Explore crypto airdrops: Learn what they are, how they operate, and their advantages in the cryptocurrency world.

What is a crypto airdrop?

Crypto airdrops have long been a useful avenue for crypto projects to engage with their audience. Airdrops involve the distribution of crypto tokens or coins directly to users’ digital wallets.

Airdrops reward existing supporters and aim to attract new ones by offering a taste of the project’s potential value, literally, for free.

The concept took the spotlight in 2014 with the distribution of Auroracoin (AUR) to Icelandic citizens, which was described as “Iceland’s Bitcoin.”

Since then, several high-profile airdrops have taken place, such as Stellar Lumens (XLM) distributing two billion XLM, valued at over $120 million at the time, to various crypto wallet users in 2019.

The largest to date was by Uniswap (UNI) in September 2020, dispersing UNI tokens worth $6.43 billion at their peak.

Another high-profile airdrop in the cryptocurrency world was by ApeCoin (APE) in March 2022, with $3.54 billion worth of APE tokens distributed.

The airdrop claim consisting of 15% of the total supply of ApeCoin will be made available to @BoredApeYC NFT holders (Bored Apes and Mutant Apes, as well as #BAKC dogs paired with either #BAYC or #MAYC).

— ApeCoin (@apecoin) March 16, 2022

Participation in airdrops can be enticing, given their potential for lucrative gains. However, the allure of free tokens can sometimes mask the risks involved, including scams and potential regulatory implications.

Let’s delve into what a crypto airdrop is and understand all about it.

Crypto airdrops explained

An airdrop in cryptocurrency is a marketing strategy used by blockchain and crypto-related projects to distribute free tokens to a large number of wallet addresses. Think of it as a way for these projects to raise awareness, attract new users, and reward existing ones.

Here’s how it typically works: a project announces an airdrop, specifying the criteria for participation, which could include holding a certain amount of their tokens, being a member of their community, or simply signing up for their platform.

Once the conditions are met, participants receive free tokens directly into their wallets. Airdrops can vary in size and value, ranging from a few dollars’ worth of tokens to very-high amounts.

You might also like: Crypto startups shifting from airdrops to loyalty points

How do crypto airdrops work?

Firstly, it’s important to note that crypto airdrops operate on blockchain. When a project decides to conduct an airdrop, it usually sets aside a certain amount of its tokens for distribution. The mechanics of a crypto airdrop typically involve the following steps:

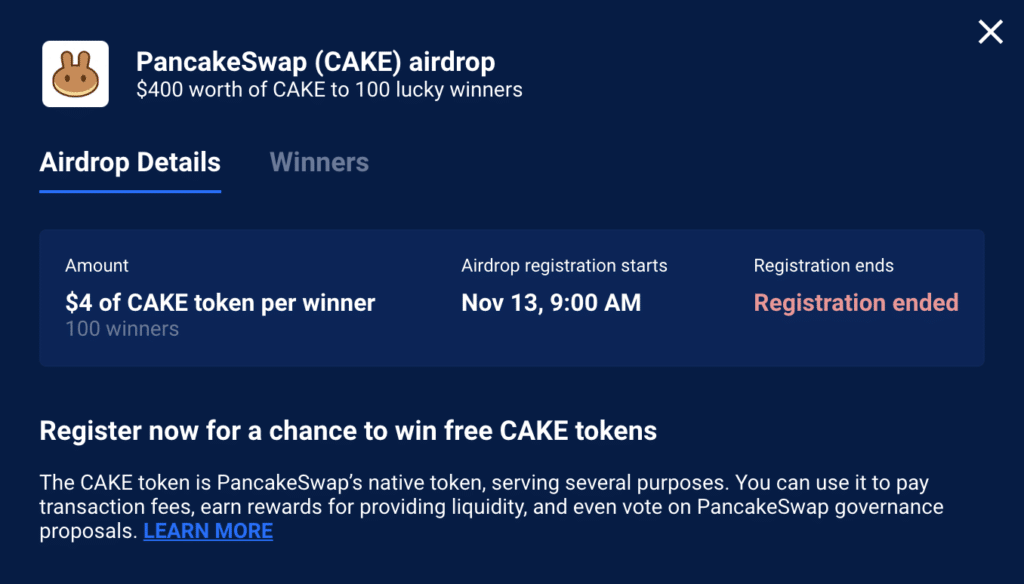

Announcement: The project announces the airdrop through various channels such as social media, forums, or their official website. They detail the eligibility criteria and instructions for participation.

