Since the launch of initial coin offerings (ICOs) like EOS and Tezos, a steady stream of alternative smart contract platforms have been labeled “Ethereum killers,” immediately pitting them against one another.

During 2021, which has arguably been the biggest year of adoption among these alternative layer 1 protocols, the success of Solana, Avalanche and others has not necessarily come at the expense of Ethereum. In fact, the ecosystems are thriving in parallel with applications deploying on all chains.

This article originally appeared in Valid Points, CoinDesk’s weekly newsletter breaking down Ethereum 2.0 and its sweeping impact on crypto markets. Subscribe to Valid Points here.

Chain-specific total value locked (TVL) is just one measure for DeFi demand, and the most prominent chains have all seen growth rather than competition between one another. At the very beginning of 2021, Ethereum had $21 billion locked in DeFi, accounting for 97% of the multi-chain ecosystem. Fast forward to June 1, and Ethereum’s DeFi TVL grew to $85.6 billion but only represented 73.2% of the overall ecosystem as Polygon and Binance Smart Chain took market share.

Today, Ethereum has $180 billion in DeFi TVL, but its dominance has fallen still further to 66.5%. I would argue that the dominance number is less important in the short term, as Ethereum looks to scale tremendously with the help of Arbitrum, Optimism, Polygon and more. The idea that these other chains are “Ethereum killers” appears to be false, as Ethereum TVL grew almost 9x, while its native token only grew 5.9x.

Open comms

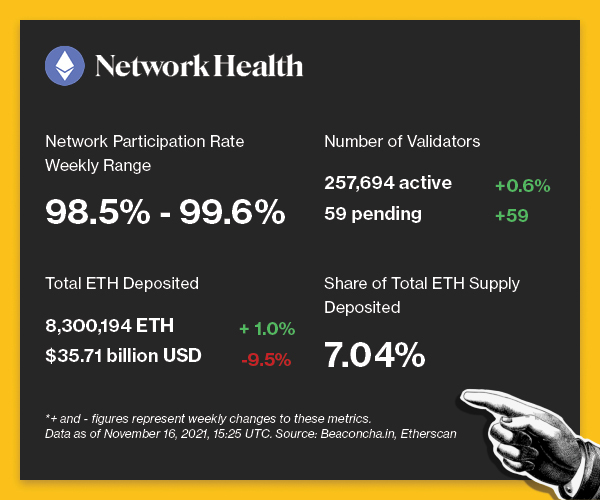

Valid Points incorporates information and data about CoinDesk’s own Eth 2.0 validator in weekly analysis. All profits made from this staking venture will be donated to a charity of our choosing once transfers are enabled on the network. For a full overview of the project, check out our announcement post.

coindesk.com

coindesk.com