If Gary Gensler ever writes an autobiography, he should call it Regulatory Clarity.

It would be a guaranteed bestseller, because the crypto industry would get so up in arms about the title that they would tweet about it nonstop. We’re talking a million copies, easy.

Regulatory clarity, of course, is the shared dream of everyone in the crypto industry. If we just knew whether crypto was or was not a stock, the thinking goes, then things would really take off.

Good news: Regulatory clarity may be coming soon. For real, this time. (Part 12)

My question is, when we get regulatory clarity, what next?

I believe smart investors should be planning for this now. Rather than complaining that the laws aren’t fair, we should be positioning ourselves for new laws. Because things are happening.

PYUSD Changes Everything

PayPal recently launched its own stablecoin, PYUSD, which some experts are saying may accelerate regulatory clarity – that is, to get crypto-specific laws passed more quickly in Congress. Here’s John Rizzo, formerly of the U.S. Treasury Department:

“The prospect of hundreds of millions of users soon having easy access to a stablecoin on a platform they already use … creates a new urgency for lawmakers in D.C. to reach a compromise on a regulatory framework for stablecoins.”

Now that PayPal’s involved, in other words, crypto’s got a lot more cred.

The crypto economy is increasingly intertwined with the traditional economy. It’s not hard to draw a line between the collapse of Terra/LUNA, to the collapse of FTX, to the failure of several well-known banks, ending (we hope) with the bailout of Credit Suisse.

The global economy is complex, so we want to avoid oversimplification, but there’s no doubt that what happens in crypto now affects the whole world, so lawmakers cannot afford to let crypto be the Wild West much longer.

So when the sheriff comes to town, what then?

History Repeats Itself

I highly recommend a book called Technological Revolutions and Financial Capital by Carlota Perez, in which she lays out five technological revolutions, from the Industrial Revolution (1771) to the Information Revolution (1971), each lasting about 40-60 years.

(The implication is that we may be in the middle of a new “Blockchain Revolution,” starting with the Satoshi whitepaper in 2008.)

Each of these revolutions, Perez argues, has two distinct phases:

The installation phase, which is full of financial speculation, bubbles, and crashes. Thus, Railway Mania during the Railway Age, and the dot-com bubble during the Information Age. These are the boom-and-bust times that fuel the growth of the new technology.

The deployment phase, which is the “golden age” that follows. The technology becomes widely adopted, leading to growth, stability, and great benefits to society. Now the new technology is just “common sense,” the way things are done, which lasts until the next great revolution.

Perez does a nice job outlining the financial, societal, and governmental changes that typically occur during these revolutions – as well as how to manage them well. Her historical examples are valuable, because they illustrate we’ve seen this movie many times before.

She describes the onset of a new technological revolution as a “Frenzy,” where early speculators rush in to make a quick buck. She calls it a “casino” period, in which financiers are “setting their own lax rules and being highly successful with them.” (Think of the ICOs of 2017.

Eventually, the bubble pops, and the government enters the picture, creating new technological regulation, which (if done well) can usher in a new golden age in which the technology becomes part of everyday life, making the world better.

To sum up: the technological revolution (blockchain) typically leads to irrational exuberance (2017-2022), which leads to euphoric bubbles (ICOs, DeFi, NFTs), which eventually crash (Terra/LUNA and the aftermath), which brings about calls for more government regulation.

And that, I believe, is where we are now.

So, what typically happens next?

Perez discusses how, once the appropriate government regulations are in place, the “arrogant self-complacency” is replaced by “confident optimism” in business growth. (Translation: crypto bros will be replaced by company execs.)

In contrast to the Wild West that came before, Perez describes this period as a time of “orderly and ordered behavior.” (Once stablecoins get regulated, you can see every bank rushing to support them – but in a neat, orderly line.)

She calls it an era of “good feeling,” in which the new technological revolution creates greater and greater benefits for society, as did the railways, the telephones, and the Internet. Gradually, the new technology becomes a part of everyday life, “the way things are done.”

Along the way, the new technology opens the doors for many complementary technologies and businesses: the infrastructure that supports it. And that is where smart investors can really shine.

New Areas of Investment Opportunity

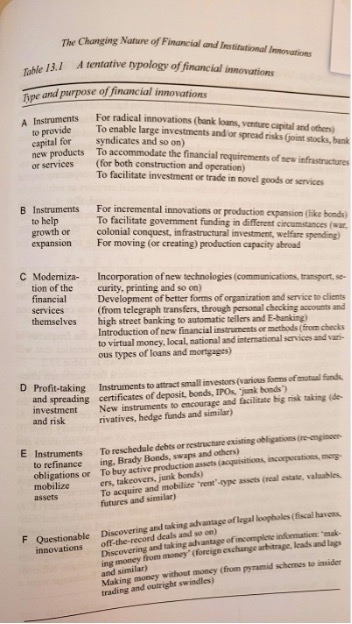

This is the chart from the book that really stuck with me, which I snapped on my phone and kept on my computer desktop for years:

This is the answer to the question, “After regulatory clarity, what next?”

When regulation comes (not if, but when), these are the types of companies – and subsequent investment opportunities – that we should watch for.

Money providers for new products and services: Look to invest in banks, funds, and VC firms making a big push into Web3. Adventurous investors can also consider joining specialized angel groups like Chain Reaction (where I’m a member) to invest in early-stage startups.

Innovations to help growth or expansion: Get ready for Web3 IPOs (not ICOs, but legit IPOs). Also, companies will begin offering their own shares as securitized tokens. Bonds – including junk bonds – will also be offered as tokens, to fuel Web3 growth.

Modernization of financial services: Look for any company that’s helping banks take their first creaky steps into Web3. Companies like Coinbase, Circle and ConsenSys are ideally positioned, but many others will flourish, including Web3 payment processors and fintechs.

Innovations to spread investment and risk: We’ve been talking about blockchain bonds for years. But also look for the explosion of Web3 derivatives on platforms like Synthetix and dYdX, as well as decentralized insurance platforms like Nexus Mutual.

Refinancing debts or mobilizing assets: Look for tokenization of any real-world assets: real estate, commodities, sports teams, music royalties, etc. (Expect NFTs to have a new golden age, too.) As the industry matures, expect plenty of mergers, acquisitions, and takeovers.

Questionable innovations: Finally, beware of continued bad behavior, now in the form of insider trading, legal loopholes, off-the-record deals, and so on. (We’ll graduate from Sam Bankman-Fried to Bernie Madoff.)

In summary, as we get regulatory clarity, we will have investment opportunities galore

– as well as new risks. Great investors will do well to prepare for both.

Investor Takeaway

“You were right. It’s not a passing fad.”

This line made my week, as it was written by New York Times financial columnist Ron Lieber. In his recent Letter to a Young Crypto Enthusiast, he admits that crypto is here to stay, and suggests a common-sense approach for investing in it.

If you, too, believe that crypto is here to stay, then it must evolve. And it is likely to evolve along the lines of previous technology revolutions: we’ll soon get regulatory clarity that will usher in a new golden age.

That presents exciting opportunities for investors like you and me.

As we get this regulatory clarity, think to yourself, which companies will be providing the infrastructure for this financial and technological revolution? Which companies will be bringing in the new golden age?

PayPal, Coinbase, and Circle are my top three. Who are yours?

bitcoinmarketjournal.com

bitcoinmarketjournal.com