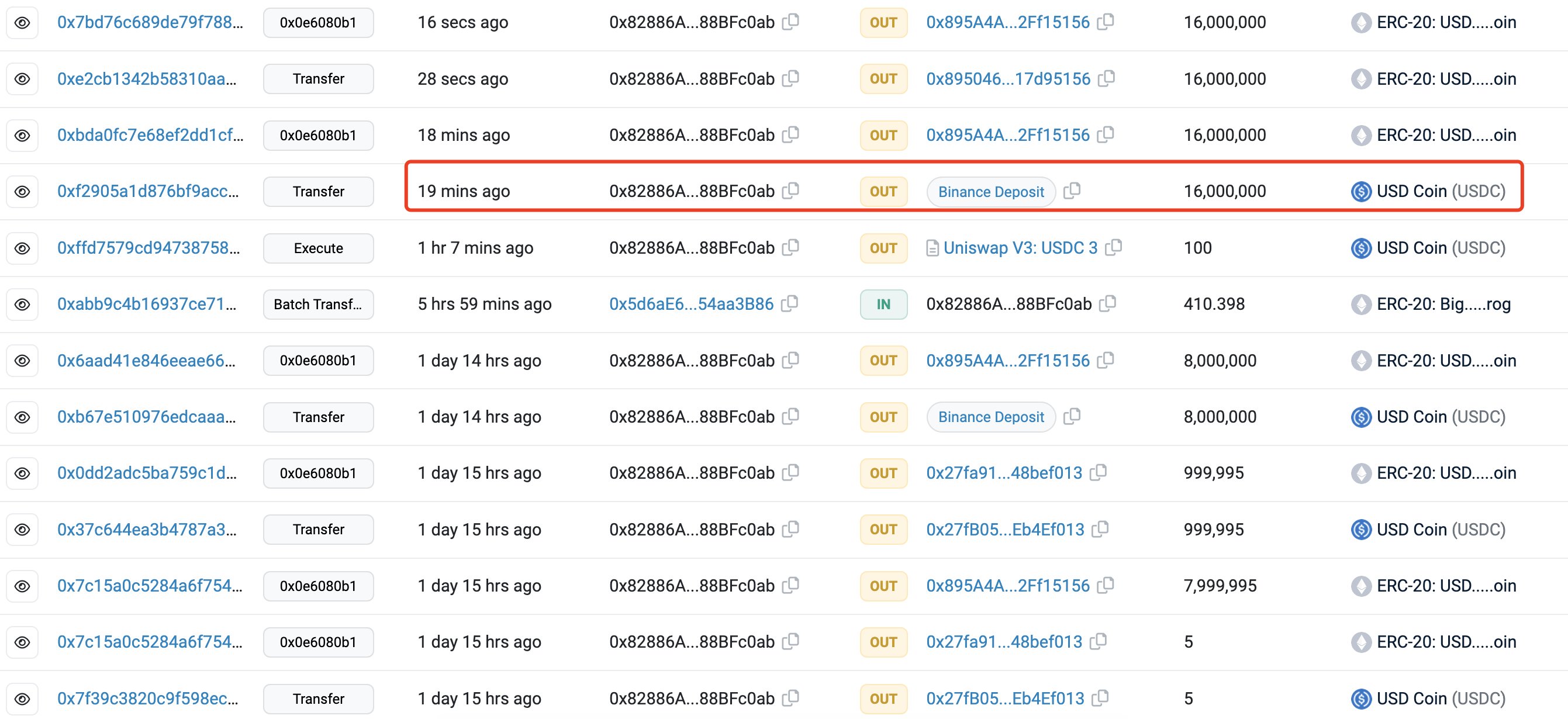

An unknown investor with a history of savvy trades has deposited $16 million worth of stablecoins into Binance, potentially to purchase more crypto assets.

First spotted by blockchain-tracking firm Lookonchain, the whale has already made three extremely clutch trades in the past, including selling Ethereum (ETH) at a local top, trading USDC for ETH before it lost its dollar peg and withdrawing all of its funds from crypto exchange FTX right before the bankrupt centralized platform suspended user withdrawals.

