Key takeaways:

- A report by crypto analytics firm Kaiko shows that trading volumes at Justin Sun-owned Poloniex and HTX don’t seem organic

- The surge in volume on Poloniex and HTX cannot be linked to any significant changes and occurred during a period when other exchanges were grappling with multi-year low trading volumes

- In March 2023, the SEC accused Justin Sun of wash trading

Crypto analytics firm Kaiko has published a startling report that highlights the abnormally high trading volumes on Huobi and Poloniex, two cryptocurrency exchanges owned by crypto entrepreneur and Tron CEO, Justin Sun.

The report follows last month’s decision to rebrand Huobi as HTX (Huobi Tron Exchange). The timing of the rebrand and the similarity with the now-defunct Sam Bankman-Fried-led exchange FTX is probably not a coincidence.

Poloniex posted record volume in August, while other exchanges experienced “one of the lowest volume months since 2020”

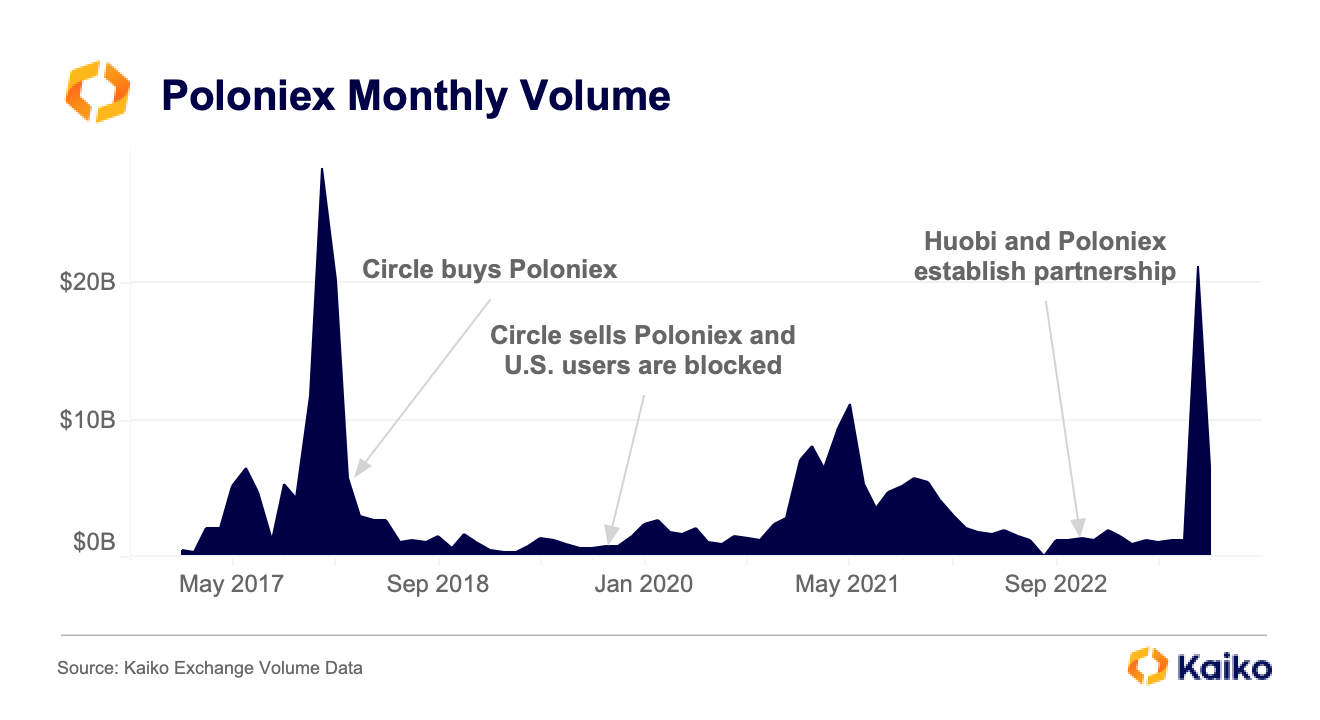

The report by Kaiko shows that the volume on Sun-owned Poloniex surged past $20 billion in August 2023, which was coincidentally one of the lowest volumes for other exchanges. “This surge did not coincide with any major changes that can influence trade volume to such an extent (for example, removing trading fees for major pairs like BTC-USDT),” wrote the author of the report, Rlyad Carey.

The surge in volume on Poloniex in August didn’t correspond to any major changes that could influence such a drastic traffic increase, per the report. Source: Kaiko

It’s impossible to say what drove the trading volume, as internal exchange transactions are, contrary to blockchain transactions, a bit of a “black box.” What’s undeniable, however, is the fact that Poloniex’s volume surged at a time when other exchanges faced significant volume declines.

