Binance, the world’s largest cryptocurrency exchange, continues to lead the market in capital inflows, according to a new report. The exchange attracted a staggering $908 million in Q2 2024, further solidifying its position at the forefront of the industry.

Top 10 CEX by Capital Inflow in Q2 2024@binance +$908M@bitfinex +$709M@bitgetglobal +$561M@Bybit_Official +$465M@gate_io +$400M@MaskEXGlobal +$177M

— CryptoRank.io (@CryptoRank_io) July 5, 2024

Korbit +$39.0M@Phemex_official +$17.2M@Coinsquare +$15.8M@RobinhoodApp +$14.6M pic.twitter.com/UwN4kqOAMu

Trailing behind Binance, Bitfinex garnered $709 million in capital inflows, while Bitget Global secured third place with $561 million. Bybit and Gate.io followed closely with $465 million and $400 million, respectively, rounding out the top five exchanges.

The significant capital inflows into Binance and other major exchanges highlight the continued confidence and interest in centralized platforms within the crypto industry. Binance’s robust ecosystem, diverse offerings, and strong market presence have made it a preferred choice for many traders and investors.

Here’s a detailed breakdown of the top 10 centralized exchanges by capital inflow in Q2 2024:

- Binance ($908 million)

- Bitfinex ($709 million)

- Bitget Global ($561 million)

- Bybit ($465 million)

- Gate.io ($400 million)

- MaskEX Global ($177 million)

- Korbit ($39 million)

- Phemex ($17.2 million)

- Coinsquare ($15.8 million)

- Robinhood ($14.6 million)

Binance’s leadership in capital inflows reflects its strategic initiatives, continuous innovation, and commitment to providing a secure and user-friendly trading environment. As the crypto market evolves, Binance remains at the forefront, setting a high bar for other exchanges.

Source: Defillama

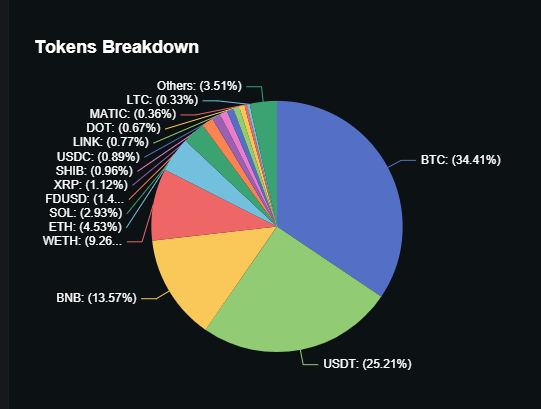

Additionally, the token breakdown on Binance reveals the most actively traded assets on the platform shows Bitcoin (BTC) leads with 34.41% of the trading volume, followed by Tether (USDT) at 25.21%, and Binance Coin (BNB) at 13.57%.

Other notable tokens include Wrapped Ethereum (WETH) at 9.26% and Ethereum (ETH) at 4.53%, with smaller portions comprising Solana (SOL), FDUSD, XRP, SHIB, USDC, LINK, DOT, MATIC, LTC, and a category labeled “Others” accounting for 3.51%.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com