Registration: Participants usually need to register for the airdrop by providing their wallet address and completing any other required tasks, such as joining a Telegram group or following the project on social media.

Verification: Once registered, the project verifies the eligibility of participants based on the criteria specified. This step ensures that only genuine users receive the airdropped tokens.

Distribution: After verification, the project distributes the free tokens directly to the wallets of eligible participants. This distribution is often automated through smart contracts on the blockchain.

Claiming tokens: Participants can then claim and access their airdropped tokens through their crypto wallets. These tokens can be held as an investment, traded on exchanges, or used within the ecosystem of the issuing project.

You might also like: Uptick in Solana airdrop scams: Nest Wallet CEO loses $125k

Types of crypto airdrops

Here are some common types of crypto airdrops:

Standard airdrops: This is the most basic form of airdrop, where tokens are distributed for free to eligible participants based on predetermined criteria set by the project.

Holder airdrops: In a holder airdrop, tokens are distributed to existing holders of a particular crypto. For example, a project might decide to airdrop cryptocurrency tokens to all holders of Ethereum or Bitcoin at a specific block height or snapshot date.

Fork airdrops: Fork airdrops occur when a blockchain project undergoes a fork, resulting in the creation of a new crypto. Holders of the original cryptocurrency are often airdropped an equivalent amount of the new cryptocurrency. This happened, for example, when Bitcoin Cash (BCH) was forked from Bitcoin (BTC).

Bounty airdrops: Bounty airdrops reward participants for completing specific tasks or contributing to the project in various ways. Tasks could include bug bounties, content creation, or community engagement. Participants receive tokens as a reward for their efforts.

Surprise airdrops: Surprise airdrops, as the name suggests, are unexpected distributions of tokens to a random selection of wallet addresses. These airdrops are typically used to reward loyal users or generate excitement within the community.

How to find crypto airdrops?

Finding a crypto airdrop doesn’t have to be a complex task. Start by exploring dedicated platforms and websites like DappRadar and Airdropalert, which track and list active and upcoming airdrops.

These sites not only provide details on how to participate but also often include assessments of the airdrop’s legitimacy.

Additionally, staying active within the crypto community can also qualify you for certain airdrops. Following cryptocurrency projects and influencers on platforms like Twitter and Reddit can provide early alerts to airdrops.

Moreover, many crypto projects announce airdrops on their official channels to generate buzz and reward their community members.

Signing up for newsletters from trusted crypto news outlets can also be beneficial. These newsletters often include announcements about new projects and upcoming airdrops, providing a convenient way to stay informed without constantly searching for information.

Yet, the golden rule remains: do your due diligence. With the excitement of free tokens, it’s easy to overlook the risks. Verify the legitimacy of the airdrop and the project behind it through thorough research.

How to get crypto airdrops?

Claiming a crypto airdrop requires various steps to ensure eligibility and security. Here’s a step-by-step guide on how to get involved:

Set up a crypto wallet: Begin by selecting a wallet that supports the blockchain or token involved in the airdrop. Ensure compatibility to receive the tokens securely.

Research projects and requirements: Investigate the project offering the airdrop. Review their team, whitepaper, roadmap, and community to verify legitimacy and alignment with your interests. Additionally, check for any specific tasks or criteria required for participation.

Meet airdrop requirements: Follow the provided instructions to meet all requirements for eligibility. If no formal announcement is made, consider becoming an active user of the platform to potentially increase your chances of receiving the airdrop.

Protect your privacy and security: Be vigilant against scams by verifying the legitimacy of the airdrop through official project channels. Avoid sharing unnecessary personal information and prioritize platforms with verified badges and community engagement.

Claim your airdrop tokens: Once the distribution period begins, follow the provided instructions to claim your tokens. This may involve verifying your wallet address or completing additional steps for authentication.

Manage your airdropped tokens: After receiving the tokens, carefully consider your options. You can choose to hold onto them, sell them, or utilize them within the project’s ecosystem. Evaluate factors such as utility, market value, and potential risks before making any decisions.