In March 2023, the SEC charged Justin Sun and his companies with the unregistered sale of crypto assets TRX and BTT, wash trading, and paying celebrities to promote these tokens without disclosing compensation.

While we can’t say for certain that the surge of volume on Poloniex in August could be attributed to wash trading, there’s certainly precedent for this kind of behavior happening at Justin Sun’s ventures.

HTX’s volume surges to pre-China ban levels

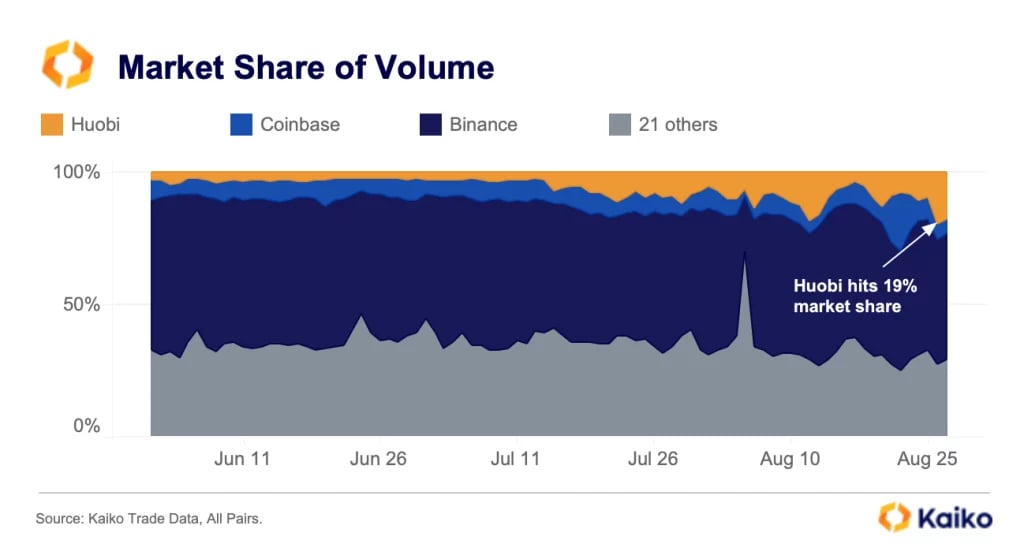

Similar to Poloniex, there’s reason to believe that something funky is going on with trading volume on HTX, which was acquired by Justin Sun-led investment firm in October 2022. It is worth noting that HTX was one of the biggest exchanges in the market before Chinese authorities cracked down on crypto, controlling about 20% of the entire market share.

HTX’s exchange volume market share increased to 20% in August 2023, a level last seen when the exchange was a dominant player in the Asian crypto market. Source: Kaiko

Fast forward to 2022, the exchange’s market share dropped to just 4%. However, seemingly out of nowhere, HTX increased its market share to 10% in July 2023 and reached nearly 20% of the market share by August 2023.

“Similar to the surge in volume on Poloniex, which came at roughly the same time, there was no obvious change that could explain such a drastic shift, especially when volumes were at multi-year lows on all other exchanges.”

It is worth noting that there’s been a large amount of selling of USDT for USDC at HTX in recent weeks. What’s more, two HTX-linked wallets transferred $400 million worth of USDC to Binance. “A net of $350mn USDT has been systematically sold for USDC on HTX while nearly $400mn USDC has been transferred from HTX to Binance,” notes Kaiko. Meanwhile, USDT sold for USDC has been replaced by stUSDT, which now accounts for $400 million of HTX’s holdings.

“USDT on Huobi that belonged to customers has now been replaced with a fistful of IOUs in the form of stUSDT, with the USDT then re-hypothecated to JustLend.”

stUSDT is a decentralized receipt token that represents an investment in real-world assets (RWAs). To obtain stUSDT, users must stake USD stablecoins such as USDT and TUSD. Once staked, users receive stUSDT in return.

stUSDT is inherently more risky than USDT, as its value can fluctuate depending on the performance of the RWAs that it is invested in. stUSDT currently promises an APY of 4.67% on staked assets.

Justin Sun says he is “defending the crypto frontier,” but is that really the case?

In September, Sun posted a video on Twitter in which he appears in a sort of a superhero role, captioned, “Defending the crypto frontier with unwavering determination!” It’s difficult to be a defender of the crypto frontier while backing projects that have been accused of wash trading and have generally low transparency.

?? Defending the crypto frontier with unwavering determination! #TRON remains steadfast in safeguarding the future of digital assets. #TRX pic.twitter.com/RVijaqzUmK

— H.E. Justin Sun 孙宇晨 (@justinsuntron) September 21, 2023

The volume spikes at Poloniex and HTX don't appear to be organic, which is a cause for concern. While we can't be certain about what's happening behind the scenes, these unusual volume patterns certainly raise questions.

coincodex.com

coincodex.com