Summary

- NFTs, harnessed through blockchain technology, offer unique ownership certificates, enabling access to exclusive content and experiences.

- The 2021 NFT hype witnessed an influx of renowned brands like Gucci, Nike, and Louis Vuitton, exploring the creative potential of the NFT market.

- 2021 saw an unprecedented surge, with NFT sales surpassing $17 billion and over 2.5 million crypto wallets linked to NFTs.

- The 2022 NFT market crash resulted from the collapse of major systems, global economic challenges, market oversaturation, and fraudulent activities.

- The current NFT market is witnessing a revival, with monthly sales exceeding $415 million and Ethereum leading the charge, closely followed by Solana and Polygon.

- Despite the positive trends, it is evident that the NFT market needs cautious optimism due to the lack of growth in transactions.

- The future of NFTs seems promising, with projected growth in revenue, users, and market capitalization. Integration of NFTs in loyalty programs and membership models is a notable trend.

Blockchain's transformative potential, particularly when harnessed through Non-Fungible Tokens (NFTs), extends far beyond its origin, promising equitable access to wealth, eliminating intermediaries, and fostering unparalleled transparency.

But what exactly are NFTs, and why are they making waves once more?

NFTs are cryptographic assets meticulously recorded on the blockchain—a digital ledger technology that securely and transparently documents transactions across a decentralized network.

Unlike traditional currency, NFTs cannot be substituted, divided, or exchanged for an equivalent value. Their residence on an immutable blockchain serves as a hallmark of authenticity and ownership, transforming them into digital certificates of ownership, ready to be traded within online marketplaces.

These unique characteristics open doors to endless possibilities, such as accessing exclusive content or attending a live concert, all autonomously governed by the code.

Consequently, NFTs grew rapidly during 2021 as many were hyped up about the technology.

The Hype

The year 2021 was the year of NFTs' meteoric rise. Non-fungible tokens became the talk of the town, captivating the imagination of artists, collectors, and investors alike. It was like a digital gold rush, with NFTs being sold for jaw-dropping amounts.

The Big Brands' Entrance

NFTs are not merely seen as assets for quick trading profits. International behemoths were eyeing the NFT market as a realm for creative exploration. Renowned brands, including Gucci, Nike, Adidas, Tiffany, and Louis Vuitton, are venturing into the NFT landscape, seeking to amplify demand for their products and discover novel revenue streams. Notably, Nike sought to leverage NFTs to safeguard the authenticity of its products.

The Explosive Surge

The summer of 2021 witnessed an unprecedented surge of interest in non-fungible tokens. According to Nonfungible.com's report, NFT sales surpassed an astounding $17 billion in 2021, marking a staggering 21,000% surge from the previous year's total of $82 million.

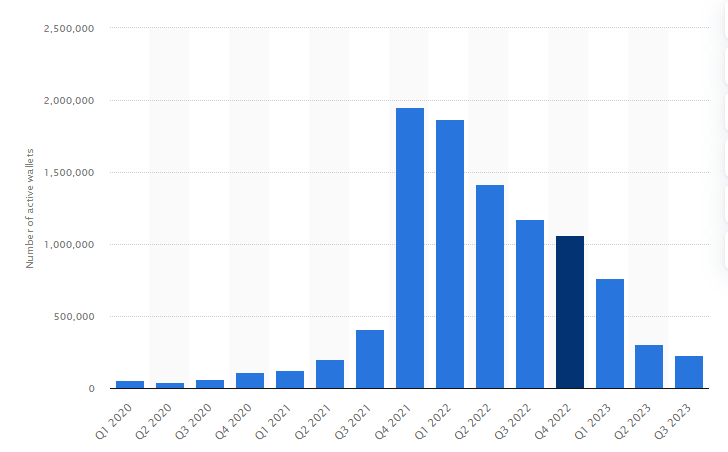

More than 2.5 million crypto wallets were linked to individuals holding or trading NFTs in 2021, a substantial increase from the mere 89,000 recorded a year earlier. The number of buyers soared to 2.3 million from 75,000, signifying the expanding interest and participation in the NFT space.

In addition, investors amassed a collective $5.4 billion in profits from NFT sales in the same year, with over 470 wallets boasting profits surpassing the $1 million mark, according to Nonfungible.com.

As for the segments that captured the most attention, collectibles emerged as the most popular category, contributing to a staggering $8.4 billion in sales. Gaming-related NFTs, exemplified by platforms like Axie Infinity, followed closely, amassing a significant $5.2 billion in sales. The diversification of NFT applications across different sectors and industries underscored the versatility and potential that these tokens hold in today's digital landscape.

