewise, shares are programmed to pay out when certain conditions are met and reported on in the news, and this programmatic system of guaranteed payouts is perceived as slightly more trustworthy than traditional gambling.

There is often a wider range of events open for trading on Polymarket compared to traditional gambling platforms, levelling the playing field for certain analysts with different types of expertise and interests.

Finally, users have the opportunity to swing trade shares while remaining somewhat agnostic to the actual outcome of a future event, a feature not typically supported in traditional gambling.

Potential risks and challenges

Polymarket is not without its own risks and unique challenges. First of all, users may find that earning money by providing liquidity is easier said than done and in fact, may be viewed as a higher risk endeavor than simply buying shares. Providing liquidity and profiting from doing so should be viewed as somewhat advanced.

The value of the assets being staked can fluctuate drastically, leaving the liquidity providers with worthless or value-reduced assets.

Of course, another risk is simply losing money to betting on the incorrect outcome of a market. The Polymarket community is known for being quote analytical and methodical compared to the typical gambling website, making the competition quite stiff for unsuspecting newcomers.

There is also, as always in DeFi, the risk of the platform itself failing or falling prey to some kind of hack, exploit, or bad action by the team or outside forces.

Is Polymarket legit?

There is no strong evidence to make an assessment on the legitimacy of Polymarket one way or another. No widely-publicized scandals have marred the reputation of the platform thus far.

TrustPilot reviews have some anecdotal reports of users feeling like certain markets they traded in were resolved unfairly or inaccurately, but there is no hard evidence that this is the case at this time.

Polymarket review: Getting started with Polymarket

To get started with Polymarket, you’ll need to register an account and deposit some USDC which you can purchase for fiat or crypto on most major crypto exchanges.

Firstly, make an account by signing up with your name and email address. The platform does not require you to provide an ID or pass a KYC check at this time.

Navigate to your profile and go to Wallet, then Deposit to make a deposit of USDC. Once that has gone through, you’re all set to buy and sell shares in future events!

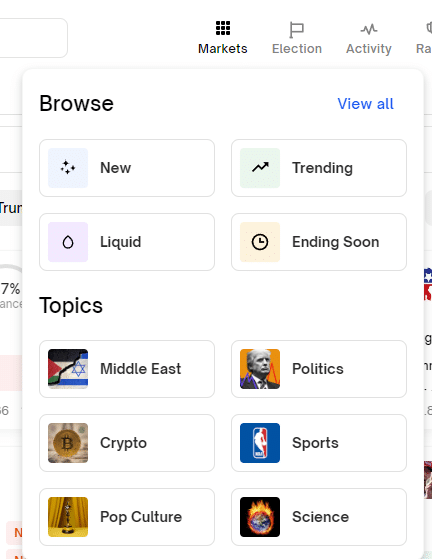

You can navigate the Polymarket interface by filtering the markets based on category.

Currently, the markets menu includes markets on the Middle East, Pop Culture, Crypto, Poltics, Sports, and Science.

You can also browse by New, Trending, Liquid, and Ending Soon.

New markets may have more favorable prices in some cases, as fewer people will have placed their bets and the outcome will be somewhat undetermined. On the other hand, markets that are ending soon will likely have a fairly well determined outcome. In some cases, the shares will already be locked in at around $0.99, indicating a 99% likelihood of a particular outcome.

These markets will be difficult to trade on profitably, unless you believe the 1% outcome is the correct one. However, sometimes a market ending soon will have a healthier margin that you can still work with. Markets that are ending soon also tie up your assets for a shorter time period than a new market, some of which may take months to resolve.

Markets that have high liquidity are often preferred, as buying shares in a low-liquidity market may incur price slippage, meaning you’re losing some of your funds in the trade.

How to trade and stay safe on Polymarket

The Polymarket platform can appeal to new users due to having so many different events to buy shares in. New users are often advised to take a methodical, evidence based approach to predicting the outcome of any event.

Successful Polymarket traders often work with a lot of historical data and build models to forecast the likelihood of an event, rather than simply buying shares based on intuition. Of course, swing trading is also possible, wherein users do not intend to see a market out to completion but rather take profits before the market ends.

As with any type of financial speculation, it’s important to have a risk management plan and well-established entry and exit points in order to target long-term profitability, as well as to deeply research and test any trading strategy before using actual funds.

You can learn more about risk management here.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.