How are crypto airdrops taxed?

Typically, the taxation of airdrops depends on various factors, including the classification of the tokens received and the individual’s tax status.

Airdropped tokens may be subject to income tax, capital gains tax, or both, depending on whether they are considered as income or as assets.

The value of the tokens at the time of receipt is usually used to determine the taxable amount. Additionally, the frequency and volume of airdrops received may impact the tax treatment.

It’s advisable to consult with a tax professional or accountant familiar with cryptocurrency taxation in your country to ensure compliance with applicable tax laws and reporting requirements.

Keeping detailed records of airdrop transactions and their corresponding values is crucial for accurate tax reporting.

Beware of crypto airdrops scam

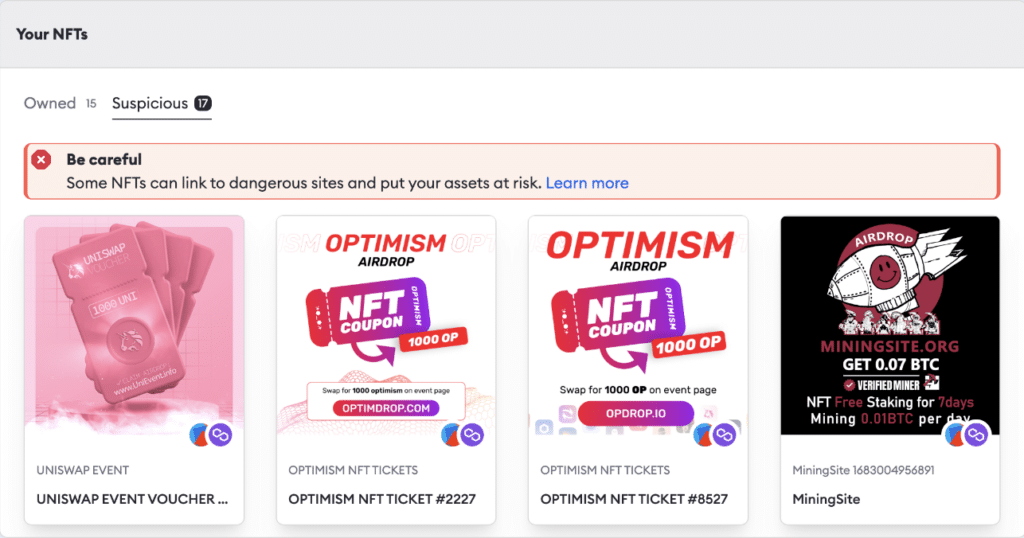

Crypto airdrop scams pose a risk to unsuspecting participants, as scammers exploit the allure of free tokens to steal personal information or funds.

These scams often mimic legitimate airdrops, using deceptive tactics to trick you into divulging sensitive information or sending crypto to fraudulent addresses.

Common red flags of crypto airdrop scams include unsolicited emails or social media messages promising large token giveaways with little to no effort required.

Scammers may also impersonate well-known projects or influencers to lend credibility to their schemes.

To avoid falling victim to crypto airdrop scams, it’s crucial to exercise caution and skepticism when encountering such offers.

Verify the legitimacy of the airdrop by researching the project and checking for official announcements on their website or social media channels. Be wary of providing personal information or sending funds to unknown addresses.

Additionally, utilize security measures such as two-factor authentication and secure wallets to safeguard your assets. Education and awareness are your only defenses against crypto airdrop scams.

FAQs

Are crypto airdrops worth it?

Participating in crypto airdrops can be worthwhile for some people, as they offer an opportunity to receive free tokens without investing money. However, whether they are worth it depends on various factors, such as the legitimacy of the project, the potential value of the airdropped tokens, and the effort required to participate. It’s essential to research each airdrop carefully and consider the risks and benefits before deciding to participate.

Are crypto airdrops safe?

While legitimate crypto airdrops can be safe, there are risks associated with scams and fraudulent schemes. Scammers often impersonate legitimate projects or influencers to lure unsuspecting users into divulging personal information or sending cryptocurrency. To stay safe, it’s crucial to verify the legitimacy of the airdrop by researching the project and avoiding offers that seem too good to be true.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Read more: Scammers pilfered $55m from 40k victims in January alone, data shows