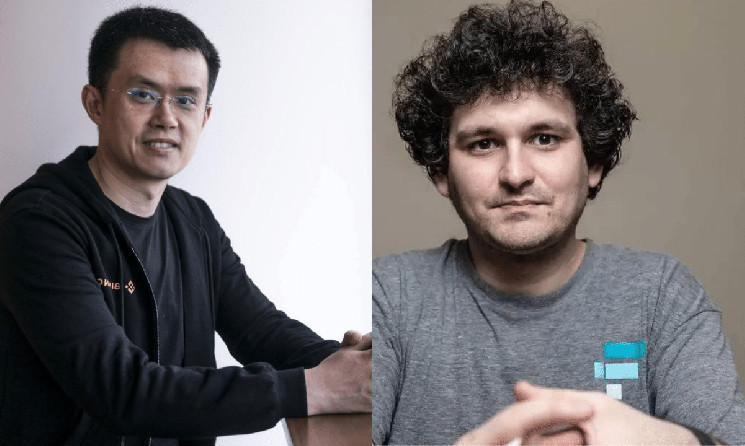

According to Michael Lewis’ book “Going Infinite,” Binance CEO Changpeng “CZ” Zhao turned down an offer in March 2019 from former FTX CEO Sam Bankman-Fried to invest $40 million in creating a cryptocurrency futures exchange.

Binance, originally a spot crypto exchange, decided to develop a futures exchange internally instead of accepting an offer from Bankman-Fried. In response, SBF established FTX in May 2019. However, FTX faced financial difficulties and filed for bankruptcy in November 2022, leading to the ongoing SBF trial.

SBF’s Crypto Futures Exchange Vision

Sam Bankman-Fried saw the potential in creating a cryptocurrency exchange but was uncertain about the steps needed to initiate the process, including engaging with the general public and attracting customers.

In 2018, he launched CryptonBTC, a bitcoin exchange, without a clear strategy for promotion or customer acquisition. He and his team proposed developing a futures platform for existing crypto exchanges. In this model, Alameda would provide the technology while the existing exchanges would bring in customers.

CZ expressed reservations about this proposed design, as a single unfavorable trade could lead to a complete loss of collateral, leaving the exchange responsible for the losses. Bankman-Fried’s alternative design, which involved constant monitoring of trades and immediate liquidation of positions in the event of losses, was more reassuring.

Bankman-Fried met Zhao the year prior and sponsored a Binance conference in early 2019 for $150,000. This collaboration led to Zhao appearing on stage with Bankman-Fried, a move that the latter believed added legitimacy to their presence in the crypto space. However, it didn’t give him a strong understanding of Zhao’s decision-making style.

FTT Token Came About to Fund the Project

Sam Bankman-Fried was confident that his product could outperform existing options and was prepared to risk billions of dollars on the venture, even in potential failure. He brought crypto experts Ryan Salame and Zane Tackett to handle the marketing aspect.

Bankman-Fried then introduced the FTX token (FTT) to secure funding for the project. The digital asset offered holders a share of FTX’s annual revenues through a buyback and burn mechanism, which Binance had previously employed successfully.

In May 2019, despite facing regulatory hurdles in the U.S., FTX generated 350 million FTT tokens aimed at international investors. Some were offered to FTX employees at five cents and to key figures in the crypto industry, including Changpeng “CZ” Zhao, at ten cents. Most FTX employees and Zhao declined this offer, except for Salame.

However, there was outside interest in the tokens at prices ranging from 20 to 70 cents. Bankman-Fried later regretted this valuation, considering it too low. When FTT was eventually listed on FTX and made available to the general public in July, it opened at $1 and traded up to $1.50.

Shortly before the listing, Bankman-Fried coincidentally met Zhao at a crypto conference in Taipei, where they exchanged warm greetings. SBF noted that it was the first time CZ seemed more interested in him than he was in him. Three weeks later, Zhao contacted Bankman-Fried and offered to purchase a 20% stake in FTX for $80 million.

cryptopotato.com

cryptopotato.com