“A smart whale deposited 16 million USDC to Binance…

The smart whale:

Dumped 34,000 ETH ($65.4 million) when the price was $1,930.

Exchanged USDC for ETH during the USDC de-pegging.

Withdrew all assets from FTX before FTX suspended withdrawals.”

At time of writing, it’s still unclear what the whale did or plans to do with the $16 million worth of dry powder now on Binance.

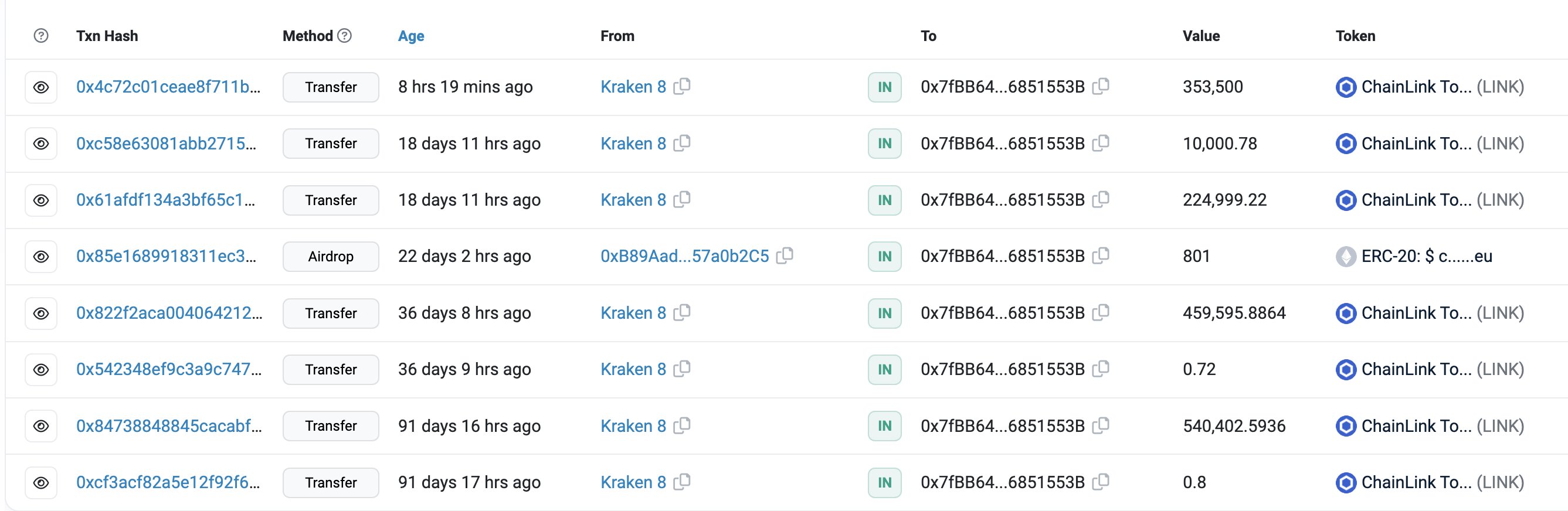

Lookonchain also spotted a whale withdrawing seven figures worth of the decentralized oracle network Chainlink (LINK) from the crypto exchange Kraken, adding to its $9.67 million LINK withdrawal streak.

“A whale withdrew 353,500 LINK ($2.14M) from Kraken again…

The whale has withdrawn a total of 1,588,500 LINK ($9.67 million) from Kraken in the past three months.

The average withdrawal price is $6.78.”

The blockchain tracker also spotted wallets belonging to crypto trading firm Jump Trading and identified four altcoins being accumulated by the company, including the liquid-staking service provider Lido DAO (LDO), the decentralized social network Mask Network (MASK), the decentralized derivatives platform Perpetual Protocol (PERP) and the decentralized leveraged trading protocol LeverFi (LEVER).

“Jump Trading has been accumulating MASK, LDO, LEVER and PERP over the past week.

Jump Trading currently holds:

1.59 million MASK ($6.15million);

1.09 million LDO ($2.11million);

509 million LEVER ($686K);

1.07 million PERP ($545K).”

dailyhodl.com

dailyhodl.com