The Eventual Fall

The meteoric rise of NFTs, characterized by soaring sales and immense enthusiasm, faced an inevitable reckoning in 2022. A number of factors combined to cause the eventual fall of the bullish NFT market, leaving many perplexed and investors recalibrating their expectations.

Collapse of Big Systems — A Domino Effect on NFTs

In any ecosystem, the fall of a major player can send reverberations throughout the entire system. In the context of the NFT market crash, the collapse of significant web3-related systems played a pivotal role in the downturn.

FTX, a major cryptocurrency exchange, declared bankruptcy, citing a liquidity shortage and withdrawal issues. Furthermore, the Terra blockchain's native crypto assets, TerraUSD and LUNA, experienced a dramatic devaluation, leaving investors grappling with significant losses.

Global Economic Challenges

The broader global landscape also exerted its influence on the fate of the NFT market. The world was still grappling with the aftermath of the COVID-19 pandemic, with economic uncertainties casting a long shadow. Inflation rates surged, and the specter of a looming recession loomed.

Market Saturation — A Flood of NFT Projects

Before the NFT craze of 2021, the market was a relatively niche domain, with only a select few NFT projects making waves. However, as the frenzy reached a fever pitch, it appeared that everyone and their uncle wanted a piece of the action. The result? A deluge of NFT projects inundated the market.

From music to gaming assets and visual artworks, NFTs emerged for every conceivable niche. While diversity is often celebrated, the sheer volume of projects led to market oversaturation. With an abundance of choices available, the demand struggled to keep pace, leading to an overall decline in value.

Scams and Fraud

As interest in NFTs skyrocketed, so did the prevalence of scams and fraudulent activities targeting unsuspecting investors.

Hackers and fraudsters seized the opportunity, employing tactics such as Discord hacks, malicious links, and deceptive "free mint" NFT scams. These schemes left many with substantial losses and a shaken trust in the market's integrity.

As the economic backdrop shifted, NFT investors and creators had to adapt their strategies and navigate a more complex marketplace. This, in turn, contributed to declining trading volumes and floor prices plummeting to historic lows.

For example, from August 2021 to April 2022, weekly trading volumes for non-fungible tokens regularly surpassed $750 million, with peak weeks exceeding $1.5 billion in volume. However, from June 2022 to May 2023, weekly trading volumes failed to breach the $277 million mark for any given week.

The decline was also evident in individual NFT prices. For instance, the average floor price of a Bored Ape Yacht Club NFT, which reached over $420,000 in April 2022, dwindled to just above $80,000 by May 2023, marking a significant 340% drop in slightly over a year. According to data from Chainalysis, the average price of NFT token sales plummeted by an astounding 92% from May 2022 to February 2023, plummeting from $3,894 to $293.

Prominent collections, like CryptoPunks and Decentraland NFTs, were not immune to the market's fluctuations. For example, the average floor price of a CryptoPunk NFT, valued at more than $240,000 in early April 2022, dwindled to slightly over $52,000 by mid-June of the same year, and as of May 2023, floor prices remained just above $80,000—a substantial reduction from mid-2022.

Similarly, the average Decentraland NFT went from $3,820 in June 2022 to only $103 in November 2022, and as of May 2023, it sat at $1,166. These plummeting values served as stark reminders of the market's vulnerability to external forces and the inherent volatility of the NFT landscape.

