Crypto communities have grown significantly over the past few years, thanks to the advanced engagement models they are using to build user participation: decentralized governance (DAO), NFT collections, staking, and fee redistribution models to the community by emerging crypto payment platforms such as Slash.

According to the latest statistics from the DAO analysis platform DeepDAO, there are currently over 19,000 DAOs, with around $40.2 billion in total locked in the treasuries of these decentralized communities. Additionally, there are an estimated 420 million crypto owners across the world, most of whom are part of one crypto community or more.

For an asset class that has only been around for a decade, and with the recent Bitcoin Spot ETF approvals, it is likely that crypto communities will grow even bigger within the next few years.

In the next section of this article, we will delve deeper into why crypto platforms are emerging as superior alternatives compared to traditional businesses when it comes to building sustainable communities.

The Crypto Platform Model: Decentralization and Incentivization

As mentioned above, there are several factors driving the growth of crypto communities. While some could be seen as still experimental, it is no coincidence that they are gaining popularity and being embraced beyond the typical crypto use cases, with sports teams like PSG Football Club, launching several NFT collections to boost fan engagement.

Decentralized Governance (DAO)

Unlike their traditional counterparts, where decisions are made by a central party (board or management), most crypto platforms have adopted a horizontal approach to governance, whereby decisions are made by community members who own a particular governance token.

Uniswap, for example, which is currently the leading decentralized exchange (DEX) in volumes enjoys a huge active community. Since the platform’s inception, there have been over 33,000 lifetime participants and 377,000 UNI governance token holders as of writing. More notably, Uniswap’s community has put forward 170 governance proposals, with over 269,000 votes.

On the contrary, centralized exchange platforms such as the New York Stock Exchange (NYSE) and Nasdaq are owned by publicly listed companies where the majority shareholders have an upperhand. For context, key decisions regarding the NYSE are mostly influenced by its holding company, the Intercontinental Exchange, Inc., while Nasdaq is owned by Nasdaq Inc.

Based on these dynamics, it is not surprising that more and more people are opting to join decentralized communities where their voices can be heard as opposed to investing in traditional businesses where despite having a stake, they have little to no control.

Fees Redistribution

One of the most important factors in building a strong community around a product is ensuring that all stakeholders are rewarded fairly. While traditional businesses that are publicly listed pay annual dividends to investors, many times the board or management are rewarded more handsomely.

In crypto communities, projects are taking a completely different approach, with cryptoasset platforms such as Slash redistributing 100% of all the fees collected back to its community who hold the native SVL token. Although still a nascent innovation compared to most of the existing payment businesses, this cryptoasset platform has facilitated over $13.5 million in transactions so far, with over 3,000 merchants having signed up.

More importantly, cryptoasset platforms like Slash are not only offering a generous distribution from the fee proceeds but also building payment rails of the future. This Japan-based cryptoasset platform charges merchants between 0%-2% compared to traditional payment service providers such as Visa and Mastercard, where card processing costs could go up to 3.5%.

Slash also intends to roll out the first regulatory-compliant crypto credit card to its arsenal, which will open the way for both newbies and crypto veterans in the Japanese market to use their crypto assets for daily payments without struggle.

Staking

Another reason why crypto communities are thriving is because of the rewards participants can derive from staking their governance tokens. Put simply, staking is the process of contributing to transaction validation and network security in a Proof-of-Stake (PoS) blockchain by locking up one’s tokens as collateral to be eligible for participation. In return, stakers are rewarded based on a fixed or flexible percentage for committing their tokens.

