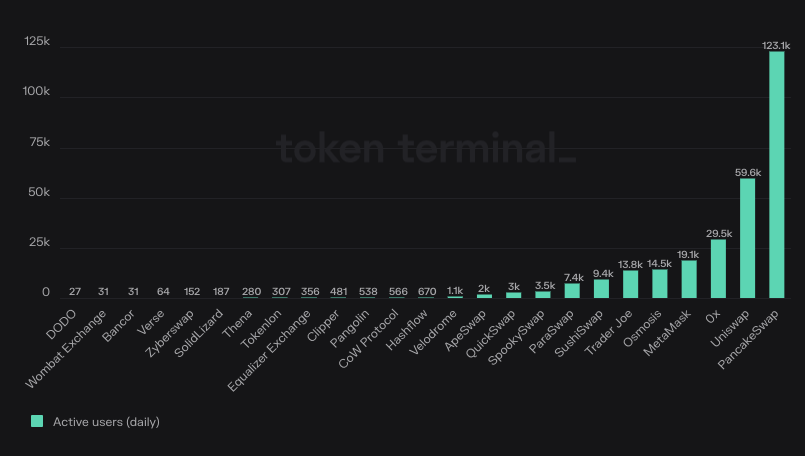

In unusual circumstances, the Daily Active Users (DAU) of PancakeSwap (CAKE) outpaced that of Uniswap (UNI). According to Token Terminal data, Uniswap’s DAU was 59,600 while PancakeSwap registered 123,100 active users.

Known as two of the top Decentralized Exchanges (DEX), Uniswap boasts the highest number of trading pairs. However, PancakeSwap has proven to be the preferred platform for users interested in tokens operating under the Binance Smart Chain.

PancakeSwap Overtakes the Leader

Therefore, the hike in the DAU suggests that the number of unique public addresses that transacted on PancakeSwap surpassed Uniswap transactions.

One of the key reasons for this is PancakeSwap’s upgrade to v3, which gave increased access to liquidity providers. Consequently, this spurred on a 65% increase in the overall BNB Chain volume between April and early June.

Although Uniswap matched PancakeSwap’s strides with its v4 launch, the price action of their respective tokens has not been similar. In the last 24 hours, CAKE’s value has decreased by 4.18%. UNI, on the other hand, rose by 2.41% as of this writing.

CAKE’s on the way to rock bottom

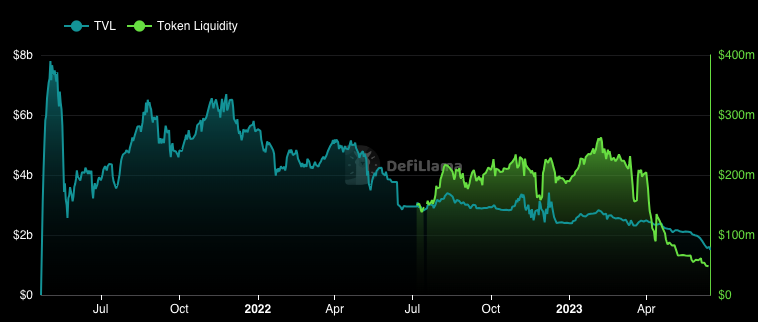

From the technical outlook, CAKE’s daily price has been sliding since its price hit $2.80 on 28 April. While the condition may be similar to many assets in the market, CAKE’s performance has been way worse.

According to indications from the Relative Strength Index (RSI), the token languished below the oversold region for a whole month. Between April 23 and May 28, CAKE’s RSI was below 30.

However, bullish action at $1.54 on May 29 pushed the RSI up to 40 as of June 4 . But unfortunately, this could not fight off the resistance it met the day after. At press time, the RSI was back at 29.12.

This reading represents that CAKE is oversold. Usually, a bullish action at this point could trigger a reversal. But CAKE seemed to lack the liquidity required for such a move. So, CAKE’s bearish momentum might continue to linger in the short term.

Meanwhile, the automated market maker could not outweigh Uniswap in terms of Total Value Locked (TVL). In the DEX category, Uniswap and Curve Finance (CRV) led the standings.

Furthermore, almost all the projects experienced a decline in TVL including PancakeSwap.

At press time, the project’s TVL was 1.51 billion. This suggests a decreasing interest in utilizing smart contract protocols operating under the DEX.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

coinedition.com

coinedition.com