Current Scenario of the NFT Market

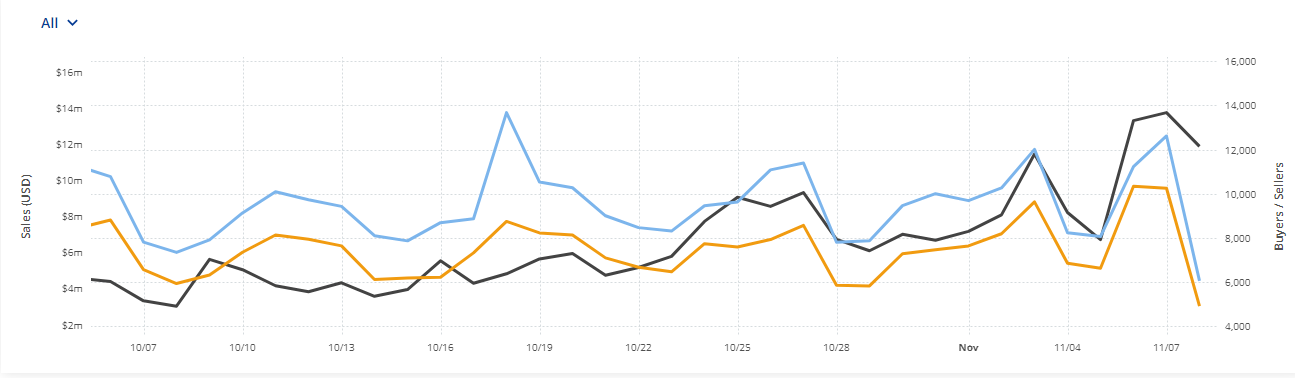

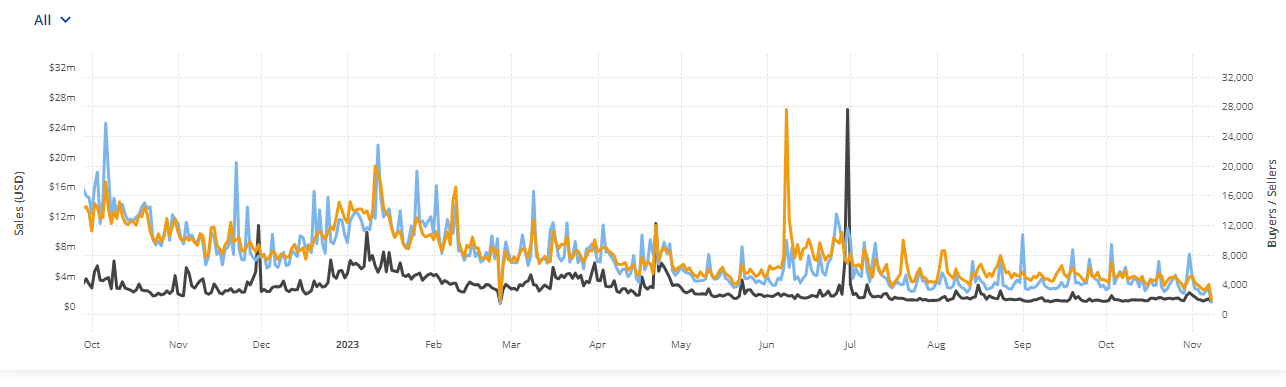

The NFT market has staged a remarkable resurgence, marking a promising growth in recent times. During October alone, the NFT market witnessed over $300 million in trading volume, an increase of about 20% from the previous month.

Even more encouraging, NFT sales surged by 9% over the last 30 days to 419.588 million.

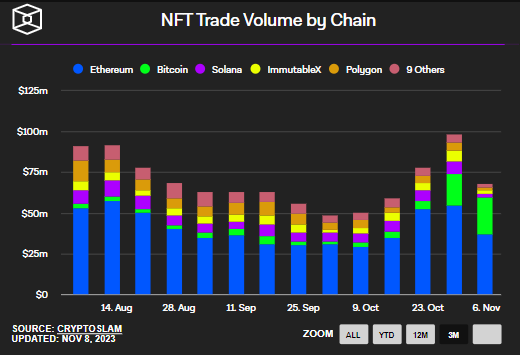

Ethereum Remains at the Helm

In terms of NFT blockchains, Ethereum continues to assert its dominance. The pioneering blockchain solution has amassed over $218 million in sales over the last 30 days, an 8% increase.

Nonetheless, the Solana and Polygon blockchains are not far behind, with Solana reporting a remarkable 29.37 million increase in NFT trading volume in the last 30 days, a 13.5% increase.

An Uptrend Affirmed

Analyzing the data from the past week underscores the undeniable uptrend NFTs are currently experiencing. Trade profits are on the rise, with global NFT sales crossing the $18.5 million mark for the first time in two months, and wash sales reaching nearly a four-month high. Notably, this represents the fourth consecutive week of increasing total NFT sales.

A Bright Side

As per recent data, some traders are particularly active, especially those who contribute liquidity to the market. Currently, they are focusing on acquiring grail NFTs, including rare CryptoPunks and Bored Apes. NFTs from iconic collections like Cryptoadz, Doodles, and Supducks are also experiencing renewed interest.

Promising Developments

Several current bullish developments are bolstering the NFT space:

- Collectibles Back in the Game: Collections like Bored Apes, The Captainz, CryptoPunks, Mutant Apes, and Potatoz jointly traded for over $29 million, signifying the return of buyers armed with liquidity and a penchant for pure collectibles.