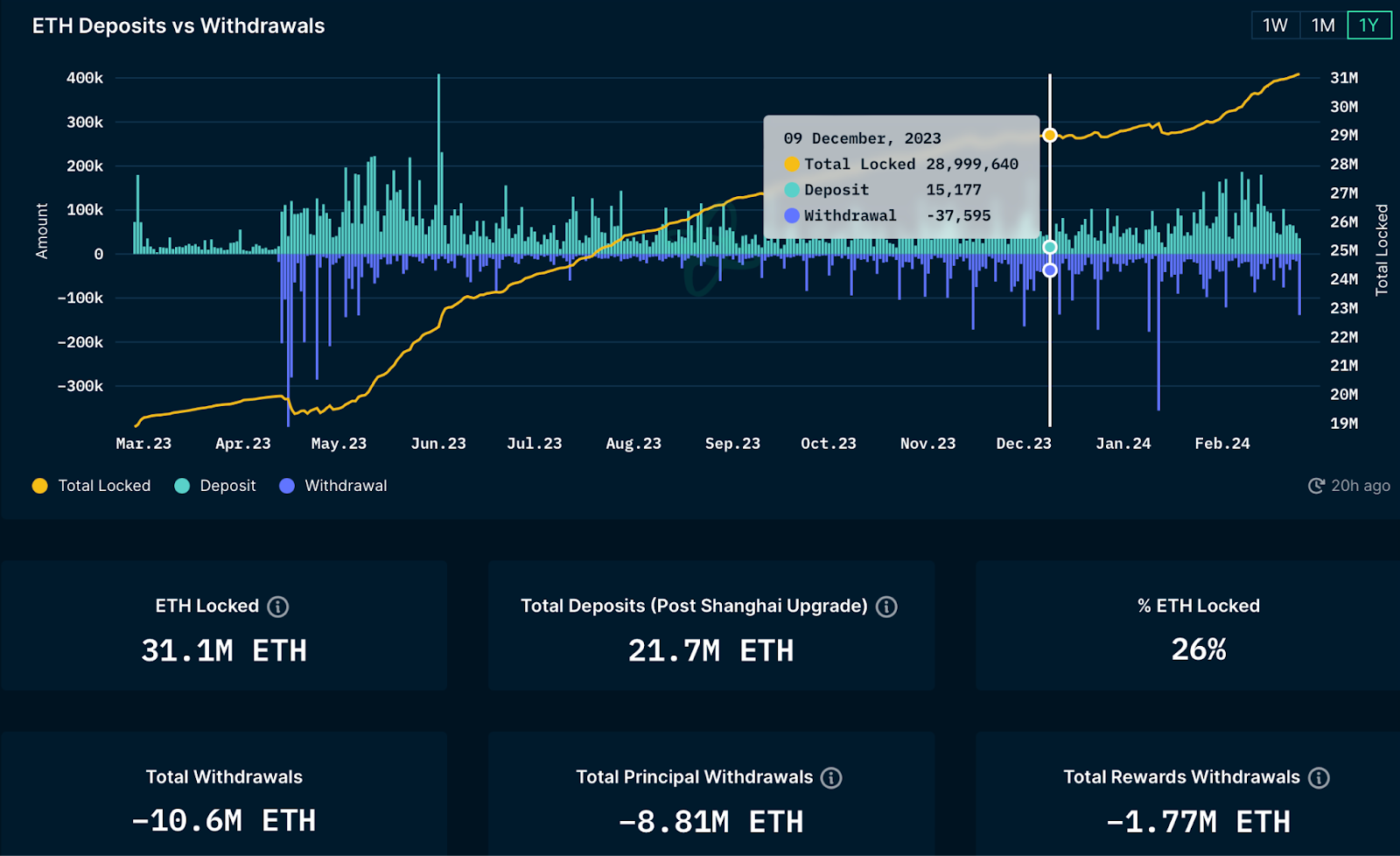

The best example here would be Ethereum’s ecosystem, which transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) blockchain last year. Since then, the number of staked ETH has shot up to 26% of the total ETH in circulation, with the reward rate currently at around 3.67%.

Source: Nansen

Even without running the numbers, it makes more sense to hold an asset which besides value appreciation, it is possible to earn a passive interest from contributing to the network. This is where staking emerges as a superior alternative to traditional business models, which do not offer a larger community a chance to participate or incentivize anyone for buying their product or simply being part of the community.

NFT Collections

NFT collections have also proven to be formidable in building vibrant communities; in fact, this approach to building community engagement is now being used beyond the crypto market. But before highlighting some of the traditional businesses jumping on the NFT bandwagon, collections such as the Bored Ape Yacht Club (BAYC) and Cryptopunks were among the most sought-after digital assets at the height of the previous bull run.

And even with the NFT market taking a hit, these collections have morphed into vibrant communities, with BAYC giving rise to the Mutant Ape Yacht Club (MAYC). This evolution of NFT collections into bigger communities goes on to show just how much value can be derived by making ownership more personal and exclusive. As of writing, the total market of BAYC is well over $700 million while the total market cap of NFT collections stands at $55 billion.

Given this success, it is not surprising that traditional businesses, including popular brands such as Nike, Coca-Cola, Adidas, and Budweiser, have all at some point launched an NFT collection to boost fan engagement. Statistics also reveal that 42% of the top 50 fashion brands have either launched or shown interest in NFT collections.

Conclusion

The crypto platform model, although still relatively new, is a challenger to traditional businesses that have long operated based on centralized leadership and skewed reward processes. With crypto communities gaining traction by the day, It’s only a matter of time before existing businesses start appreciating the value of decentralized communities. Gone will be the days when companies go home with the lion’s share while users of a particular platform (community) are barely rewarded for their engagement.