Yuga Labs lawsuit dismissed: a US federal judge found Bored Ape Yacht Club NFTs, ApeCoin and other Yuga-issued tokens do not meet the Howey Test’s three prongs and therefore are not securities, ruling purchasers bought consumable digital collectibles rather than investment contracts.

-

Judge ruled NFTs were consumable collectibles, not investment contracts

-

Judge Fernando M. Olguin found no common enterprise or explicit profit promise tied to Yuga’s NFT sales.

-

Court cited precedent that most digital assets are not securities and noted independent fees and public blockchain trading data.

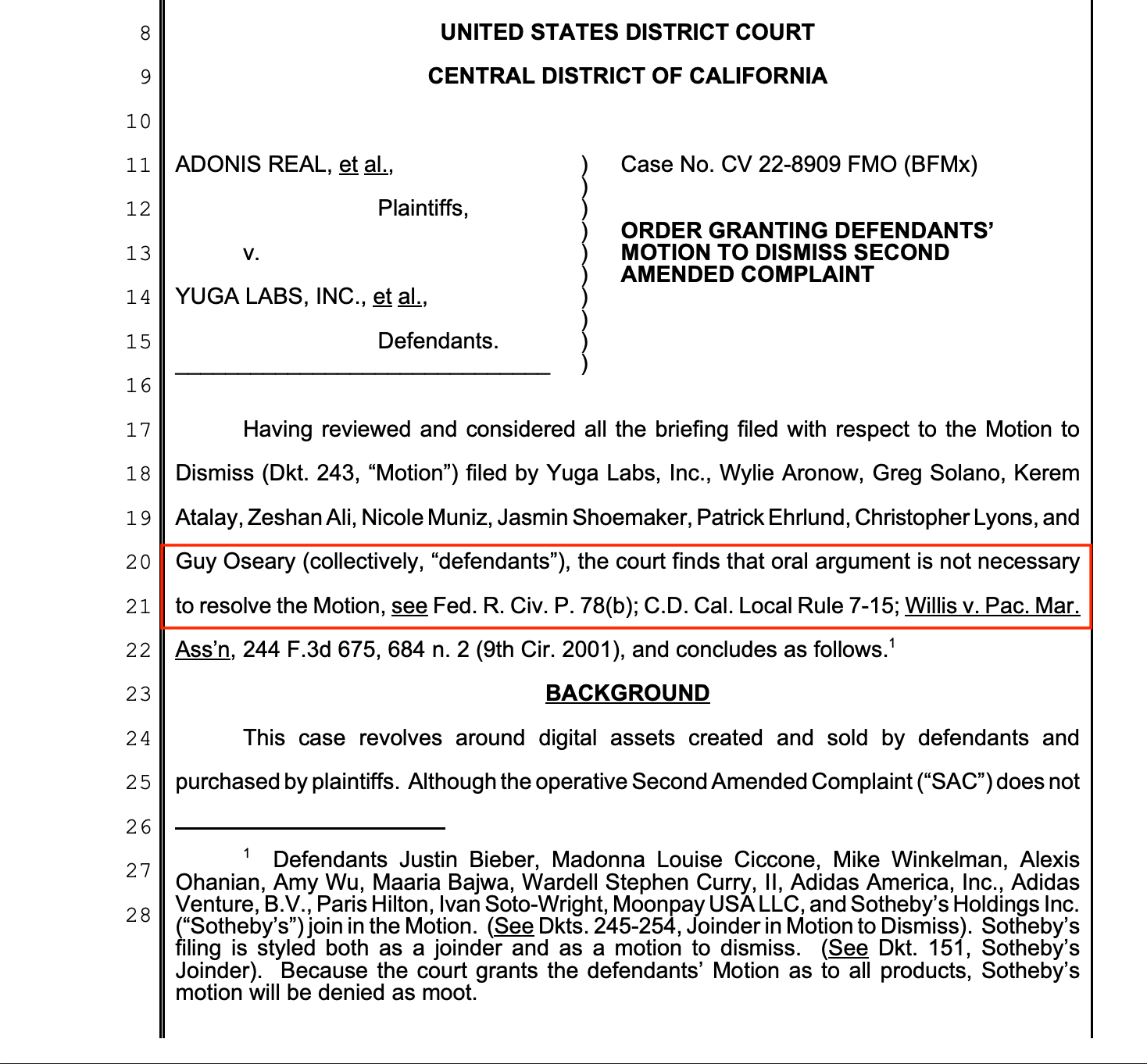

What is the ruling in the Yuga Labs lawsuit?

Yuga Labs lawsuit dismissed by Judge Fernando M. Olguin concluded the plaintiffs failed to show Bored Ape Yacht Club (BAYC), ApeCoin (APE) and other Yuga NFTs qualify as securities under the Howey Test. The court held purchasers bought consumable digital collectibles and membership perks, not investment contracts tied to Yuga’s efforts.

How did the court apply the Howey Test to BAYC and ApeCoin?

The judge assessed the three Howey prongs—an investment of money, a common enterprise, and an expectation of profit produced by others—and found the plaintiffs proved none. The ruling noted Yuga marketed NFTs as collectibles with membership benefits and did not make explicit profit promises to buyers.

Judge Olguin dismisses investor lawsuit against Yuga Labs. Source: Court Listener

Why did the court find no common enterprise or profit expectation?

Judge Olguin determined the NFTs’ trading on public blockchains and the transactional structure did not create the ongoing, dependent financial relationship required for a common enterprise. Fees paid to Yuga were treated as independent charges, and the roadmap and promotional statements did not equate to enforceable profit promises.

The court emphasized: “Statements about a product’s inherent or intrinsic value are not necessarily statements about profit.” Even references to past prices or trading volumes were insufficient to establish an actionable expectation of profit under Howey.

What evidence and precedent influenced the decision?

The ruling referenced legal precedent that most digital assets are not automatically securities and examined specific contractual and marketing language from Yuga. Commentary from market participants and attorneys — including public posts by industry lawyers — were discussed as factual context without altering the court’s statutory analysis.