- Bitcoin's $SATS BRC-20 Collection: This collection emerged as the top-selling blockchain collectible in the past week, amassing over $10.4 million in sales. Controversial it may be, but it continues to capture attention.

- Sorare's NFT Success: Sorare's Unique Victor Wembanyama NFT sale underscored the demand for fantasy sports powered by NFTs. The 1/1 player card sold for 61.18 ETH (US$110,000).

- Memeland's $MEME Coin Distribution: Last week, Memeland distributed millions of dollars worth of their new $MEME coin to NFT holders, injecting fresh liquidity into the NFT market. Upcoming airdrops like $BLUR and Friend.tech are expected to further fuel the January liftoff.

- Bitcoin's Resurgence: Bitcoin has made a substantial comeback, driven by BRC-20 swap platforms and a renewed interest in Ordinals. Sales have risen by 193%, and the introduction of new art platforms featuring renowned artists suggests the potential for further growth.

- Mythos Chain's Resilience: Mythos Chain has demonstrated its ability to thrive not only in a bear market but also in bullish environments.

- Solana's Consistent Performance: Despite a week of barely any decline, Solana maintained its position with over $7.3 million in sales.

However, a critical concern remains the number of transactions and the lack of growth in that aspect. While existing NFT enthusiasts are displaying renewed conviction in acquiring prized NFTs, the broader audience is not yet actively spending their cryptocurrencies on NFTs. This trend is a potential cause for concern and should, at the very least, temper expectations.

Looking into the Future

As the NFT market surges back to life, the future holds promise and potential for this transformative digital asset class. Industry experts and data projections offer a glimpse into what lies ahead.

Cyclic Resilience

Jason Bailey, co-founder and CEO of ClubNFT, a prominent NFT tool and self-custody solution, holds a confident outlook. He believes that "NFTs will come back and go mainstream," highlighting the cyclical nature of crypto and NFT markets, akin to previous technological crashes.

Projected Growth

Data from Statista paints an encouraging picture of the NFT market's future. Projections indicate continued growth in terms of revenue, users, and market capitalization. In 2023, there are approximately 13.95 million NFT users, with expectations of this number swelling to 19.31 million by 2027.

Steady Expansion

The consulting and global research firm VMR (Verified Market Research) offers an even more ambitious estimate, anticipating the overall value of the NFT market to surge to $231 billion by 2030.

According to the report, the global NFT market was valued at $11.3 billion in 2021. The forecast anticipates a robust compound annual growth rate of 33.7% over the next eight years. This bullish outlook aligns with the increased demand for NFTs, driven by their diverse applications across a spectrum of industries, including gaming, music, film, and sports.

Loyalty Programs and Membership Models

NFTs are also permeating the realm of loyalty programs and membership-based models. Venues such as hospitality establishments and gyms are already exploring the potential of NFTs in this context, marking a burgeoning trend within this niche.

Shift towards Enduring Value: Maturing NFT Landscape

The NFT market's revival, as we've explored, is a compelling testament to the enduring appeal of digital assets. There is no doubt that the NFT landscape is evolving since the heady days of the 2021 bull market brought in a wave of opportunistic projects, which often disillusioned token holders.

The emergence of Web3 gaming and the advent of innovative digital art collections could attract a substantial share of new capital. These developments signify a vital maturation of the NFT market, steering it away from fleeting hype and toward enduring value.

Several factors contribute to this positive outlook. Reduced transaction fees pave the way for more accessible participation, making NFTs an enticing prospect for a broader audience. The evolution of NFTs goes beyond mere speculation and extends to real-world applicability, offering a glimpse into the promising future of these digital assets.

Even though the NFT market has seen rapid growth, its inherent risks require close attention. Cyber-attacks and identity theft pose significant threats, with scammers replicating digital assets and selling them as NFTs, leading to potential copyright infringements. Fraudulent activities, including "rug-pulls" and NFT thefts, have heightened concerns, while the practice of "wash trading" has created misleading perceptions of NFT values.

Additionally, privacy vulnerabilities on the Ethereum blockchain raise alarms, as the platform lacks comprehensive user anonymity measures. Moreover, keep in mind that the majority of NFT projects are based on hype alone. Thus, to ensure a secure and reliable NFT ecosystem, stakeholders must prioritize due diligence, robust security protocols, and a deep understanding of the intricacies of digital assets.

bsc.news

bsc.news